Exam 3: Financial Statements and Ratio Analysis

Exam 1: The Role of Managerial Finance133 Questions

Exam 2: The Financial Market Environment91 Questions

Exam 3: Financial Statements and Ratio Analysis209 Questions

Exam 4: Cash Flow and Financial Planning185 Questions

Exam 5: Time Value of Money173 Questions

Exam 6: Interest Rates and Bond Valuation224 Questions

Exam 7: Stock Valuation188 Questions

Exam 8: Risk and Return190 Questions

Exam 9: The Cost of Capital137 Questions

Exam 10: Capital Budgeting Techniques167 Questions

Exam 11: Capital Budgeting Cash Flows and Risk Refinements195 Questions

Exam 12: Leverage and Capital Structure217 Questions

Exam 13: Payout Policy130 Questions

Exam 14: Working Capital and Current Assets Management340 Questions

Exam 15: Current Liabilities Management171 Questions

Select questions type

In general, the more debt (other people's money) a firm uses in relation to its assets, the smaller its financial leverage.

Free

(True/False)

4.7/5  (30)

(30)

Correct Answer:

False

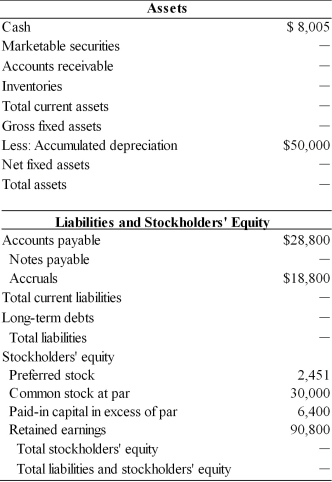

Complete the balance sheet for General Aviation, Inc. based on the following financial data.

Balance Sheet

General Aviation, Inc.

December 31, 2005  Key Financial Data (2005)

1. Sales totaled $720,000.

2. The gross profit margin was 38.7 percent.

3. Inventory turned 6 times.

4. There are 360 days in a year.

5. The average collection period was 31 days.

6. The current ratio was 2.35.

7. The total asset turnover was 2.81.

8. The debt ratio was 49.4 percent.

9. Total current assets equal $159,565.

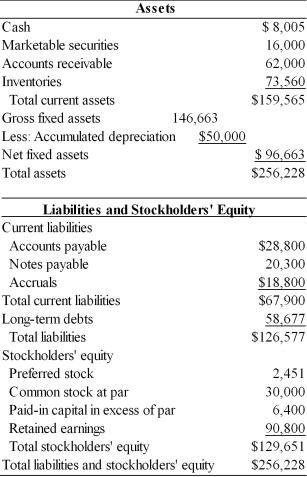

Key Financial Data (2005)

1. Sales totaled $720,000.

2. The gross profit margin was 38.7 percent.

3. Inventory turned 6 times.

4. There are 360 days in a year.

5. The average collection period was 31 days.

6. The current ratio was 2.35.

7. The total asset turnover was 2.81.

8. The debt ratio was 49.4 percent.

9. Total current assets equal $159,565.

Free

(Essay)

4.9/5  (39)

(39)

Correct Answer:

Balance Sheet

General Aviation, Inc.

December 31, 2005

In ratio analysis, the financial statements being used for comparison should be dated at the same point in time during the year. If not, the effect of seasonality may produce erroneous conclusions and decisions.

Free

(True/False)

4.8/5  (38)

(38)

Correct Answer:

True

Which of the following ratios is difficult for creditors of a firm to analyze because the data are usually not available in published financial statements?

(Multiple Choice)

4.9/5  (29)

(29)

The par value of common stock is an arbitrarily assigned per share value used primarily for accounting purposes.

(True/False)

5.0/5  (32)

(32)

On December 31, 2004, the Bradshaw Corporation had $485,000 as an ending balance for its retained earnings account. During 2005, the corporation declared a $3.50/share dividend to its stockholders. The Bradshaw Corporation has 35,000 shares of common stock outstanding. When the books were closed for 2005 year end, the corporation had a final retained earnings balance of $565,000. What was the net profit earned by Bradshaw Corporation during 2005?

(Essay)

4.8/5  (26)

(26)

The Financial Accounting Standards Board (FASB) is the federal regulatory body that governs the sale and listing of securities.

(True/False)

4.7/5  (34)

(34)

Cross-sectional ratio analysis involves comparing the firm's ratios to those of firms in other industries at the same point in time.

(True/False)

4.7/5  (36)

(36)

The ________ measures the percentage of each sales dollar remaining after ALL expenses, including taxes, have been deducted.

(Multiple Choice)

4.9/5  (31)

(31)

The ________ ratio measures the firm's ability to pay contractual interest payments.

(Multiple Choice)

4.7/5  (27)

(27)

The modified DuPont formula relates the firm's return on total assets (ROA) to the

(Multiple Choice)

4.9/5  (40)

(40)

The average payment period can be calculated as accounts payable divided by average sales per day.

(True/False)

4.8/5  (32)

(32)

The original price per share received by the firm on a single issue of common stock is equal to the sum of the common stock and paid-in capital in excess of par accounts divided by the number of shares outstanding.

(True/False)

5.0/5  (32)

(32)

The ________ represents a summary statement of the firm's financial position at a given point in time.

(Multiple Choice)

4.9/5  (39)

(39)

A firm had year end 2004 and 2005 retained earnings balances of $670,000 and $560,000, respectively. The firm paid $10,000 in dividends in 2005. The firm's net profit after taxes in 2002 was ________.

(Multiple Choice)

4.9/5  (40)

(40)

________ is used by financial managers as a structure for dissecting the firm's financial statements to assess its financial condition.

(Multiple Choice)

4.8/5  (36)

(36)

The average age of inventory can be calculated as inventory divided by 365.

(True/False)

4.8/5  (40)

(40)

Showing 1 - 20 of 209

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)