Exam 20: Accounting Changes and Error Corrections

Exam 1: Financial Reporting89 Questions

Exam 2: A Review of the Accounting Cycle100 Questions

Exam 3: The Balance Sheet and Notes to the Financial Statements74 Questions

Exam 4: The Income Statement86 Questions

Exam 5: Statement of Cash Flows and Articulation83 Questions

Exam 6: Earnings Management47 Questions

Exam 7: The Revenuereceivablescash Cycle87 Questions

Exam 8: Revenue Recognition89 Questions

Exam 9: Inventory and Cost of Goods Sold134 Questions

Exam 10: Investments in Noncurrent Operating Assets-Acquisition88 Questions

Exam 11: Investments in Noncurrent Operating Assets-Utilization and Retirement84 Questions

Exam 12: Debt Financing111 Questions

Exam 13: Equity Financing97 Questions

Exam 14: Investments in Debt and Equity Securities88 Questions

Exam 15: Leases83 Questions

Exam 16: Income Taxes87 Questions

Exam 17: Employee Compensation-Payroll,pensions, Other Compissues83 Questions

Exam 19: Derivatives, contingencies, business Segments, and Interim Reports82 Questions

Exam 20: Accounting Changes and Error Corrections86 Questions

Exam 21: Statement of Cash Flows Revisited68 Questions

Exam 22: Accounting in a Global Market62 Questions

Exam 23: Analysis of Financial Statements65 Questions

Select questions type

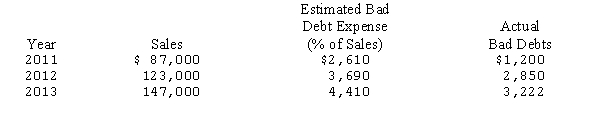

Improved Technologies has estimated bad debts using the percentage-of-sales method since their business began operations in 2011.Information relating to bad debts and sales is as follows:

At the beginning of 2014,Improved proposes changing their estimation of bad debt expense from 3 percent of sales to 2.5 percent.Sales for the year totaled $186,000 and actual bad debts amounted to $3,910.

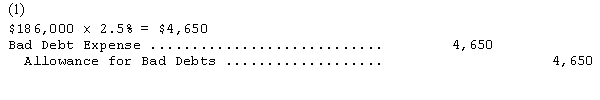

(1)Prepare the journal entry to record bad debt expense at the end of 2014.

(2)Determine the balance in "Allowance for Bad Debts" on December 31,2014.

At the beginning of 2014,Improved proposes changing their estimation of bad debt expense from 3 percent of sales to 2.5 percent.Sales for the year totaled $186,000 and actual bad debts amounted to $3,910.

(1)Prepare the journal entry to record bad debt expense at the end of 2014.

(2)Determine the balance in "Allowance for Bad Debts" on December 31,2014.

Free

(Essay)

4.8/5  (28)

(28)

Correct Answer:

A company changes from an accounting principle that is not generally accepted to one that is generally accepted.The effect of the change should be reported as a

Free

(Multiple Choice)

4.8/5  (40)

(40)

Correct Answer:

C

Which of the following would cause income of the current period to be understated?

Free

(Multiple Choice)

4.9/5  (41)

(41)

Correct Answer:

D

Which of the following changes in accounting principle does not require the retrospective approach?

(Multiple Choice)

4.7/5  (31)

(31)

FASB ASC Topic 250 (Presentation-Accounting Changes and Error Corrections,requires that voluntary changes in accounting principles be reported retrospectively.The standard recognizes that such retrospective restatement is not always practical.

Required:

1.Explain how a company would report a change from FIFO method of inventory costing to the LIFO method under ASC Topic 250.

2.Suppose a company has some,but not all,of the information needed to account for a change retrospectively.As an example,a company changes to the LIFO inventory method on January 1,2014.Management has information that would allow it to revise all assets and liabilities based on the newly adopted method for 2013 in its comparative financial statements,but not for 2012.Explain how this change would be reported under the circumstances described.

3.Suppose a company does not have the information necessary to retrospectively adjust retained earnings,but does have information available to revise all assets and liabilities for one or more specific years.As an example,a company changes to the LIFO inventory method on January 1,2014.The required records of inventory purchases and sales for some previous years are not available.The company does have the information required to apply the LIFO method on a prospective basis beginning in 2012.Explain how this change would be reported under the circumstances described.

