Exam 4: Cost Management Systems

Exam 1: Management Accounting and Management Decisions90 Questions

Exam 2: Cost Behaviour and Cost-Volume Relationships96 Questions

Exam 3: Measurement of Cost Behaviour97 Questions

Exam 4: Cost Management Systems134 Questions

Exam 5: Cost Allocation and Activity-Based Costing Systems128 Questions

Exam 6: Job-Costing Systems88 Questions

Exam 7: Process-Costing Systems82 Questions

Exam 8: Relevant Information and Decision Making: Marketing Decisions100 Questions

Exam 9: Relevant Information and Decision Making: Production Decisions111 Questions

Exam 10: Capital Budgeting Decisions116 Questions

Exam 11: The Master Budget112 Questions

Exam 12: Flexible Budgets and Variance Analysis106 Questions

Exam 13: Management Control Systems, the Balanced Scorecard, and Responsibility Accounting94 Questions

Exam 14: Management Control in Decentralized Organizations103 Questions

Select questions type

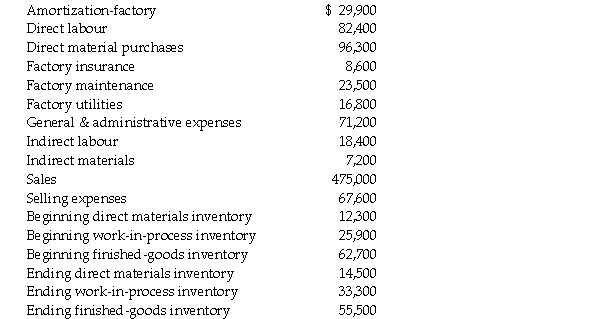

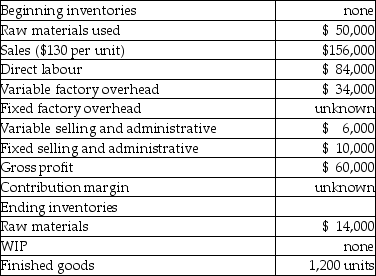

Elder, Inc. has supplied the following information:  Required:

a. Compute the cost of goods manufactured.

b. Compute the cost of goods sold.

c. Compute the net income.

Required:

a. Compute the cost of goods manufactured.

b. Compute the cost of goods sold.

c. Compute the net income.

(Essay)

4.7/5  (41)

(41)

Absorption costing is also known as all of the following EXCEPT

(Multiple Choice)

4.8/5  (40)

(40)

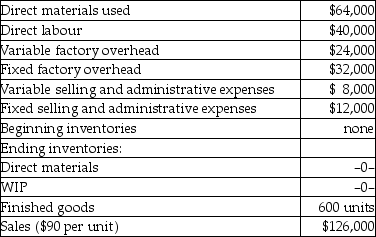

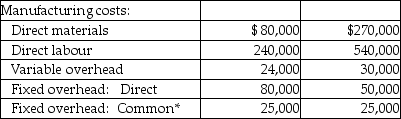

Schultz Company reported the following information about the production and sales of its only product:

-The cost of producing one unit of product using absorption costing would be

-The cost of producing one unit of product using absorption costing would be

(Multiple Choice)

4.9/5  (44)

(44)

A product-costing method that assigns only variable manufacturing costs to a product.

(Short Answer)

4.9/5  (34)

(34)

Absorption costing separates costs into manufacturing and non-manufacturing categories.

(True/False)

4.8/5  (34)

(34)

A company has the following information:

-How much factory overhead is included in the ending inventory under absorption costing?

-How much factory overhead is included in the ending inventory under absorption costing?

(Multiple Choice)

5.0/5  (27)

(27)

Which of the following is NOT considered a payroll fringe cost?

(Multiple Choice)

4.7/5  (33)

(33)

Costs that can be identified specifically and exclusively with a given cost objective in an economically feasible way.

(Short Answer)

4.9/5  (40)

(40)

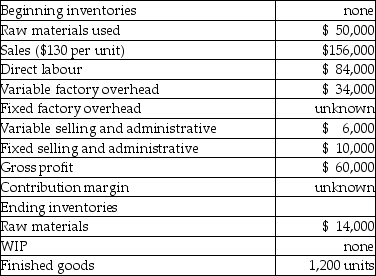

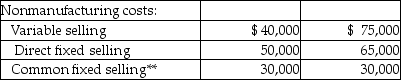

The following information was taken from the records of the Gallon Company for the year ended December 31, 20X4. There were no beginning or ending inventories.  Prepare an income statement for the year ended December 31, 20X4 using both the absorption approach and the contribution approach.

Prepare an income statement for the year ended December 31, 20X4 using both the absorption approach and the contribution approach.

