Exam 3: Financial Statements and Ratio Analysis

Exam 1: The Role of Managerial Finance133 Questions

Exam 2: The Financial Market Environment91 Questions

Exam 3: Financial Statements and Ratio Analysis209 Questions

Exam 4: Cash Flow and Financial Planning183 Questions

Exam 5: Time Value of Money173 Questions

Exam 6: Interest Rates and Bond Valuation224 Questions

Exam 7: Stock Valuation188 Questions

Exam 8: Risk and Return190 Questions

Exam 9: The Cost of Capital137 Questions

Exam 10: Capital Budgeting Techniques167 Questions

Exam 11: Capital Budgeting Cash Flows117 Questions

Exam 12: Risk and Refinements in Capital Budgeting106 Questions

Exam 13: Leverage and Capital Structure217 Questions

Exam 14: Payout Policy130 Questions

Exam 15: Working Capital and Current Assets Management340 Questions

Exam 16: Current Liabilities Management171 Questions

Exam 17: Hybrid and Derivative Securities185 Questions

Exam 18: Mergers, Lbos, Divestitures, and Business Failure191 Questions

Exam 19: International Managerial Finance108 Questions

Select questions type

Firm ABC had operating profits of $100,000, taxes of $17,000, interest expense of $34,000 and preferred dividends of $5,000. What was the firm's net profit after taxes?

(Multiple Choice)

4.9/5  (39)

(39)

Net profit margin measures the percentage of each sales dollar remaining after all costs and expenses, including interest, taxes, and common stock dividends, have been deducted.

(True/False)

4.7/5  (39)

(39)

The primary concern of creditors when assessing the strength of a firm is the firm's

(Multiple Choice)

4.9/5  (38)

(38)

________ is where the firm's ratio values are compared to those of a key competitor or group of competitors, primarily to identify areas for improvement.

(Multiple Choice)

4.8/5  (39)

(39)

Gross profit margin measures the percentage of each sales dollar left after the firm has paid for its goods and operating expenses.

(True/False)

4.8/5  (30)

(30)

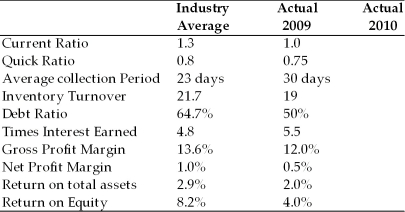

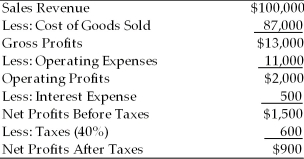

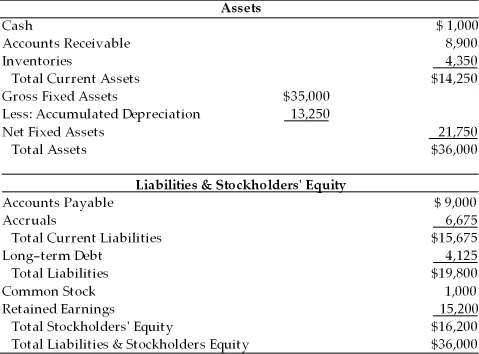

Table 3.2

Dana Dairy Products Key Ratios  Income Statement

Dana Dairy Products

For the Year Ended December 31, 2010

Income Statement

Dana Dairy Products

For the Year Ended December 31, 2010  Balance Sheet

Dana Dairy Products

December 31, 2010

Balance Sheet

Dana Dairy Products

December 31, 2010  -Using the modified DuPont formula allows the analyst to break Dana Dairy Products return on equity into 3 components: the net profit margin, the total asset turnover, and a measure of leverage (the financial leverage multiplier). Which of the following mathematical expressions represents the modified DuPont formula relative to Dana Dairy Products' 2010 performance? (See Table 3.2)

-Using the modified DuPont formula allows the analyst to break Dana Dairy Products return on equity into 3 components: the net profit margin, the total asset turnover, and a measure of leverage (the financial leverage multiplier). Which of the following mathematical expressions represents the modified DuPont formula relative to Dana Dairy Products' 2010 performance? (See Table 3.2)

(Multiple Choice)

4.9/5  (27)

(27)

A firm had year end 2004 and 2005 retained earnings balance of $670,000 and $560,000, respectively. The firm reported net profits after taxes of $100,000 in 2005. The firm paid dividends in 2005 of

(Multiple Choice)

4.9/5  (28)

(28)

The firm's creditors are primarily interested in the short-term liquidity of the company and its ability to make interest and principal payments.

(True/False)

4.8/5  (31)

(31)

Paid-in capital in excess of par represents the firm's book value received from the original sale of common stock.

(True/False)

4.9/5  (34)

(34)

Without adjustment, inflation may tend to cause ________ firms to appear more efficient and profitable than ________ firms, all else being the same.

(Multiple Choice)

5.0/5  (33)

(33)

The ________ measures the overall effectiveness of management in generating profits with its available assets.

(Multiple Choice)

5.0/5  (34)

(34)

The ________ ratio may indicate that the firm will not be able to meet interest obligations due on outstanding debt.

(Multiple Choice)

4.7/5  (40)

(40)

The liquidity of a business firm is measured by its ability to satisfy its long-term obligations as they come due.

(True/False)

4.8/5  (43)

(43)

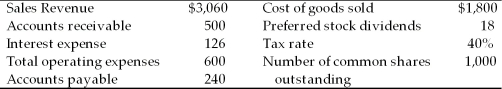

A firm had the following accounts and financial data for 2005:  The firm's earnings per share, rounded to the nearest cent, for 2005 was ________.

The firm's earnings per share, rounded to the nearest cent, for 2005 was ________.

(Multiple Choice)

4.8/5  (29)

(29)

In the DuPont system, the return on total assets (asset) is equal to

(Multiple Choice)

4.9/5  (36)

(36)

At the end of 2005, the Long Life Light Bulb Company announced it had produced a gross profit of $1 million. The company has also established that over the course of this year it has incurred $345,000 in operating expenses and $125,000 in interest expenses. The company is subject to a 30% tax rate and has declared $57,000 total preferred stock dividends.

(a) How much is the earnings available for common stockholders?

(b) Compute the increased retained earnings for 2005 if the company were to declare a $4.25 common stock dividend. The company has 15,000 shares of common stock outstanding.

(Essay)

4.8/5  (38)

(38)

To analyze the firm's financial performance, the following types of ratio analyses EXCEPT ________ may be used.

(Multiple Choice)

4.7/5  (36)

(36)

The federal regulatory body governing the sale and listing of securities is called the

(Multiple Choice)

4.9/5  (31)

(31)

________ analysis involves the comparison of different firms' financial ratios at the same point in time.

(Multiple Choice)

4.9/5  (33)

(33)

Showing 141 - 160 of 209

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)