(Essay)

4.9/5  (35)

(35)

Badger Corporation purchased a machine for $132,000 on January 1,2011,and depreciated it by the straight-line method using an estimated useful life of eight years with no salvage value.On January 1,2014,Badger determined that the machine had a useful life of six years from the date of acquisition and will have a salvage value of $12,000.A change in estimate was made in 2014 to reflect these additional data.What amount should Badger record as the balance of the accumulated depreciation account for this machine at December 31,2014?

(Multiple Choice)

4.9/5  (33)

(33)

For a company with a periodic inventory system,which of the following would cause income to be overstated in the period of occurrence?

(Multiple Choice)

4.9/5  (29)

(29)

In 2014,a company changed from the FIFO method of accounting for inventory to LIFO.The company's 2013 and 2014 comparative financial statements will reflect which method or methods?

(Short Answer)

4.8/5  (39)

(39)

Baron Co.began operations on January 1,2011,at which time it acquired depreciable assets of $100,000.The assets have an estimated useful life of ten years and no salvage value.

In 2014,Baron Co.changed from the sum-of-the-years'-digits depreciation method to the straight-line depreciation method.

Required:

Determine the depreciation expense for 2014 and prepare the appropriate journal entry.

(Essay)

4.9/5  (35)

(35)

The ending inventory for Wyeth Company was overstated by $6,000 in 2014.The overstatement will cause Wyeth Company's

(Multiple Choice)

4.9/5  (40)

(40)

Which of the following is not correct regarding the provisions of IAS No.8 on accounting changes and error corrections?

(Multiple Choice)

4.8/5  (34)

(34)

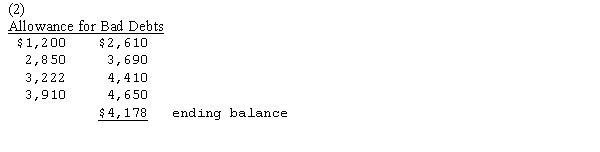

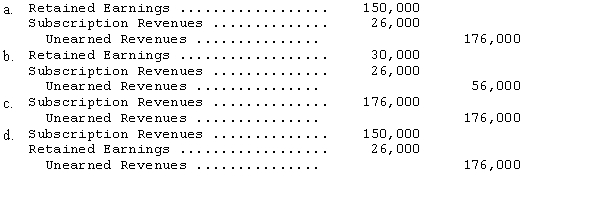

Pages,Inc.receives subscription payments for annual (one year)subscriptions to its magazine.Payments are recorded as revenue when received.Amounts received but unearned at the end of each of the last three years are shown below.

Pages failed to record the unearned revenues in each of the three years.The entry needed to correct the above errors is

Pages failed to record the unearned revenues in each of the three years.The entry needed to correct the above errors is

(Short Answer)

4.8/5  (36)

(36)

The September 30,2014,physical inventory of Pollack Corporation appropriately included $6,300 of merchandise purchased on account that was not recorded in purchases until October 2014.What effect will this error have on September 30,2014,assets,liabilities,retained earnings,and earnings for the year then ended,respectively?

(Multiple Choice)

4.8/5  (39)

(39)

A change in the unit depletion rate would be accounted for as a

(Multiple Choice)

4.8/5  (40)

(40)

An accounting change that requires the retrospective approach is a change in

(Multiple Choice)

4.9/5  (31)

(31)

Which of the following is NOT correct regarding a change in reporting entity?

(Multiple Choice)

4.8/5  (35)

(35)

In 2014,a company changed from the LIFO method of accounting for inventory to FIFO.The company's 2013 and 2014 comparative financial statements will reflect which method or methods?

(Short Answer)

4.8/5  (43)

(43)

The cumulative effect on prior years' earnings of a change in accounting principle should be reported separately as an adjustment to retained earnings for the earliest period presented for all of the following changes except

(Multiple Choice)

4.9/5  (38)

(38)

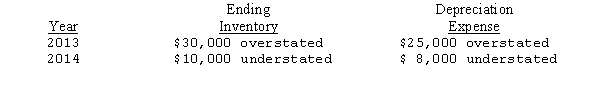

Rickles,Inc.is a calendar-year corporation whose financial statements for 2013 and 2014 included errors as follows:

Assume that purchases were recorded correctly and that no correcting entries were made at December 31,2013,or December 31,2014.Ignoring income taxes,by how much should Rickles's retained earnings be retroactively adjusted at January 1,2015?

Assume that purchases were recorded correctly and that no correcting entries were made at December 31,2013,or December 31,2014.Ignoring income taxes,by how much should Rickles's retained earnings be retroactively adjusted at January 1,2015?

(Multiple Choice)

4.7/5  (41)

(41)

Showing 1 - 20 of 86

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)