Exam 22: Accounting in a Global Market

Exam 1: Financial Reporting89 Questions

Exam 2: A Review of the Accounting Cycle100 Questions

Exam 3: The Balance Sheet and Notes to the Financial Statements74 Questions

Exam 4: The Income Statement86 Questions

Exam 5: Statement of Cash Flows and Articulation83 Questions

Exam 6: Earnings Management47 Questions

Exam 7: The Revenuereceivablescash Cycle87 Questions

Exam 8: Revenue Recognition89 Questions

Exam 9: Inventory and Cost of Goods Sold134 Questions

Exam 10: Investments in Noncurrent Operating Assets-Acquisition88 Questions

Exam 11: Investments in Noncurrent Operating Assets-Utilization and Retirement84 Questions

Exam 12: Debt Financing111 Questions

Exam 13: Equity Financing97 Questions

Exam 14: Investments in Debt and Equity Securities88 Questions

Exam 15: Leases83 Questions

Exam 16: Income Taxes87 Questions

Exam 17: Employee Compensation-Payroll,pensions, Other Compissues83 Questions

Exam 19: Derivatives, contingencies, business Segments, and Interim Reports82 Questions

Exam 20: Accounting Changes and Error Corrections86 Questions

Exam 21: Statement of Cash Flows Revisited68 Questions

Exam 22: Accounting in a Global Market62 Questions

Exam 23: Analysis of Financial Statements65 Questions

Select questions type

Under international accounting standards,cash received from interest (associated with interest revenue)can be shown on the statement of cash flows as an

(Multiple Choice)

4.7/5  (44)

(44)

Which of the following is NOT a short-term convergence topic that the IASB must address in order to eliminate the reconciliation of accounts prepared under different sets of standards of different countries?

(Multiple Choice)

4.8/5  (39)

(39)

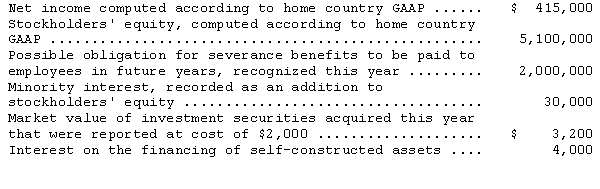

The following financial information is for Pasha Company,a non-U.S.firm with shares listed on a U.S.stock exchange:

If Pasha Company were following U.S.GAAP,the minority interest would have been classified as a liability instead of as part of stockholders' equity.In addition,minority interest income of $5,000 for the year would have been excluded from the computation of net income.Under U.S.GAAP the investment securities would have been classified as trading securities and the interest on financing of self-constructed assets would have been capitalized rather than expensed.

Prepare reconciliations of Pasha's reported stockholders' equity and net income to U.S.GAAP.

If Pasha Company were following U.S.GAAP,the minority interest would have been classified as a liability instead of as part of stockholders' equity.In addition,minority interest income of $5,000 for the year would have been excluded from the computation of net income.Under U.S.GAAP the investment securities would have been classified as trading securities and the interest on financing of self-constructed assets would have been capitalized rather than expensed.

Prepare reconciliations of Pasha's reported stockholders' equity and net income to U.S.GAAP.

(Essay)

4.8/5  (33)

(33)

Foreign currency translation adjustments arising from translation of the financial statements of a foreign subsidiary are reported in

(Multiple Choice)

4.7/5  (31)

(31)

Which of the following is correct regarding the treatment of short-term obligations expected to be refinanced?

(Multiple Choice)

4.9/5  (40)

(40)

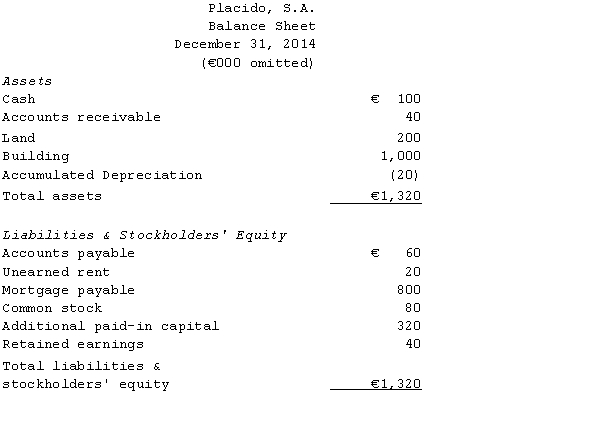

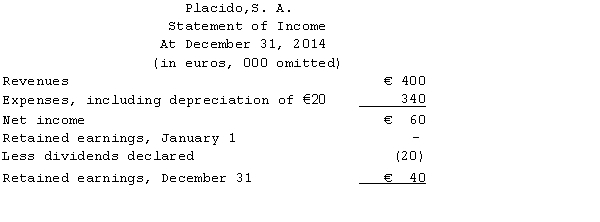

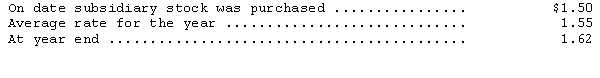

Lunes Company,a U.S.company,owns a 100% interest in its subsidiary,Placido,S.A.,located in Italy.Placido,S.A.,began operations on January 1,2014.The subsidiary's operations consist of leasing space in an office building.The building,which cost one million euros,was financed primarily by Italian banks.All revenues and expenses are received and paid in euros.The subsidiary also maintains its accounting records in euros.In light of these facts,management of the U.S.parent has determined that the euro is the functional currency of the subsidiary.

