Exam 5: Statement of Cash Flows and Articulation

Exam 1: Financial Reporting89 Questions

Exam 2: A Review of the Accounting Cycle100 Questions

Exam 3: The Balance Sheet and Notes to the Financial Statements74 Questions

Exam 4: The Income Statement86 Questions

Exam 5: Statement of Cash Flows and Articulation83 Questions

Exam 6: Earnings Management47 Questions

Exam 7: The Revenuereceivablescash Cycle87 Questions

Exam 8: Revenue Recognition89 Questions

Exam 9: Inventory and Cost of Goods Sold134 Questions

Exam 10: Investments in Noncurrent Operating Assets-Acquisition88 Questions

Exam 11: Investments in Noncurrent Operating Assets-Utilization and Retirement84 Questions

Exam 12: Debt Financing111 Questions

Exam 13: Equity Financing97 Questions

Exam 14: Investments in Debt and Equity Securities88 Questions

Exam 15: Leases83 Questions

Exam 16: Income Taxes87 Questions

Exam 17: Employee Compensation-Payroll,pensions, Other Compissues83 Questions

Exam 19: Derivatives, contingencies, business Segments, and Interim Reports82 Questions

Exam 20: Accounting Changes and Error Corrections86 Questions

Exam 21: Statement of Cash Flows Revisited68 Questions

Exam 22: Accounting in a Global Market62 Questions

Exam 23: Analysis of Financial Statements65 Questions

Select questions type

Which of the following would be subtracted from net income when using the indirect method to derive net cash flows from operating activities?

Free

(Multiple Choice)

4.9/5  (37)

(37)

Correct Answer:

C

In a statement of cash flows,if equipment is sold at a gain,the amount shown as a cash inflow from investing activities equals the carrying amount of the equipment

Free

(Multiple Choice)

4.8/5  (35)

(35)

Correct Answer:

C

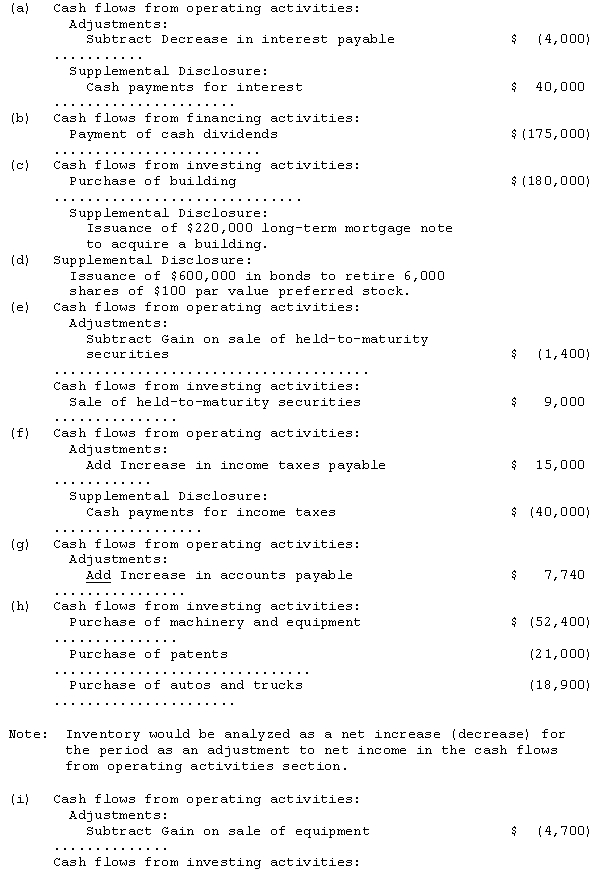

A review of the financial records of Stonehenge,Inc.for the current year revealed the following information:

(a)Reported interest expense of $36,000.The Interest Payable balance decreased $4,000.

(b)Declared and paid cash dividends of $175,000.

(c)Purchased a $400,000 building with a $220,000 long-term mortgage note.The remainder was paid in cash.

(d)Issued bonds with a $600,000 par value to retire 6,000 shares of $100 par value preferred stock.

(e)Held-to-maturity securities with a book value of $7,600 were sold for $9,000 during the year.

(f)Reported income tax expense of $55,000.The Income Taxes Payable balance increased $15,000.

(g)The Accounts Payable balance increased $7,740.

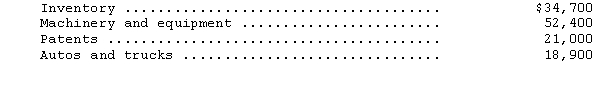

(h)Cash of $127,000 was paid to purchase business assets consisting of:

(i)Sold equipment with a net book value of $95,000 for $99,700.

(j)Issued $75,000 in common stock to acquire land with a selling price of $120,000.The difference was paid in cash.

Explain how each of the preceding items is presented in the cash flow statement,indirect method,or disclosed in the financial statements of Stonehenge,Inc.Indicate "not included" for any item that would not be reported or disclosed.Evaluate each item separately.

(i)Sold equipment with a net book value of $95,000 for $99,700.

