Exam 4: Cash Flow and Financial Planning

Exam 1: The Role of Managerial Finance133 Questions

Exam 2: The Financial Market Environment91 Questions

Exam 3: Financial Statements and Ratio Analysis209 Questions

Exam 4: Cash Flow and Financial Planning183 Questions

Exam 5: Time Value of Money173 Questions

Exam 6: Interest Rates and Bond Valuation224 Questions

Exam 7: Stock Valuation188 Questions

Exam 8: Risk and Return190 Questions

Exam 9: The Cost of Capital137 Questions

Exam 10: Capital Budgeting Techniques167 Questions

Exam 11: Capital Budgeting Cash Flows117 Questions

Exam 12: Risk and Refinements in Capital Budgeting106 Questions

Exam 13: Leverage and Capital Structure217 Questions

Exam 14: Payout Policy130 Questions

Exam 15: Working Capital and Current Assets Management340 Questions

Exam 16: Current Liabilities Management171 Questions

Exam 17: Hybrid and Derivative Securities185 Questions

Exam 18: Mergers, Lbos, Divestitures, and Business Failure191 Questions

Exam 19: International Managerial Finance108 Questions

Select questions type

The financial planning process begins with short-run, or operating, plans and budgets that in turn guide the formulation of long-run, or strategic, financial plans.

(True/False)

4.8/5  (45)

(45)

A firm plans to retire outstanding bonds in the next planning period. The statements that will be affected are the

(Multiple Choice)

4.9/5  (32)

(32)

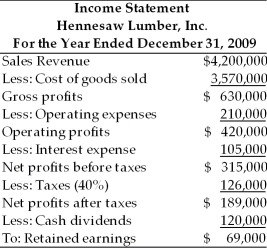

Table 4.4

Use the percent-of-sales method to prepare a pro forma income statement for the year ended December 31, 2010, for Hennesaw Lumber, Inc.

Hennesaw Lumber, Inc. estimates that its sales in 2000 will be $4,500,000. Interest expense is to remain unchanged at $105,000 and the firm plans to pay cash dividends of $150,000 during 2010. Hennesaw Lumber, Inc.'s income statement for the year ended December 31, 2009 is shown below. From your preparation of the pro forma income statement, answer the following multiple choice questions.  -The pro forma operating expenses for 2010 are ________. (See Table 4.4)

-The pro forma operating expenses for 2010 are ________. (See Table 4.4)

(Multiple Choice)

4.7/5  (30)

(30)

Under the judgmental approach for developing a pro forma balance sheet, the "plug" figure required to bring the statement into balance may be called the

(Multiple Choice)

4.9/5  (36)

(36)

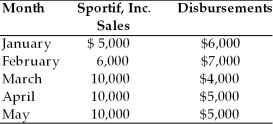

Table 4.3

The financial analyst for Sportif, Inc. has compiled sales and disbursement estimates for the coming months of January through May. Historically, 75 percent of sales are for cash with the remaining 25 percent collected in the following month. The ending cash balance in January is $3,000. Prepare a cash budget for the months of February through May to answer the following multiple choice questions.  -The firm has a negative net cash flow in the month(s) of ________. (See Table 4.3)

-The firm has a negative net cash flow in the month(s) of ________. (See Table 4.3)

(Multiple Choice)

5.0/5  (35)

(35)

The statement of cash flows allows the financial manager and other interested parties to analyze the firm's past and possibly future profitability.

(True/False)

4.7/5  (34)

(34)

________ is an expense that is a legal obligation of the firm.

(Multiple Choice)

4.7/5  (36)

(36)

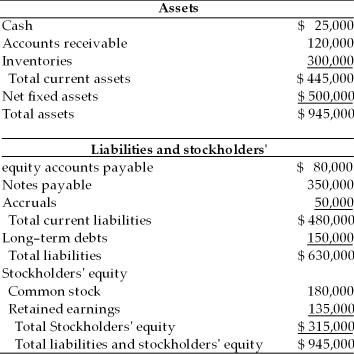

Table 4.5

A financial manager at General Talc Mines has gathered the financial data essential to prepare a pro forma balance sheet for cash and profit planning purposes for the coming year ended December 31, 2010. Using the percent-of-sales method and the following financial data, prepare the pro forma balance sheet in order to answer the following multiple choice questions.

(a) The firm estimates sales of $1,000,000.

(b) The firm maintains a cash balance of $25,000.

(c) Accounts receivable represents 15 percent of sales.

