Exam 20: Accounting Changes and Error Corrections

Exam 1: Financial Reporting89 Questions

Exam 2: A Review of the Accounting Cycle100 Questions

Exam 3: The Balance Sheet and Notes to the Financial Statements74 Questions

Exam 4: The Income Statement86 Questions

Exam 5: Statement of Cash Flows and Articulation83 Questions

Exam 6: Earnings Management47 Questions

Exam 7: The Revenuereceivablescash Cycle87 Questions

Exam 8: Revenue Recognition89 Questions

Exam 9: Inventory and Cost of Goods Sold134 Questions

Exam 10: Investments in Noncurrent Operating Assets-Acquisition88 Questions

Exam 11: Investments in Noncurrent Operating Assets-Utilization and Retirement84 Questions

Exam 12: Debt Financing111 Questions

Exam 13: Equity Financing97 Questions

Exam 14: Investments in Debt and Equity Securities88 Questions

Exam 15: Leases83 Questions

Exam 16: Income Taxes87 Questions

Exam 17: Employee Compensation-Payroll,pensions, Other Compissues83 Questions

Exam 19: Derivatives, contingencies, business Segments, and Interim Reports82 Questions

Exam 20: Accounting Changes and Error Corrections86 Questions

Exam 21: Statement of Cash Flows Revisited68 Questions

Exam 22: Accounting in a Global Market62 Questions

Exam 23: Analysis of Financial Statements65 Questions

Select questions type

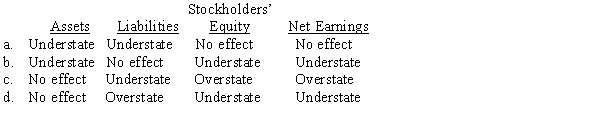

Queener Corporation uses a periodic inventory system and neglected to record a purchase of merchandise on account at year-end.This merchandise was omitted from the year-end physical count.How will these errors affect Queener's assets,liabilities,and stockholders' equity at year-end and net earnings for the year?

(Short Answer)

4.8/5  (38)

(38)

The correction of an error in the financial statements of a prior period should be reflected,net of applicable income taxes,in the current

(Multiple Choice)

4.8/5  (36)

(36)

Witherfork Company was recently acquired by a new owner who has decided to correct the prior accounting records during the current reporting period ending December 31,2014.The accounts have been partially adjusted but have not been closed for 2014.The following items have been discovered:

1.The merchandise inventory at December 31,2013,was overstated by $10,000; the company uses a periodic inventory system.

2.During January 2012,extraordinary repairs on machinery were debited to repair expense; the $15,000 amount should have been debited to machinery,which is being depreciated 15 percent per year on cost,with no residual value.

3.A patent that cost $9,350 has been amortized using the straight-line method for the past 10 years (excluding 2014)over its legal life of 20 years.Management has determined that the economic life will not be more than 15 years from the initial acquisition date.

4.At the end of 2013,sales revenue collected in advance of $3,000 was included in 2013 sales revenue,despite the fact that the amount was earned in 2014.

5.The company paid $8,000 during January 2012 for ordinary repairs on a machine that was acquired during January 2012.The repairs were incorrectly capitalized.The machine has an estimated life of five years and no residual value.The company plans to use straight-line depreciation for this machine.

6.The rate used for bad debts has been 1/2 percent of credit sales,which has proved to be too low.As a result,for 2014 and thereafter,the rate used will be 1 percent of credit sales.The amount of expense per year recorded under the old rate was $800 in 2012 and $1,000 in 2013.The amount for 2014 has not been entered into the accounts since the adjusting entries have not been made.Credit sales for 2014 exceeded 2013 credit sales by 20 percent.

7.During January 2012,a five-year insurance premium of $750 was paid.This amount was debited in full to insurance expense at that time.

8.At the end of 2013,accrued wages payable of $1,800 were not recorded.These wages were first recorded when paid in early 2014.Unpaid wages at the end of 2014 were $2,100.

Required:

Provide the appropriate entry to record any change or correction and give any adjusting entry needed in each instance at the end of 2014.Show computations for entries made,and provide explanations for situations for which no entry is required.

(Essay)

4.7/5  (44)

(44)

Sandusky Enterprise purchased a machine on January 3,2011.The machine cost $46,000 with an estimated salvage value of $2,000 and an estimated useful life of 10 years.As a result of technological improvements,a revision of the machine's useful life and estimated salvage value was made.On January 1,2014,the equipment was estimated to last through 2015 with an estimated value at that time of $500.Sandusky uses the straight-line method for depreciation.

Prepare the journal entry to record depreciation on December 31,2014.

(Essay)

4.7/5  (33)

(33)

On January 1,2011,Mardi Gras Shipping bought a machine for $1,500,000.At that time,this machine had an estimated useful life of six years,with no salvage value.As a result of additional information,Mardi Gras determined on January 1,2014,that the machine had an estimated useful life of eight years from the date it was acquired,with no salvage value.Accordingly,the appropriate accounting change was made in 2014.How much depreciation expense for this machine should Mardi Gras record for the year ended December 31,2014,assuming Mardi Gras uses the straight-line method of depreciation?

(Multiple Choice)

4.9/5  (34)

(34)

Which of the following accounting treatments is proper for a change in reporting entity?

(Multiple Choice)

4.9/5  (40)

(40)

Showing 81 - 86 of 86

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)