Exam 4: Cost Management Systems

Exam 1: Management Accounting and Management Decisions90 Questions

Exam 2: Cost Behaviour and Cost-Volume Relationships96 Questions

Exam 3: Measurement of Cost Behaviour97 Questions

Exam 4: Cost Management Systems134 Questions

Exam 5: Cost Allocation and Activity-Based Costing Systems128 Questions

Exam 6: Job-Costing Systems88 Questions

Exam 7: Process-Costing Systems82 Questions

Exam 8: Relevant Information and Decision Making: Marketing Decisions100 Questions

Exam 9: Relevant Information and Decision Making: Production Decisions111 Questions

Exam 10: Capital Budgeting Decisions116 Questions

Exam 11: The Master Budget112 Questions

Exam 12: Flexible Budgets and Variance Analysis106 Questions

Exam 13: Management Control Systems, the Balanced Scorecard, and Responsibility Accounting94 Questions

Exam 14: Management Control in Decentralized Organizations103 Questions

Select questions type

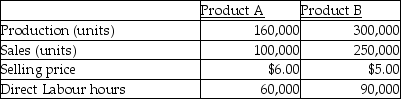

The following information refers to the Cowan Company's past year of operations.

*Common overhead totals $50,000 and is divided equally between the two products.

**Common fixed selling totals $60,000 and is divided equally between the two products.

Budgeted fixed overhead for the year of $180,000 equalled actual fixed overhead. Fixed overhead is assigned to products using a plant-wide rate based on expected direct labour hours, which were 150,000. The company had 5,000 of Product B in inventory at the beginning of the year. These units had the same unit cost as the units produced during the year.

-Variable costing net income for the year is

*Common overhead totals $50,000 and is divided equally between the two products.

**Common fixed selling totals $60,000 and is divided equally between the two products.

Budgeted fixed overhead for the year of $180,000 equalled actual fixed overhead. Fixed overhead is assigned to products using a plant-wide rate based on expected direct labour hours, which were 150,000. The company had 5,000 of Product B in inventory at the beginning of the year. These units had the same unit cost as the units produced during the year.

-Variable costing net income for the year is

(Multiple Choice)

5.0/5  (32)

(32)

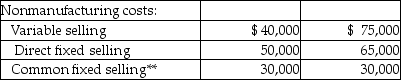

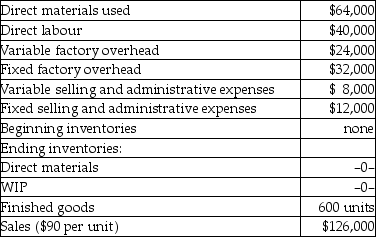

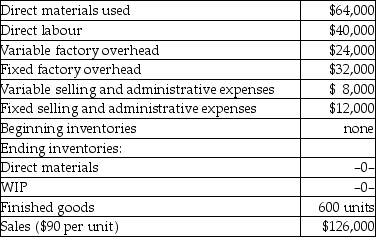

Radlin Inc. has just completed its first year of operations. The unit costs on a normal costing basis are as follows:

__________________________________________________________________  Actual fixed overhead was $170,000 for the year and actual variable overhead was $72,000. Budgeted fixed overhead was $180,000 and the company used an expected activity level of 40,000 direct labour hours to compute the predetermined overhead rates. Any overhead variances are closed to Cost of Goods Sold.

a. Compute the unit cost under:

(i) absorption costing

(ii) variable costing

b. Prepare an absorption-costing income statement.

c. Prepare a variable-costing income statement.

d. Reconcile the difference between the two income statements.

Actual fixed overhead was $170,000 for the year and actual variable overhead was $72,000. Budgeted fixed overhead was $180,000 and the company used an expected activity level of 40,000 direct labour hours to compute the predetermined overhead rates. Any overhead variances are closed to Cost of Goods Sold.

a. Compute the unit cost under:

(i) absorption costing

(ii) variable costing

b. Prepare an absorption-costing income statement.

c. Prepare a variable-costing income statement.

d. Reconcile the difference between the two income statements.