(j)Issued $75,000 in common stock to acquire land with a selling price of $120,000.The difference was paid in cash.

Explain how each of the preceding items is presented in the cash flow statement,indirect method,or disclosed in the financial statements of Stonehenge,Inc.Indicate "not included" for any item that would not be reported or disclosed.Evaluate each item separately.

Free

(Essay)

4.8/5  (37)

(37)

Correct Answer:

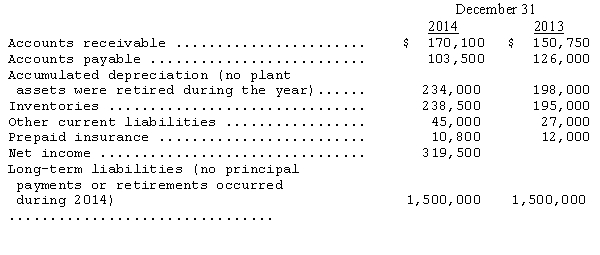

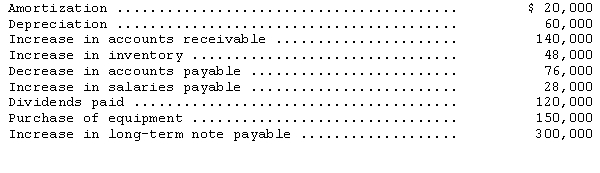

The following data were taken from the books of Golden Company.

Cash dividends of $169,000 were declared and paid during 2011.Also,$56,000 of preferred stock was issued during the period.

Compute the net cash flow provided by (used in)operating activities during 2014 for Golden Company.

Cash dividends of $169,000 were declared and paid during 2011.Also,$56,000 of preferred stock was issued during the period.

Compute the net cash flow provided by (used in)operating activities during 2014 for Golden Company.

(Essay)

4.9/5  (30)

(30)

Waller Corporation had the following account balances for 2014:

Waller's 2014 net income is $450,000.What amount should Waller include as net cash provided by operating activities in its 2014 statement of cash flows?

Waller's 2014 net income is $450,000.What amount should Waller include as net cash provided by operating activities in its 2014 statement of cash flows?

(Multiple Choice)

4.7/5  (35)

(35)

A gain on the sale of a plant asset should be included in which of the following sections of a statement of cash flows prepared using the direct method?

(Multiple Choice)

4.7/5  (39)

(39)

During 2014,Larson Corp.acquired buildings for $325,000,paying $75,000 cash and signing a 10% mortgage note payable in 10 years for the balance.How should the transaction be shown in the cash flow statement for Larson in 2014?

(Multiple Choice)

4.9/5  (33)

(33)

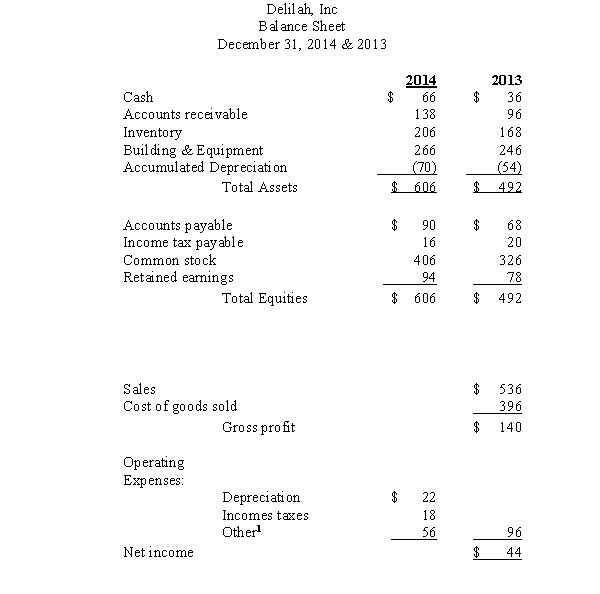

Delilah, Inc., presents the following comparative balance sheets and income statement (all amounts in thousands of dollars):

1Includes interest paid in cash of $23.

-See information regarding Delilah,Inc.above.The following additional information is provided:

1.Fully depreciated equipment costing $6,000 was abandoned on the first business day of 2014.

2.A building to store materials was acquired for $26,000.

3.A stock dividend of $20,000 was declared and distributed as was a cash dividend of $8,000.

4.Additional stock was sold during 2014 for cash.

Required:

Compute the following:

1.Cash received from customers

2.Cash paid to purchase inventory

3.Cash paid for income taxes

4.Cash from sale of common stock

1Includes interest paid in cash of $23.

-See information regarding Delilah,Inc.above.The following additional information is provided:

1.Fully depreciated equipment costing $6,000 was abandoned on the first business day of 2014.

2.A building to store materials was acquired for $26,000.

3.A stock dividend of $20,000 was declared and distributed as was a cash dividend of $8,000.

4.Additional stock was sold during 2014 for cash.

