Exam 6: Relevant Information for Decision Making With a Focus

Exam 1: Managerial Accounting, the Business Organization129 Questions

Exam 2: Introduction to Cost Behavior and Cost-Volume Relationships152 Questions

Exam 3: Measurement of Cost Behavior141 Questions

Exam 4: Cost Management Systems and Activity-Based Costing129 Questions

Exam 5: Relevant Information for Decision Making With a Focus128 Questions

Exam 6: Relevant Information for Decision Making With a Focus148 Questions

Exam 7: Introduction to Budgets and Preparing the Master Budget144 Questions

Exam 8: Flexible Budgets and Variance Analysis143 Questions

Exam 9: Management Control Systems and Responsibility Accounting147 Questions

Exam 10: Management Control in Decentralized Organizations160 Questions

Exam 11: Capital Budgeting141 Questions

Exam 12: Cost Allocation125 Questions

Exam 13: Accounting for Overhead Costs127 Questions

Exam 14: Job-Order Costing and Process-Costing Systems157 Questions

Exam 15: Basic Accounting: Concepts, techniques, and Conventions154 Questions

Exam 16: Understanding Corporate Annual Reports: Basic Financial Statements149 Questions

Exam 17: Understanding and Analyzing Consolidated Financial Statements122 Questions

Select questions type

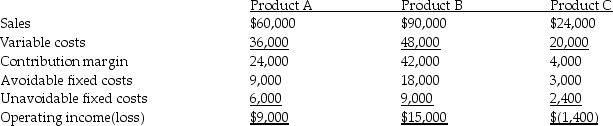

Vineyard Company has three product lines: A,B and C.The following annual information is available:  Assume Vineyard Company can increase the selling price of Product C to $30,000.Assume all other information remains the same.What will happen to operating income?

Assume Vineyard Company can increase the selling price of Product C to $30,000.Assume all other information remains the same.What will happen to operating income?

(Multiple Choice)

4.7/5  (33)

(33)

Sue is considering leaving her current position to open a coffee shop.Sue's current annual salary is $83,000.Annual coffee shop revenue and costs are estimated at $260,000 and $210,000,respectively.What is Sue's opportunity cost of opening the coffee shop in the first year?

(Multiple Choice)

4.9/5  (33)

(33)

________ costs are costs of manufacturing two or more products that are not separately identifiable as individual products until their split-off point.

(Multiple Choice)

4.9/5  (31)

(31)

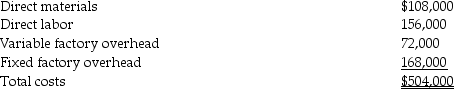

Dally Company produces a part that is used in the manufacture of one of its products.The costs associated with the production of 5,000 units of this part are as follows:  Of the fixed factory overhead costs,$72,000 are avoidable.Assuming there is no other use for the facilities.What is the highest price Dally Company should be willing to pay for 5,000 units of the part?

Of the fixed factory overhead costs,$72,000 are avoidable.Assuming there is no other use for the facilities.What is the highest price Dally Company should be willing to pay for 5,000 units of the part?

(Multiple Choice)

4.8/5  (35)

(35)

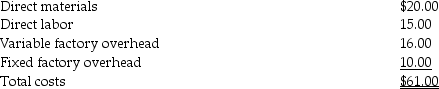

Johnson Company manufactures a part for its production cycle.The annual costs per unit for 10,000 units of the part are as follows:  The fixed factory overhead costs are unavoidable.Spalding Company has offered to sell 10,000 units of the same part to Johnson Company for $60 per unit.The facilities currently used to make the part could be rented out to another manufacturer for $100,000 per year.Johnson Company should ________.

The fixed factory overhead costs are unavoidable.Spalding Company has offered to sell 10,000 units of the same part to Johnson Company for $60 per unit.The facilities currently used to make the part could be rented out to another manufacturer for $100,000 per year.Johnson Company should ________.

(Multiple Choice)

4.8/5  (30)

(30)

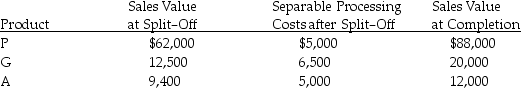

Down Corporation has a joint process that produces three products: P,G and A.Each product may be sold at split-off or processed further and then sold.Joint-processing costs for a year amount to $25,000.Other data follows:  Processing Product G beyond the split-off point will cause profits to ________.

Processing Product G beyond the split-off point will cause profits to ________.

(Multiple Choice)

5.0/5  (36)

(36)

When managers are making a decision regarding adding or dropping a product,ethical considerations may also be influential.

(True/False)

4.7/5  (33)

(33)

The disposal value of old equipment is relevant in equipment replacement decisions.

(True/False)

4.8/5  (31)

(31)

Showing 141 - 148 of 148

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)