Exam 6: Relevant Information for Decision Making With a Focus

Exam 1: Managerial Accounting, the Business Organization129 Questions

Exam 2: Introduction to Cost Behavior and Cost-Volume Relationships152 Questions

Exam 3: Measurement of Cost Behavior141 Questions

Exam 4: Cost Management Systems and Activity-Based Costing129 Questions

Exam 5: Relevant Information for Decision Making With a Focus128 Questions

Exam 6: Relevant Information for Decision Making With a Focus148 Questions

Exam 7: Introduction to Budgets and Preparing the Master Budget144 Questions

Exam 8: Flexible Budgets and Variance Analysis143 Questions

Exam 9: Management Control Systems and Responsibility Accounting147 Questions

Exam 10: Management Control in Decentralized Organizations160 Questions

Exam 11: Capital Budgeting141 Questions

Exam 12: Cost Allocation125 Questions

Exam 13: Accounting for Overhead Costs127 Questions

Exam 14: Job-Order Costing and Process-Costing Systems157 Questions

Exam 15: Basic Accounting: Concepts, techniques, and Conventions154 Questions

Exam 16: Understanding Corporate Annual Reports: Basic Financial Statements149 Questions

Exam 17: Understanding and Analyzing Consolidated Financial Statements122 Questions

Select questions type

Separable costs are part of a joint process and cannot be exclusively identified with individual products.

(True/False)

4.9/5  (38)

(38)

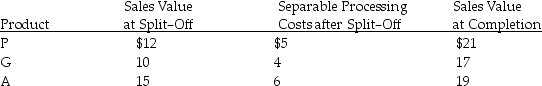

Strawberry Corporation has a joint process that produces three products: P,G and A.Each product may be sold at split-off or processed further and then sold.Joint-processing costs for a year amount to $25,000.The production level for each product is 10,000 units.Other data follows:  Processing Product P beyond the split-off point will cause profits to ________.

Processing Product P beyond the split-off point will cause profits to ________.

(Multiple Choice)

4.9/5  (32)

(32)

Outsourcing is the purchase of products or services by a company from an outside supplier.

(True/False)

4.9/5  (32)

(32)

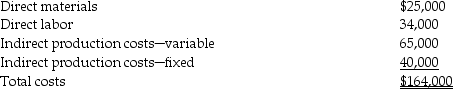

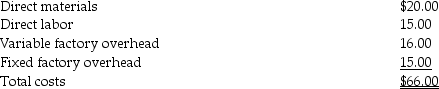

Jeff Company produces a part that is used in the manufacture of one of its products.The annual costs associated with the production of 11,000 units of this part are as follows:

A supplier is willing to sell 11,000 units of the part to Jeff Company for $12.50 per unit.When examining the indirect production costsfixed,Jeff Company determines $10,000 is avoidable.

Required:

A)If there are no alternative uses for the facilities,should Jeff Company take advantage of the supplier's offer?

B)If Jeff Company decides to buy the part from the supplier,Jeff Company can rent out the idle facilities for $50,000 per year.Should Jeff Company take advantage of the supplier's offer?

A supplier is willing to sell 11,000 units of the part to Jeff Company for $12.50 per unit.When examining the indirect production costsfixed,Jeff Company determines $10,000 is avoidable.

Required:

A)If there are no alternative uses for the facilities,should Jeff Company take advantage of the supplier's offer?

B)If Jeff Company decides to buy the part from the supplier,Jeff Company can rent out the idle facilities for $50,000 per year.Should Jeff Company take advantage of the supplier's offer?

(Essay)

4.8/5  (36)

(36)

Ernie Company is considering replacing a machine that is currently used in the production process.The ________ is irrelevant to the replacement decision.

(Multiple Choice)

4.8/5  (46)

(46)

Future costs are relevant in decision making when they ________.

(Multiple Choice)

4.8/5  (40)

(40)

When making a make-or-buy decision for a part,what items are relevant to the decision?

(Multiple Choice)

4.8/5  (39)

(39)

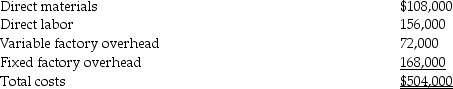

Match Company produces a part that is used in the manufacture of one of its products.The costs associated with the production of 5,000 units of this part are as follows:  Of the fixed factory overhead costs,$72,000 are avoidable.Today Company has offered to sell 5,000 units of the same part to Match for $86.40 per unit.Assuming there is no other use for the facilities,Match Company should ________.

Of the fixed factory overhead costs,$72,000 are avoidable.Today Company has offered to sell 5,000 units of the same part to Match for $86.40 per unit.Assuming there is no other use for the facilities,Match Company should ________.

(Multiple Choice)

4.8/5  (41)

(41)

BEE Company is considering the replacement of a machine that is presently used in production.Which of the following items are irrelevant to the replacement decision?

(Multiple Choice)

4.9/5  (36)

(36)

Future costs are relevant if they are the same under all feasible alternatives.

