Exam 8: Risk, return, and Portfolio Theory

Exam 1: An Introduction to Finance54 Questions

Exam 2: Business Corporatefinance74 Questions

Exam 3: Financial Statements53 Questions

Exam 4: Financial Statement Analysis and Forecasting93 Questions

Exam 5: Time Value of Money85 Questions

Exam 6: Bond Valuation and Interest Rates80 Questions

Exam 7: Equity Valuation103 Questions

Exam 8: Risk, return, and Portfolio Theory104 Questions

Exam 9: The Capital Asset Pricing Model Capm113 Questions

Exam 10: Market Efficiency49 Questions

Exam 11: Forwards,futures,and Swaps55 Questions

Exam 12: Options56 Questions

Exam 13: Capital Budgeting, risk Considerations, and Other Special Issues143 Questions

Exam 14: Cash Flow Estimation and Capital Budgeting Decisions124 Questions

Exam 15: Mergers and Acquisitions89 Questions

Exam 16: Leasing50 Questions

Exam 17: Investment Banking and Securities Law69 Questions

Exam 18: Debt Instruments52 Questions

Exam 19: Equity and Hybrid Instruments72 Questions

Exam 20: Cost of Capital64 Questions

Exam 21: Capital Structure Decisions81 Questions

Exam 22: Dividend Policy54 Questions

Exam 23: Working Capital Management: General Issues50 Questions

Exam 24: Working Capital Management: Current Assets and Current Liabilities80 Questions

Select questions type

Steve bought a share of Toronto Skates Inc.three years ago for $45.00.He was paid two annual dividends of $4.50 in the past two years.If the stock price today is $ 48.50,what is the annual holding period return of the stock?

(Multiple Choice)

4.7/5  (42)

(42)

Laura purchased a share of MVP Company for $26.43 one year ago.The stock paid a quarterly dividend of $0.50 during the year.What is the capital gain yield if the current stock price is $28.26?

(Multiple Choice)

4.7/5  (39)

(39)

Amazon's new mobile phone Fire spectacularly under-performed analyst expectations leading to a drop in share price.This is an example of:

(Multiple Choice)

4.9/5  (34)

(34)

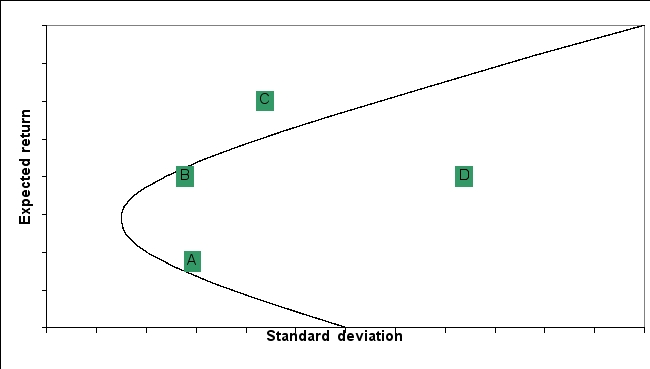

The standard deviation and expected returns for 4 portfolios (A,B,C,and D)are graphed on the following efficient frontier:  Which of the following portfolios are attainable?

Which of the following portfolios are attainable?

(Multiple Choice)

4.9/5  (33)

(33)

The expected returns for ABC Company and XYZ Company are 12 percent and 9 percent,respectively.The standard deviation is 20 percent for ABC and 15 percent for XYZ.What is the portfolio standard deviation if one-third of the portfolio is in ABC and the two securities have perfect positive correlation?

(Multiple Choice)

4.9/5  (37)

(37)

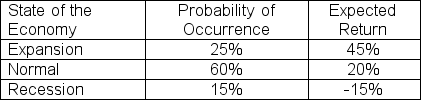

Given the following forecasts,what is the expected return for a portfolio that has $1,500 invested in Stock A and $4,500 invested in Stock B?

(Multiple Choice)

4.8/5  (35)

(35)

Which of the following is NOT a correct statement about income yield?

(Multiple Choice)

4.7/5  (32)

(32)

The closing prices for Stock B from December to June are: $42.90,$44.20,$51.50,$49.60,$45.50,$46.30,and $42.50.What is the standard deviation of returns over the six-month period?

(Multiple Choice)

4.9/5  (38)

(38)

The geometric average quarterly return of ROM Company was 5 percent for the previous year.What was the return for the third quarter if the returns for the first,second,and fourth quarters were 10 percent,-9.05 percent,and 8 percent,respectively?

(Multiple Choice)

4.9/5  (42)

(42)

Suppose you have a total return of 8 percent on the 500 shares of XYZ Company that you bought for $9,590 last year.XYZ paid four equal quarterly dividends during the year.What would be the quarterly dividend if the current stock price is $18.64 per share?

(Multiple Choice)

4.7/5  (34)

(34)

Suppose you plan to create a portfolio with two securities: Tobin and Bino,with weights to be greater than or equal to zero.The expected return of Tobin is 10 percent with a standard deviation of 12 percent.The expected return of Bino is 16 percent with a standard deviation of 20 percent.The correlation between the two securities is 0.30.

A) What percentage of your investment should be invested in Tobin to obtain a portfolio standard deviation of 12.2638 percent?

B) What is the expected return of the portfolio?

(Essay)

4.9/5  (42)

(42)

A share of Oedipus Construction Company was selling for $32.16 one year ago.The stock paid an annual dividend of $0.25 during the year.What is the capital gain yield if the current stock price is $34.02?

(Multiple Choice)

4.8/5  (34)

(34)

Given the following forecasts,what is the variance of returns?

(Multiple Choice)

4.8/5  (39)

(39)

What is the expected return for a portfolio that has $1,000 invested in Stock X,$1,500 invested in Stock Y,and $2,500 invested in Stock Z,if the expected returns on Stock X,Stock Y,and Stock Z are 10%,12%,and 15%,respectively?

(Multiple Choice)

4.8/5  (29)

(29)

The expected return on Alpha Inc.is 8 percent and the expected return on Beta Inc.is 24 percent.What is the trade-off between investing in Alpha and Beta if the portfolio weight in Alpha is increased by 1%?

(Multiple Choice)

4.8/5  (36)

(36)

Showing 21 - 40 of 104

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)