(Essay)

5.0/5  (34)

(34)

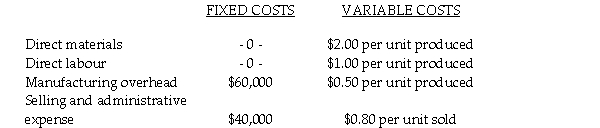

A company has the following information:

-The total contribution margin under variable costing would be

-The total contribution margin under variable costing would be

(Multiple Choice)

4.7/5  (42)

(42)

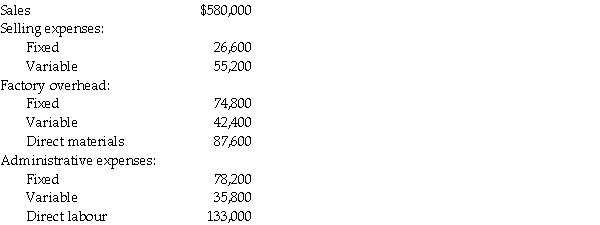

Bowzer Industries began operations on January 1, 2006. The company sells a single product for $10 per unit. During 2006, 60,000 units were produced and 50,000 units were sold. There was no work in process inventory at December 31, 2006.

Bowzer uses an actual cost system for product costing and actual costs for 1998 were as follows:  a. What is the product cost per unit under:

(i) variable costing

(ii) absorption costing

b. What is the finished goods inventory cost at December 31, 2006 under:

(i) variable costing

(ii) absorption costing

c. Prepare income statements for 2006 under:

(i) variable costing

(ii) absorption costing

d. Reconcile the difference between variable costing income and absorption costing income.

a. What is the product cost per unit under:

(i) variable costing

(ii) absorption costing

b. What is the finished goods inventory cost at December 31, 2006 under:

(i) variable costing

(ii) absorption costing

c. Prepare income statements for 2006 under:

(i) variable costing

(ii) absorption costing

d. Reconcile the difference between variable costing income and absorption costing income.

(Essay)

4.9/5  (31)

(31)

Expenses that are not directly traceable to a particular segment and are unaffected by the elimination of any one segment.

(Short Answer)

4.8/5  (28)

(28)

The term expense is used to describe both an inventory expenditure and a cost.

(True/False)

4.9/5  (36)

(36)

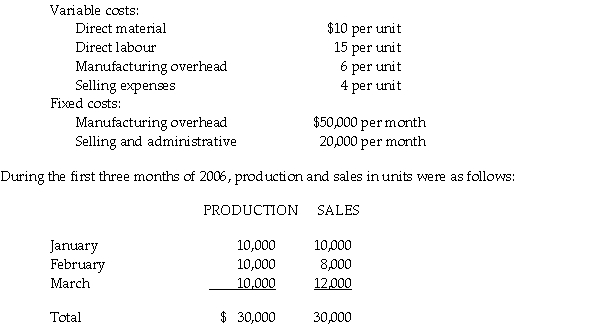

The Minler Company began the year 2006 with no inventories of work in process or finished goods. The company produces a single product, and cost data for the product are given below.  The company uses an actual cost system. The selling price of the product is $50 per unit. There were no work in process inventories at the end of each month.

a. Determine the unit cost of production for each month under:

(i) variable costing

(ii) absorption costing

b. Prepare income statements for the three months under:

(i) variable costing

(ii) absorption costing

c. If selling prices and costs do not change significantly, what can be said about the relationship of income under absorption costing and variable costing when:

(i) sales equal production

(ii) sales are less than production

(iii) sales are greater than production

The company uses an actual cost system. The selling price of the product is $50 per unit. There were no work in process inventories at the end of each month.

a. Determine the unit cost of production for each month under:

(i) variable costing

(ii) absorption costing

b. Prepare income statements for the three months under:

(i) variable costing

(ii) absorption costing

c. If selling prices and costs do not change significantly, what can be said about the relationship of income under absorption costing and variable costing when:

(i) sales equal production

(ii) sales are less than production

(iii) sales are greater than production

(Essay)

4.9/5  (34)

(34)

In the contribution approach, all factory overhead is considered to be product costs that are expensed as incurred.

(True/False)

4.8/5  (42)

(42)

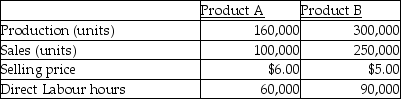

The following information refers to the Cowan Company's past year of operations.

*Common overhead totals $50,000 and is divided equally between the two products.

**Common fixed selling totals $60,000 and is divided equally between the two products.

Budgeted fixed overhead for the year of $180,000 equalled actual fixed overhead. Fixed overhead is assigned to products using a plant-wide rate based on expected direct labour hours, which were 150,000. The company had 5,000 of Product B in inventory at the beginning of the year. These units had the same unit cost as the units produced during the year.

-Using absorption costing, cost of goods sold for the year is

*Common overhead totals $50,000 and is divided equally between the two products.

**Common fixed selling totals $60,000 and is divided equally between the two products.

Budgeted fixed overhead for the year of $180,000 equalled actual fixed overhead. Fixed overhead is assigned to products using a plant-wide rate based on expected direct labour hours, which were 150,000. The company had 5,000 of Product B in inventory at the beginning of the year. These units had the same unit cost as the units produced during the year.

-Using absorption costing, cost of goods sold for the year is

(Multiple Choice)

4.9/5  (34)

(34)

Cost accounting system typically includes two processes, cost accumulation and cost determination.

(True/False)

4.7/5  (45)

(45)

Showing 61 - 80 of 134

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)