(True/False)

4.7/5  (36)

(36)

In deciding whether to add or delete a product,the insurance expense associated with the custom-built equipment used to produce the product is an ________ cost.Assume the equipment will be sold if the company discontinues the product.

(Multiple Choice)

4.8/5  (41)

(41)

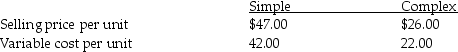

Watson Corporation manufactures two products,Simple and Complex.The following annual information was gathered:  Total annual fixed costs are $18,000.Assume Watson Corporation can produce and sell any mix of Simple or Complex at full capacity.It takes one hour to make one unit of Complex.However,Simple takes 50% longer to manufacture when compared to Complex.Only 120,000 hours of plant capacity are available.How many units of Simple and Complex should Watson Corporation produce and sell in a year to maximize profits?

Total annual fixed costs are $18,000.Assume Watson Corporation can produce and sell any mix of Simple or Complex at full capacity.It takes one hour to make one unit of Complex.However,Simple takes 50% longer to manufacture when compared to Complex.Only 120,000 hours of plant capacity are available.How many units of Simple and Complex should Watson Corporation produce and sell in a year to maximize profits?

(Multiple Choice)

4.7/5  (30)

(30)

Ford Company manufactures a part for its production cycle.The costs per unit for 10,000 units of the part are as follows:  The fixed factory overhead costs are unavoidable.Assuming no other use for the facilities,what is the highest price that Ford Company should be willing to pay for the part?

The fixed factory overhead costs are unavoidable.Assuming no other use for the facilities,what is the highest price that Ford Company should be willing to pay for the part?

(Multiple Choice)

4.8/5  (30)

(30)

The cost of new equipment is relevant in deciding whether to keep or replace old equipment.

(True/False)

4.8/5  (34)

(34)

If a company has excess capacity,the most it should be willing to pay for a part for a product that it currently makes would be the ________.

(Multiple Choice)

4.7/5  (31)

(31)

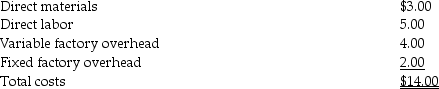

Lakers Company manufactures a part for its production cycle.The annual costs per unit for 5,000 units of the part are as follows:  The fixed factory overhead costs are unavoidable.Spalding Company has offered to sell 5,000 units of the same part to Lakers Company for $14 per unit.The facilities currently used for the part could be used to make 5,000 units annually of a new product that would contribute $5 a unit to fixed expenses.No additional fixed costs would be incurred with the new product.Lakers Company should ________.

The fixed factory overhead costs are unavoidable.Spalding Company has offered to sell 5,000 units of the same part to Lakers Company for $14 per unit.The facilities currently used for the part could be used to make 5,000 units annually of a new product that would contribute $5 a unit to fixed expenses.No additional fixed costs would be incurred with the new product.Lakers Company should ________.

(Multiple Choice)

4.9/5  (35)

(35)

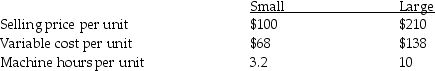

Ring Corporation manufactures two types of tables: Small and Large.The following data is available:

Total fixed costs are $9,600.Ring Corporation can sell a maximum of 1,000 units of each size of table.Machine hour capacity is 8,000 hours per year.

Required:

A)Which table has the highest contribution margin per unit?

B)Which table has the highest contribution margin per machine hour?

C)How many tables of each size should be produced to maximize operating income?

Total fixed costs are $9,600.Ring Corporation can sell a maximum of 1,000 units of each size of table.Machine hour capacity is 8,000 hours per year.

Required:

A)Which table has the highest contribution margin per unit?

B)Which table has the highest contribution margin per machine hour?

C)How many tables of each size should be produced to maximize operating income?

(Essay)

4.8/5  (31)

(31)

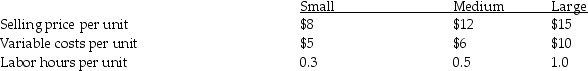

Schmidt Company makes three sizes of shirts: Small,Medium and Large.The company uses one assembly line that has a limit of 600 labor hours per week.Schmidt Company can sell all the shirts it can make under current operating capacity.The following information is available:

Required:

A)Determine the weekly contribution margin when all the labor hours are allotted to the shirts with the highest selling price per unit.

B)Determine the weekly contribution margin when all the labor hours are allotted to the shirts with the highest contribution margin per unit.

C)Determine the weekly contribution margin when all the labor hours are allotted to the shirts with the highest contribution margin per labor hour.

Required:

A)Determine the weekly contribution margin when all the labor hours are allotted to the shirts with the highest selling price per unit.

B)Determine the weekly contribution margin when all the labor hours are allotted to the shirts with the highest contribution margin per unit.

C)Determine the weekly contribution margin when all the labor hours are allotted to the shirts with the highest contribution margin per labor hour.

(Essay)

4.9/5  (29)

(29)

Joint products should be processed beyond the split-off point if ________.

(Multiple Choice)

4.9/5  (33)

(33)

Showing 81 - 100 of 148

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)