(Essay)

4.8/5  (36)

(36)

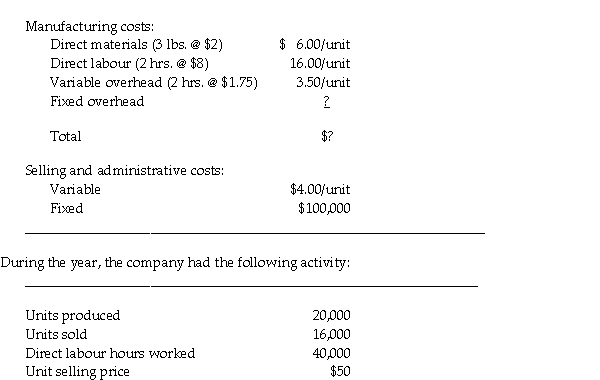

A company has the following information:

-The fixed-overhead rate is determined by dividing the budgeted fixed manufacturing overhead by

-The fixed-overhead rate is determined by dividing the budgeted fixed manufacturing overhead by

(Multiple Choice)

4.8/5  (35)

(35)

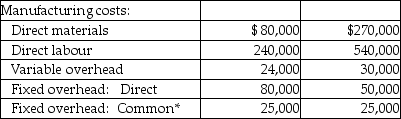

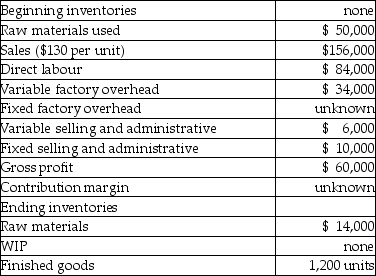

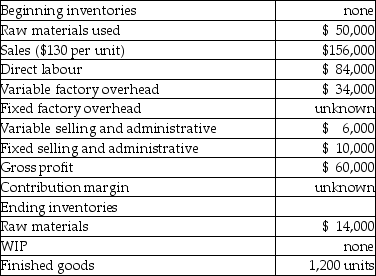

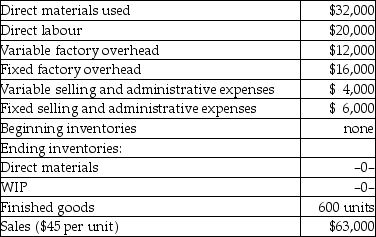

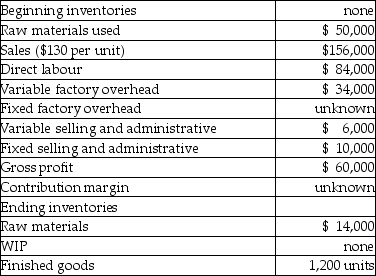

Schultz Company reported the following information about the production and sales of its only product:

-The contribution margin under variable costing would be

-The contribution margin under variable costing would be

(Multiple Choice)

4.8/5  (25)

(25)

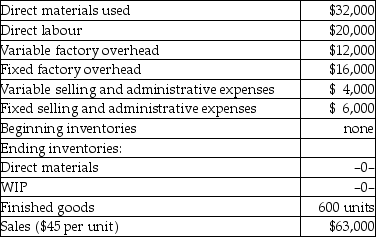

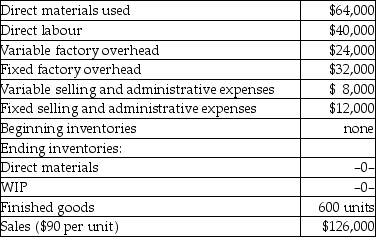

A company has the following information:

-The ending inventory under variable costing would be

-The ending inventory under variable costing would be

(Multiple Choice)

4.8/5  (45)

(45)

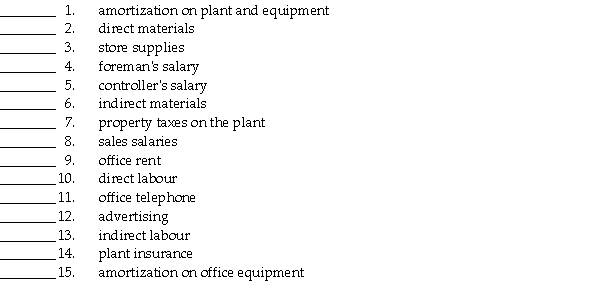

DeJager Company reported the following information about the production and sales of its only product:

-The cost of producing one unit of product using variable costing would be

-The cost of producing one unit of product using variable costing would be

(Multiple Choice)

4.8/5  (34)

(34)

The cost of goods purchased line on the income statement of a retailer is the equivalent to which line on a manufacturer's income statement?

