Exam 4: Cash Flow and Financial Planning

Exam 1: The Role of Managerial Finance133 Questions

Exam 2: The Financial Market Environment91 Questions

Exam 3: Financial Statements and Ratio Analysis209 Questions

Exam 4: Cash Flow and Financial Planning183 Questions

Exam 5: Time Value of Money173 Questions

Exam 6: Interest Rates and Bond Valuation224 Questions

Exam 7: Stock Valuation188 Questions

Exam 8: Risk and Return190 Questions

Exam 9: The Cost of Capital137 Questions

Exam 10: Capital Budgeting Techniques167 Questions

Exam 11: Capital Budgeting Cash Flows117 Questions

Exam 12: Risk and Refinements in Capital Budgeting106 Questions

Exam 13: Leverage and Capital Structure217 Questions

Exam 14: Payout Policy130 Questions

Exam 15: Working Capital and Current Assets Management340 Questions

Exam 16: Current Liabilities Management171 Questions

Exam 17: Hybrid and Derivative Securities185 Questions

Exam 18: Mergers, Lbos, Divestitures, and Business Failure191 Questions

Exam 19: International Managerial Finance108 Questions

Select questions type

Utilizing past cost and expense ratios (percent-of-sales method) when preparing pro forma financial statements will tend to

(Multiple Choice)

4.7/5  (31)

(31)

Non-cash charges are expenses that involve an actual outlay of cash during the period but are not deducted on the income statement.

(True/False)

4.8/5  (31)

(31)

The best way to adjust for the presence of fixed costs when using the simplified approach for pro forma income statement preparation is

(Multiple Choice)

4.8/5  (36)

(36)

Business firms are permitted to systematically charge a portion of the market value of fixed assets, as depreciation, against annual revenues.

(True/False)

4.8/5  (39)

(39)

The net fixed asset investment (NFAI) is defined as the change in net fixed assets plus depreciation.

(True/False)

5.0/5  (37)

(37)

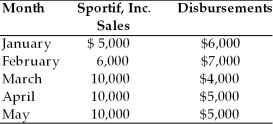

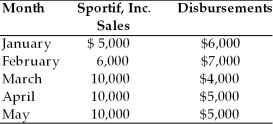

Table 4.3

The financial analyst for Sportif, Inc. has compiled sales and disbursement estimates for the coming months of January through May. Historically, 75 percent of sales are for cash with the remaining 25 percent collected in the following month. The ending cash balance in January is $3,000. Prepare a cash budget for the months of February through May to answer the following multiple choice questions.  -The firm has a total financing requirement of ________ for the period from February through May. (See Table 4.3)

-The firm has a total financing requirement of ________ for the period from February through May. (See Table 4.3)

(Multiple Choice)

4.9/5  (38)

(38)

The cash flows from operating activities section of the statement of cash flows considers

(Multiple Choice)

4.9/5  (39)

(39)

The key inputs for preparing pro forma income statements using the simplified approaches are the

(Multiple Choice)

4.8/5  (33)

(33)

The number and type of intervals in the cash budget depend on the nature of the business. The more seasonal and uncertain a firm's cash flows, the greater the number of intervals and the shorter time intervals.

(True/False)

4.9/5  (38)

(38)

NICO Corporation had net fixed assets of $2,000,000 at the end of 2010 and $1,800,000 at the end of 2009. In addition, the firm had a depreciation expense of $200,000 during 2010 and $180,000 during 2009. Using this information, NICO's net fixed asset investment for 2010 was

(Multiple Choice)

4.9/5  (34)

(34)

