Exam 4: Cash Flow and Financial Planning

Exam 1: The Role of Managerial Finance133 Questions

Exam 2: The Financial Market Environment91 Questions

Exam 3: Financial Statements and Ratio Analysis209 Questions

Exam 4: Cash Flow and Financial Planning183 Questions

Exam 5: Time Value of Money173 Questions

Exam 6: Interest Rates and Bond Valuation224 Questions

Exam 7: Stock Valuation188 Questions

Exam 8: Risk and Return190 Questions

Exam 9: The Cost of Capital137 Questions

Exam 10: Capital Budgeting Techniques167 Questions

Exam 11: Capital Budgeting Cash Flows117 Questions

Exam 12: Risk and Refinements in Capital Budgeting106 Questions

Exam 13: Leverage and Capital Structure217 Questions

Exam 14: Payout Policy130 Questions

Exam 15: Working Capital and Current Assets Management340 Questions

Exam 16: Current Liabilities Management171 Questions

Exam 17: Hybrid and Derivative Securities185 Questions

Exam 18: Mergers, Lbos, Divestitures, and Business Failure191 Questions

Exam 19: International Managerial Finance108 Questions

Select questions type

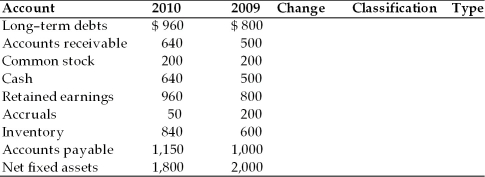

Calculate the change in the key balance sheet accounts between 2009 and 2010 and classify each as a source (S), a use (U), or neither (N), and indicate which type of cash flow it is: an operating cash flow (O), and investment cash flow (I) or a financing cash flow (F).

ABC Corp.

Balance Sheet Changes and Classification

of Key Accounts between 2009 and 2010

(Essay)

4.8/5  (37)

(37)

Table 4.3

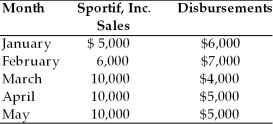

The financial analyst for Sportif, Inc. has compiled sales and disbursement estimates for the coming months of January through May. Historically, 75 percent of sales are for cash with the remaining 25 percent collected in the following month. The ending cash balance in January is $3,000. Prepare a cash budget for the months of February through May to answer the following multiple choice questions.  -At the end of May, the firm has an ending cash balance of ________. (See Table 4.3)

-At the end of May, the firm has an ending cash balance of ________. (See Table 4.3)

(Multiple Choice)

4.7/5  (31)

(31)

Showing 181 - 183 of 183

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)