Exam 11: Long-Term Liabilities, Bonds Payable, and Classification of Liabilities on the Balance Sheet

Exam 1: Accounting and the Business Environment156 Questions

Exam 2: Recording Business Transactions156 Questions

Exam 3: The Adjusting Process160 Questions

Exam 4: Completing the Accounting Cycle165 Questions

Exam 5: Merchandising Operations168 Questions

Exam 6: Merchandising Inventory155 Questions

Exam 7: Internal Control and Cash161 Questions

Exam 8: Receivables166 Questions

Exam 9: Plant Assets and Intangibles170 Questions

Exam 10: Current Liabilities and Payroll159 Questions

Exam 11: Long-Term Liabilities, Bonds Payable, and Classification of Liabilities on the Balance Sheet161 Questions

Exam 12: Corporations: Paid-In Capital and the Balance Sheet167 Questions

Exam 13: Corporations: Effects on Retained Earnings and the Income Statement164 Questions

Exam 14: The Statement of Cash Flows162 Questions

Exam 15: Financial Statement Analysis163 Questions

Exam 16: Introduction to Management Accounting163 Questions

Exam 17: Job Order and Process Costing172 Questions

Exam 18: Activity-Based Costing and Other Cost Management Tools162 Questions

Exam 19: Cost-Volume-Profit Analysis165 Questions

Exam 20: Short-Term Business Decisions163 Questions

Exam 21: Capital Investment Decisions and the Time Value of Money153 Questions

Exam 22: The Master Budget and Responsibility Accounting157 Questions

Exam 23: Flexible Budgets and Standard Costs166 Questions

Exam 24: Performance Evaluation and the Balanced Scorecard166 Questions

Select questions type

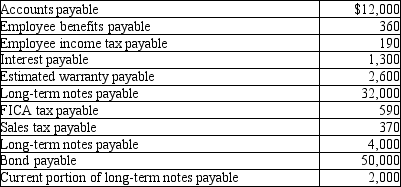

Please refer to the following list of liability balances.  What is the total amount of current liabilities?

What is the total amount of current liabilities?

(Multiple Choice)

4.9/5  (43)

(43)

Compute the present value of a bond: The principal amount is $50,000, the stated rate is 3%, and the term of the bond is 6 years. The bond pays interest semiannually. At the time of issue, the market rate is 4%. Please compute the present value of the bond at market rate using the present value tables.

(Multiple Choice)

4.9/5  (34)

(34)

The time value of money is related to which of the following concepts?

(Multiple Choice)

4.8/5  (42)

(42)

The balance in the Bonds payable account is a credit of $50,000. The balance in the Premium on bonds payable account is a credit of $900. The bond carrying amount is $50,900.

(True/False)

4.9/5  (40)

(40)

If a bond's stated interest rate is lower than the market rate, which of the following is TRUE?

(Multiple Choice)

4.9/5  (36)

(36)

If bonds with a face value of $100,000 are sold at par, the amount of cash proceeds is:

(Multiple Choice)

5.0/5  (38)

(38)

When a bond is sold, the selling price is generally equivalent to the present value of the bond payments.

(True/False)

4.9/5  (33)

(33)

If a bond is issued at a discount, it will sell for more than face value.

(True/False)

4.8/5  (43)

(43)

The balance in the Bonds payable account is a credit of $50,000. The balance in the Discount on bonds payable account is a debit of $1,500. How much is the bond carrying amount?

(Multiple Choice)

4.9/5  (46)

(46)

On July 1, 2013, Avery Services issued a 4% long-term note payable for $10,000. It is payable over a 5-year term in $2,000 principal installments on July 1 of each year. Each yearly installment will include both principal repayment of $2,000 and interest payment for the preceding one-year period. Please provide the journal entry needed at year-end 2013 to accrue the interest expense from July 1 through the end of the year.

(Essay)

4.8/5  (32)

(32)

The balance in the Bonds payable is a credit of $50,000. The balance in the Premium on bonds payable is a credit of $900. The balance sheet will report the bond balance as $49,100.

(True/False)

5.0/5  (30)

(30)

On November 1, 2015, Archangel Services issued $200,000 of 10-year bonds with a stated rate of 3%. The bonds were sold at par, and make semiannual payments on April 30 and October 31. At December 31, 2015, Archangel made an adjusting entry to accrue interest at year-end. How much interest expense will be recorded at December 31, 2015?

(Multiple Choice)

4.9/5  (39)

(39)

On November 1, 2015, Archangel Services issued $200,000 of 10-year bonds with a stated rate of 3%. The bonds were sold at discount for $191,000, and make semiannual payments on April 30 and October 31. At December 31, 2015, Archangel made an adjusting entry to accrue interest at year-end. How much interest expense is recorded at December 31, 2015?

A)$1,075

B)$2,000

C)$1,150

D)$2,150

(Essay)

4.8/5  (38)

(38)

On December 31, 2013, Peterson Sales has a Bonds payable balance of $40,000 and a Discount on bonds payable of $2,100. On the balance sheet, how will this information be shown?

(Multiple Choice)

4.8/5  (40)

(40)

McDonald Sales prepared a bond issue of $20,000 dated January 1, 2013. The bonds have a stated rate of 3% and a term of 6 years. The bond issue was delayed, and the bonds were finally sold on March 1, 2013 at par. On June 30, 2013, the first semiannual interest payment is made. How much will be paid out to bondholders on June 30, 2013?

(Multiple Choice)

4.8/5  (38)

(38)

On January 1, 2013, Davie Services issued $20,000 of 8% bonds that mature in five years. They were sold at par. The bonds pay semiannual interest payments on June 30 and December 31 of each year. On June 30, 2013, how much are the total interest payments made to bondholders?

(Multiple Choice)

4.9/5  (30)

(30)

On November 1, 2015, Archangel Services issued $200,000 of 10-year bonds with a stated rate of 3%. The bonds were sold at discount for $191,000, and make semiannual payments on April 30 and October 31. At December 31, 2015, Archangel made an adjusting entry to accrue interest at year-end. No further entries were made until April 30, 2016 when the first interest payment was made. How much interest expense will be recorded for the period of January through April, 2016?

A)$3,000

B)$2,700

C)$2,000

D)$2,300

(Essay)

4.8/5  (38)

(38)

On January 1, 2013, Davie Services issued $20,000 of 8% bonds that mature in five years. They were sold at discount, for a total of $19,000. The bonds pay semiannual interest payments on June 30 and December 31 of each year. On June 30, 2013, how much is the total amount paid to bondholders?

(Multiple Choice)

4.8/5  (28)

(28)

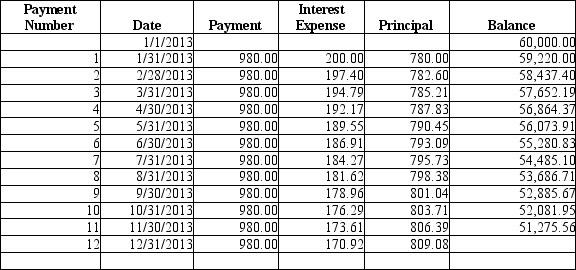

On January 1, 2013, Thames Company purchases property and signs a 6-year mortgage note for $60,000 at 4%. Please see the partial amortization schedule below.  For the year 2013, what will be the total interest expense recorded by Thames Company for this mortgage?

For the year 2013, what will be the total interest expense recorded by Thames Company for this mortgage?

(Multiple Choice)

4.9/5  (28)

(28)

Showing 101 - 120 of 161

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)