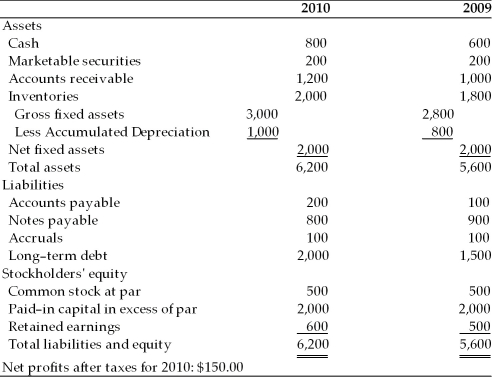

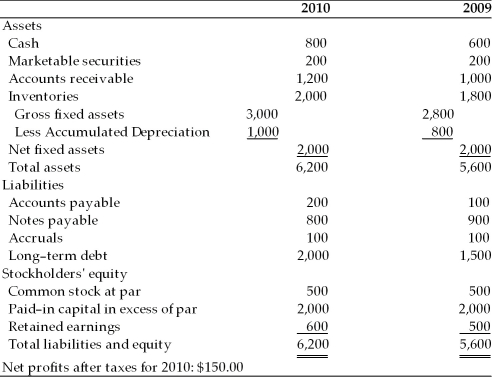

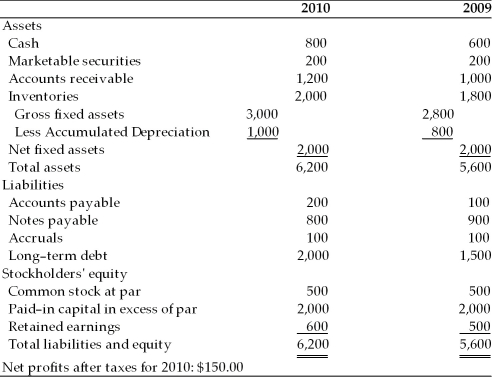

Table 4.1

Ruff Sandpaper Co.

Balance Sheets

For the Years Ended 2009 and 2010  -A corporation sold a fixed asset for $100,000. This is

-A corporation sold a fixed asset for $100,000. This is

(Multiple Choice)

4.8/5  (35)

(35)

In general, firms that are subject to a high degree of ________, relatively short production cycles, or both tend to use shorter planning horizons.

(Multiple Choice)

4.9/5  (31)

(31)

Table 4.1

Ruff Sandpaper Co.

Balance Sheets

For the Years Ended 2009 and 2010  -The firm may have increased long-term debts to finance ________. (See Table 4.1)

-The firm may have increased long-term debts to finance ________. (See Table 4.1)

(Multiple Choice)

4.8/5  (34)

(34)

The cash flows from operating activities section of the statement of cash flows considers

(Multiple Choice)

4.9/5  (43)

(43)

In the development of proforma statements, a firm that requires external funds means that the firm's projected level of cash is in excess of its needs and that funds would therefore be available for repaying debt, repurchasing stock, or increasing the dividend to stockholders.

(True/False)

4.8/5  (30)

(30)

It would be correct to define Operating Cash Flow (OCF) as net operating profit after taxes minus depreciation.

(True/False)

4.9/5  (41)

(41)

Table 4.1

Ruff Sandpaper Co.

Balance Sheets

For the Years Ended 2009 and 2010  -A corporation raises $500,000 in long-term debt to acquire additional plant capacity. This is considered

-A corporation raises $500,000 in long-term debt to acquire additional plant capacity. This is considered

(Multiple Choice)

4.8/5  (30)

(30)

Table 4.3

The financial analyst for Sportif, Inc. has compiled sales and disbursement estimates for the coming months of January through May. Historically, 75 percent of sales are for cash with the remaining 25 percent collected in the following month. The ending cash balance in January is $3,000. Prepare a cash budget for the months of February through May to answer the following multiple choice questions.  -If a pro forma balance sheet dated at the end of May was prepared from the information presented, the marketable securities would total ________. (See Table 4.3)

-If a pro forma balance sheet dated at the end of May was prepared from the information presented, the marketable securities would total ________. (See Table 4.3)

(Multiple Choice)

4.8/5  (36)

(36)

A firm's net cash flow is the mathematical difference between the firm's beginning cash and its cash disbursements in each period.

(True/False)

4.9/5  (28)

(28)

Showing 61 - 80 of 183

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)