Exam 3: Financial Statements and Ratio Analysis

Exam 1: The Role of Managerial Finance133 Questions

Exam 2: The Financial Market Environment91 Questions

Exam 3: Financial Statements and Ratio Analysis209 Questions

Exam 4: Cash Flow and Financial Planning183 Questions

Exam 5: Time Value of Money173 Questions

Exam 6: Interest Rates and Bond Valuation224 Questions

Exam 7: Stock Valuation188 Questions

Exam 8: Risk and Return190 Questions

Exam 9: The Cost of Capital137 Questions

Exam 10: Capital Budgeting Techniques167 Questions

Exam 11: Capital Budgeting Cash Flows117 Questions

Exam 12: Risk and Refinements in Capital Budgeting106 Questions

Exam 13: Leverage and Capital Structure217 Questions

Exam 14: Payout Policy130 Questions

Exam 15: Working Capital and Current Assets Management340 Questions

Exam 16: Current Liabilities Management171 Questions

Exam 17: Hybrid and Derivative Securities185 Questions

Exam 18: Mergers, Lbos, Divestitures, and Business Failure191 Questions

Exam 19: International Managerial Finance108 Questions

Select questions type

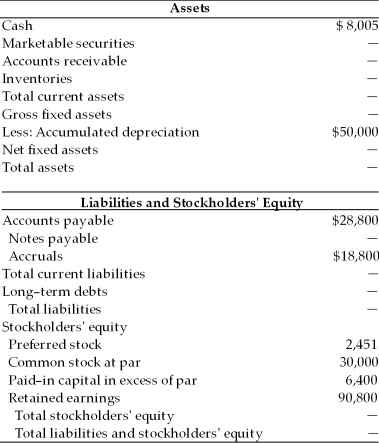

Complete the balance sheet for General Aviation, Inc. based on the following financial data.

Balance Sheet

General Aviation, Inc.

December 31, 2005  Key Financial Data (2005)

1. Sales totaled $720,000.

2. The gross profit margin was 38.7 percent.

3. Inventory turned 6 times.

4. There are 360 days in a year.

5. The average collection period was 31 days.

6. The current ratio was 2.35.

7. The total asset turnover was 2.81.

8. The debt ratio was 49.4 percent.

9. Total current assets equal $159,565.

Key Financial Data (2005)

1. Sales totaled $720,000.

2. The gross profit margin was 38.7 percent.

3. Inventory turned 6 times.

4. There are 360 days in a year.

5. The average collection period was 31 days.

6. The current ratio was 2.35.

7. The total asset turnover was 2.81.

8. The debt ratio was 49.4 percent.

9. Total current assets equal $159,565.

(Essay)

4.7/5  (36)

(36)

________ analysis involves comparison of current to past performance and the evaluation of developing trends.

(Multiple Choice)

4.9/5  (37)

(37)

A firm had year end 2004 and 2005 retained earnings balances of $670,000 and $560,000, respectively. The firm paid $10,000 in dividends in 2005. The firm's net profit after taxes in 2002 was

(Multiple Choice)

4.8/5  (32)

(32)

Cross-sectional ratio analysis involves comparing the firm's ratios to those of firms in other industries at the same point in time.

(True/False)

4.8/5  (27)

(27)

The DuPont formula allows the firm to break down its return into the net profit margin, which measures the firm's profitability on sales, and its total asset turnover, which indicates how efficiently the firm has used its assets to generate sales.

(True/False)

4.7/5  (37)

(37)

The Sarbanes-Oxley Act of 2002 established the Public Company Accounting Oversight Board (PCAOB) which is a not-for-profit corporation that oversees auditors of public corporations.

(True/False)

4.8/5  (26)

(26)

The 2002 law that established the Public Company Accounting Oversight Board (PCAOB) was called

(Multiple Choice)

4.8/5  (31)

(31)

Due to inflationary effects, inventory costs and depreciation write-offs can differ from their true values, thereby distorting profits.

(True/False)

4.8/5  (33)

(33)

The McCain-Feingold Act of 2002 was passed to eliminate many of the disclosure and conflict of interest problems of corporations.

(True/False)

4.9/5  (31)

(31)

Time-series analysis is the evaluation of the firm's financial performance in comparison to other firm(s) at the same point in time.

(True/False)

4.9/5  (33)

(33)

A corporation had a year end 2004 retained earnings balance of $220,000. The firm reported net profits after taxes of $50,000 in 2005 and paid dividends in 2005 of $30,000. The firm's retained earnings balance at year end 2005 was

(Multiple Choice)

4.8/5  (32)

(32)

Using the DuPont system of analysis and holding other factors constant, an increase in financial leverage will result in ________ in the return on equity.

(Multiple Choice)

4.8/5  (37)

(37)

The ________ ratio measures the firm's ability to pay contractual interest payments.

(Multiple Choice)

4.8/5  (37)

(37)

________ is used by financial managers as a structure for dissecting the firm's financial statements to assess its financial condition.

(Multiple Choice)

4.9/5  (33)

(33)

A firm with a total asset turnover lower than the industry standard may have

(Multiple Choice)

4.7/5  (34)

(34)

________ evidence of the existence of a problem or outstanding management performance is provided by ratio analysis.

(Multiple Choice)

4.9/5  (32)

(32)

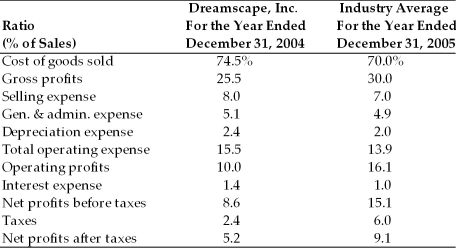

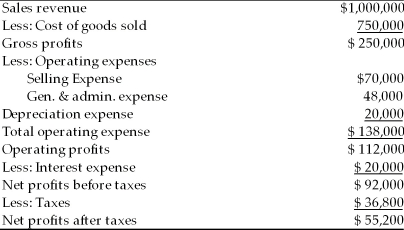

Key Financial Data  Income Statement, Dreamscape, Inc.

For the Year Ended December 31, 2005

Income Statement, Dreamscape, Inc.

For the Year Ended December 31, 2005  Prepare a common-size income statement for Dreamscape, Inc. for the year ended December 31, 2005. Evaluate the company's performance against industry average ratios and against last year's results.

Prepare a common-size income statement for Dreamscape, Inc. for the year ended December 31, 2005. Evaluate the company's performance against industry average ratios and against last year's results.

(Essay)

4.7/5  (29)

(29)

The Sunshine Company had a retained earnings balance of $850,000 at the beginning of 2005. By the end of 2005, the company's retained earnings balance was $950,000. During 2005, the company earned $245,000 as net profits after paying its taxes. The company was then able to pay its preferred stockholders $45,000. Compute the common stock dividend per share in 2005 assuming 10,000 shares of common stock outstanding.

(Essay)

4.8/5  (32)

(32)

Showing 101 - 120 of 209

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)