Required:

Compute the following:

1.Cash received from customers

2.Cash paid to purchase inventory

3.Cash paid for income taxes

4.Cash from sale of common stock

(Essay)

4.9/5  (36)

(36)

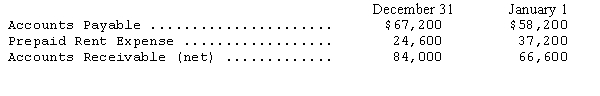

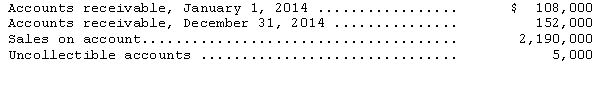

The following information was taken from the 2014 financial statements of Glocken Corporation:

No accounts receivable were written off or recovered during the year.If Glocken prepares a statement of cash flows using the direct method,what amount should be reported as collected from customers in 2014?

No accounts receivable were written off or recovered during the year.If Glocken prepares a statement of cash flows using the direct method,what amount should be reported as collected from customers in 2014?

(Multiple Choice)

4.7/5  (39)

(39)

American Corporation purchased a 3-month U.S.Treasury bill.In preparing American's statement of cash flows,this purchase would

(Multiple Choice)

4.9/5  (35)

(35)

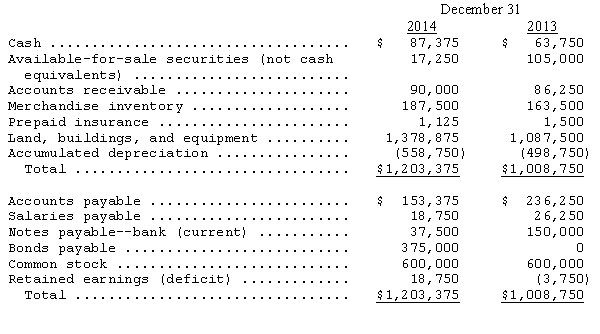

The Dakota Corporation prepared,for 2014 and 2013,the following balance sheet data:

Additional information:

(a)Sold available-for-sale securities (not cash equivalents)costing $87,750 for $90,000.

(b)Equipment costing $18,750 with a book value of $3,750 was sold for $4,500.

(c)Issued 8% bonds payable at par,$375,000.

(d)Purchased new equipment for cash,$310,125.

(e)Paid cash dividends of $22,500 during the year.

(f)Net income for 2014 was $45,000.

(g)Proceeds from the notes payable were used for operating purposes.

Prepare a cash flow statement for Dakota Corporation for 2014,using the indirect method.Calculate the Cash Flow to Net Income and the Cash Flow Adequacy ratios.

Additional information:

(a)Sold available-for-sale securities (not cash equivalents)costing $87,750 for $90,000.

(b)Equipment costing $18,750 with a book value of $3,750 was sold for $4,500.

(c)Issued 8% bonds payable at par,$375,000.

(d)Purchased new equipment for cash,$310,125.

(e)Paid cash dividends of $22,500 during the year.

(f)Net income for 2014 was $45,000.

(g)Proceeds from the notes payable were used for operating purposes.

Prepare a cash flow statement for Dakota Corporation for 2014,using the indirect method.Calculate the Cash Flow to Net Income and the Cash Flow Adequacy ratios.

(Essay)

4.8/5  (38)

(38)

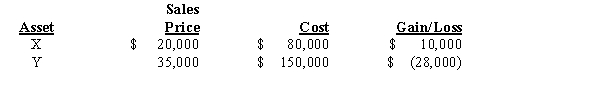

Net income for Parton Company for 2014 includes the effect of the following transactions involving the sale of fixed assets:

Purchases of fixed assets during 2014 amounted to $340,000.The Accumulated Depreciation account increased $40,000 during 2014.How much was depreciation expense for 2014?

Purchases of fixed assets during 2014 amounted to $340,000.The Accumulated Depreciation account increased $40,000 during 2014.How much was depreciation expense for 2014?

(Multiple Choice)

4.7/5  (35)

(35)

The most likely situation in which reported earnings are positive but operations are consuming rather than generating cash would be a

(Multiple Choice)

4.8/5  (39)

(39)

Supplemental disclosures required only when the statement of cash flows is prepared using the indirect method include

(Multiple Choice)

4.9/5  (34)

(34)

Thomson Company's income statement for the year ended December 31,2014,reported net income of $360,000.The financial statements also disclosed the following information:

Net cash provided by operating activities for 2014 should be reported as

Net cash provided by operating activities for 2014 should be reported as

(Multiple Choice)

4.8/5  (36)

(36)

In a statement of cash flows,proceeds from the sale of a company's own bonds or mortgages should be classified as cash inflows from

(Multiple Choice)

4.9/5  (36)

(36)

In preparing a statement of cash flows,sale of treasury stock at an amount greater than cost would be classified as a(n)

(Multiple Choice)

4.8/5  (38)

(38)

In preparing a statement of cash flows,which of the following transactions would be considered an investing activity?

(Multiple Choice)

4.8/5  (42)

(42)

In preparing a statement of cash flows (indirect method),cash flows from operating activities

(Multiple Choice)

4.8/5  (38)

(38)

Showing 1 - 20 of 83

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)