(d) Inventory represents 35 percent of sales.

(e) A new piece of mining equipment costing $150,000 will be purchased in 2010.

Total depreciation for 2010 will be $75,000.

(f) Accounts payable represents 10 percent of sales.

(g) There will be no change in notes payable, accruals, and common stock.

(h) The firm plans to retire a long term note of $100,000.

(i) Dividends of $45,000 will be paid in 2010.

(j) The firm predicts a 4 percent net profit margin.

Balance Sheet

General Talc Mines

December 31, 2009  -The external financing required in 2010 will be ________. (See Table 4.5)

-The external financing required in 2010 will be ________. (See Table 4.5)

(Multiple Choice)

4.9/5  (32)

(32)

Terrel Manufacturing expects stable sales through the summer months of June, July, and August of $500,000 per month. The firm will make purchases of $350,000 per month during these months. Wages and salaries are estimated at $60,000 per month plus 7 percent of sales. The firm must make a principal and interest payment on an outstanding loan in June of $100,000. The firm plans a purchase of a fixed asset costing $75,000 in July. The second quarter tax payment of $20,000 is also due in June. All sales are for cash.

(a) Construct a cash budget for June, July, and August, assuming the firm has a

beginning cash balance of $100,000 in June.

(b) The sales projections may not be accurate due to the lack of experience by a

newly-hired sales manager. If the sales manager believes the most optimistic

and pessimistic estimates of sales are $600,000 and $400,000, respectively, what

are the monthly net cash flows and required financing or excess cash balances?

(Essay)

4.8/5  (45)

(45)

The net current asset investment (NCAI) is defined as the change in current assets minus the change in sum of the accounts payable and accruals.

(True/False)

5.0/5  (40)

(40)

Cash budgets and pro forma statements are useful not only for internal financial planning but also are routinely required by the Internal Revenue Service (IRS).

(True/False)

4.8/5  (33)

(33)

Operating cash flow (OCF) is equal to the firm's net operating profits after taxes minus all non-cash charges.

(True/False)

4.8/5  (35)

(35)

________ generally reflect(s) the anticipated financial impact of planned long-term actions.

(Multiple Choice)

4.8/5  (28)

(28)

Identify each expense or revenue as a cash flow from operating activities (O), a cash flow from investment activities (I), or a cash flow from financing activities (F).

Administrative expenses

Rent payment

Interest on a note payable

Interest on a note receivable

Sale of equipment

Dividend payment

Stock repurchase

Sale of finished goods

Labor expense

Sale of a bond issue

Repayment of a long-term debt

Selling expenses

Depreciation expense

Sale of common stock

Purchase of fixed assets

(Essay)

4.7/5  (40)

(40)

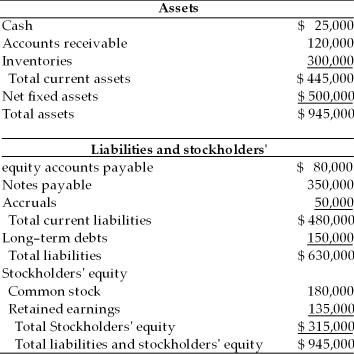

Table 4.5

A financial manager at General Talc Mines has gathered the financial data essential to prepare a pro forma balance sheet for cash and profit planning purposes for the coming year ended December 31, 2010. Using the percent-of-sales method and the following financial data, prepare the pro forma balance sheet in order to answer the following multiple choice questions.

(a) The firm estimates sales of $1,000,000.

(b) The firm maintains a cash balance of $25,000.

(c) Accounts receivable represents 15 percent of sales.

(d) Inventory represents 35 percent of sales.

(e) A new piece of mining equipment costing $150,000 will be purchased in 2010.

Total depreciation for 2010 will be $75,000.

(f) Accounts payable represents 10 percent of sales.

(g) There will be no change in notes payable, accruals, and common stock.

(h) The firm plans to retire a long term note of $100,000.

(i) Dividends of $45,000 will be paid in 2010.

(j) The firm predicts a 4 percent net profit margin.

Balance Sheet

General Talc Mines

December 31, 2009  -The pro forma current liabilities amount is ________.(See Table 4.5)

-The pro forma current liabilities amount is ________.(See Table 4.5)

(Multiple Choice)

4.9/5  (31)

(31)

Because the typical cash budget shows cash flows only on a monthly basis, the information provided by the cash budget is not necessarily adequate for ensuring solvency.

(True/False)

5.0/5  (26)

(26)

Showing 21 - 40 of 183

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)