(Multiple Choice)

4.8/5  (44)

(44)

DeJager Company reported the following information about the production and sales of its only product:

-The cost of goods sold under absorption costing would be

-The cost of goods sold under absorption costing would be

(Multiple Choice)

4.8/5  (27)

(27)

DeJager Company reported the following information about the production and sales of its only product:

-The operating income (loss) under variable costing would be

-The operating income (loss) under variable costing would be

(Multiple Choice)

4.9/5  (29)

(29)

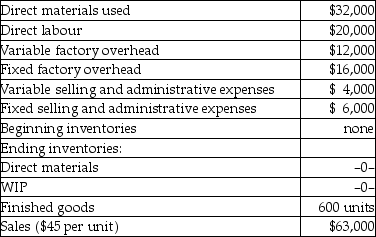

Indicate whether each of the following costs is an Inventoriable cost (I) or a Period cost (P):

(Essay)

4.9/5  (34)

(34)

Schultz Company reported the following information about the production and sales of its only product:

-The cost of goods sold under absorption costing would be

-The cost of goods sold under absorption costing would be

(Multiple Choice)

4.9/5  (34)

(34)

Which of the following terms appears on an income statement prepared using the contribution approach but NOT on an income statement using absorption costing?

(Multiple Choice)

4.8/5  (44)

(44)

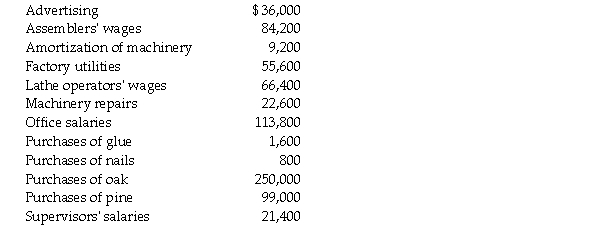

Lentz Manufacturers, a manufacturer of wood doors, has prepared the following list of accounts:  There were no beginning or ending inventories.

Required:

Calculate the following:

a. Direct materials used

b. Direct labour

c. Factory overhead

d. Prime costs

e. Conversion costs

There were no beginning or ending inventories.

Required:

Calculate the following:

a. Direct materials used

b. Direct labour

c. Factory overhead

d. Prime costs

e. Conversion costs

(Essay)

4.8/5  (31)

(31)

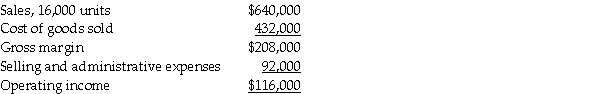

Johnson Corp. prepared the following absorption-costing income statement for the year ended May 31, 20X1.  Additional information follows:

Selling and administrative expenses include $3 of variable cost per unit sold. There was no beginning inventory, and 17,500 units were produced. Variable manufacturing costs were $22 per unit. Actual fixed costs were equal to budgeted fixed costs.

Required: Prepare a variable costing income statement for the same period.

Additional information follows:

Selling and administrative expenses include $3 of variable cost per unit sold. There was no beginning inventory, and 17,500 units were produced. Variable manufacturing costs were $22 per unit. Actual fixed costs were equal to budgeted fixed costs.

Required: Prepare a variable costing income statement for the same period.

(Essay)

4.9/5  (38)

(38)

How many inventory accounts does a manufacturer usually have?

(Multiple Choice)

4.8/5  (37)

(37)

A company has the following information:

-The net income under absorption costing would be

-The net income under absorption costing would be

(Multiple Choice)

4.9/5  (43)

(43)

Schultz Company reported the following information about the production and sales of its only product:

-The gross profit under absorption costing would be

-The gross profit under absorption costing would be

(Multiple Choice)

4.8/5  (45)

(45)

Showing 21 - 40 of 134

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)