The subsidiary's balance sheet at December 31,2014,and income statement for the year then ended,are presented below,in euros:

The following are relevant exchange rates for the year 2014:

€1 = $1.50 at the beginning of 2014,at which time the common stock

was issued and the land and building were financed by the mortgage.

€1 = $1.55 weighted average for 2014.

€1 = $1.58 at the date the dividends were declared and paid and

the unearned rent was received.

€1 = $1.62 at the end of 2014.

Required:

Prepare in U.S.dollars a balance sheet at December 31,2014,and an income statement for the year then ended.

The following are relevant exchange rates for the year 2014:

€1 = $1.50 at the beginning of 2014,at which time the common stock

was issued and the land and building were financed by the mortgage.

€1 = $1.55 weighted average for 2014.

€1 = $1.58 at the date the dividends were declared and paid and

the unearned rent was received.

€1 = $1.62 at the end of 2014.

Required:

Prepare in U.S.dollars a balance sheet at December 31,2014,and an income statement for the year then ended.

(Essay)

4.8/5  (33)

(33)

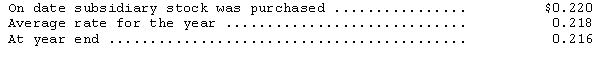

DeGaulle Enterprises,a subsidiary of Clinton Company based in New York,reported the following information at the end of its first year of operations (all in French francs): assets--4,790,000; expenses--6,500,000; liabilities--2,950,000; capital stock--1,200,000,revenues--7,140,000.Relevant exchange rates are as follows:

As a result of the translation process,what amount is recorded on the financial statements as the translation adjustment?

As a result of the translation process,what amount is recorded on the financial statements as the translation adjustment?

(Multiple Choice)

4.9/5  (38)

(38)

The SEC currently requires foreign companies that list shares on U.S.exchanges to provide

(Multiple Choice)

4.9/5  (39)

(39)

Which of the following is true regarding the accounting for property,plant,and equipment under international accounting standards?

(Multiple Choice)

4.9/5  (34)

(34)

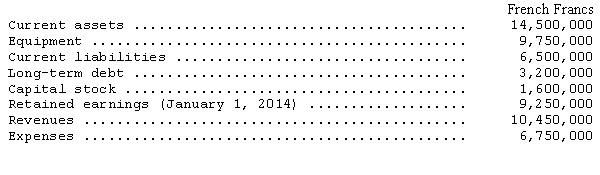

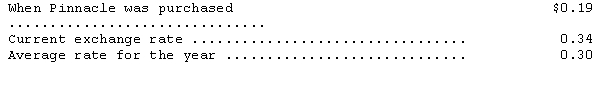

Financial information for Pinnacle Enterprises at the end of 2014 is as follows:

Relevant exchange rates are as follows:

Relevant exchange rates are as follows:

In addition,the computed retained earnings balance from the prior year's translated financial statements is $2,405,000 at the end of 2014.

Prepare a translated trial balance for Pinnacle Enterprises.

In addition,the computed retained earnings balance from the prior year's translated financial statements is $2,405,000 at the end of 2014.

Prepare a translated trial balance for Pinnacle Enterprises.

(Essay)

4.8/5  (46)

(46)

Florence Enterprises,a subsidiary of Verona Company based in New York,reported the following information at the end of its first year of operations (all in euros): assets--1,320,000; expenses--340,000; liabilities--880,000; capital stock--80,000,revenues--400,000.Relevant exchange rates are as follows:

As a result of the translation process,what amount is recorded on the financial statements as the translation adjustment?

As a result of the translation process,what amount is recorded on the financial statements as the translation adjustment?

(Multiple Choice)

4.7/5  (41)

(41)

Which of the following is the primary factor in determining the functional currency of a foreign subsidiary?

(Multiple Choice)

4.8/5  (40)

(40)

Under international accounting standards,remote contingent liabilities are

(Multiple Choice)

4.8/5  (26)

(26)

A translation adjustment resulting from the translation process is disclosed on the financial statements as

(Multiple Choice)

4.8/5  (34)

(34)

The primary purpose of the Security and Exchange Commission's Form 20-F is to

(Multiple Choice)

4.8/5  (41)

(41)

Under international accounting standards,the pension-related asset or liability is recognized on the balance sheet as the

(Multiple Choice)

4.8/5  (33)

(33)

Which of the following statements regarding international accounting standards for the impairment of tangible assets is correct?

(Multiple Choice)

4.8/5  (32)

(32)

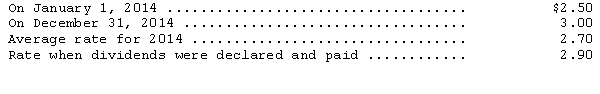

Finnish Company converts its foreign subsidiary financial statements using the translation process.The company's subsidiary in Denmark reported the following for 2014: revenues and expenses of 95,000 and 63,000 kroner,respectively,earned or incurred evenly throughout the year,dividends of 43,000 kroner were paid during the year.The following exchange rates are available:

Translated net income for 2014 is

Translated net income for 2014 is

(Multiple Choice)

4.7/5  (36)

(36)

Which of the following is true regarding the application of lower-of-cost-or-market method under international accounting standards?

(Multiple Choice)

4.9/5  (33)

(33)

Under international accounting standards,cash received from dividends (associated with dividend revenue)can be shown on the statement of cash flows as

(Multiple Choice)

4.9/5  (39)

(39)

Showing 41 - 60 of 62

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)