Exam 11: Long-Term Liabilities, Bonds Payable, and Classification of Liabilities on the Balance Sheet

Exam 1: Accounting and the Business Environment156 Questions

Exam 2: Recording Business Transactions156 Questions

Exam 3: The Adjusting Process160 Questions

Exam 4: Completing the Accounting Cycle165 Questions

Exam 5: Merchandising Operations168 Questions

Exam 6: Merchandising Inventory155 Questions

Exam 7: Internal Control and Cash161 Questions

Exam 8: Receivables166 Questions

Exam 9: Plant Assets and Intangibles170 Questions

Exam 10: Current Liabilities and Payroll159 Questions

Exam 11: Long-Term Liabilities, Bonds Payable, and Classification of Liabilities on the Balance Sheet161 Questions

Exam 12: Corporations: Paid-In Capital and the Balance Sheet167 Questions

Exam 13: Corporations: Effects on Retained Earnings and the Income Statement164 Questions

Exam 14: The Statement of Cash Flows162 Questions

Exam 15: Financial Statement Analysis163 Questions

Exam 16: Introduction to Management Accounting163 Questions

Exam 17: Job Order and Process Costing172 Questions

Exam 18: Activity-Based Costing and Other Cost Management Tools162 Questions

Exam 19: Cost-Volume-Profit Analysis165 Questions

Exam 20: Short-Term Business Decisions163 Questions

Exam 21: Capital Investment Decisions and the Time Value of Money153 Questions

Exam 22: The Master Budget and Responsibility Accounting157 Questions

Exam 23: Flexible Budgets and Standard Costs166 Questions

Exam 24: Performance Evaluation and the Balanced Scorecard166 Questions

Select questions type

Paris Company buys a building on a plot of land for $100,000, paying $20,000 cash and signing a 20-year mortgage note for $80,000 at 6%. Monthly payments are $570. The first monthly payment was made in January, 2013. Please provide the journal entry for the first monthly payment.

(Essay)

5.0/5  (43)

(43)

The Amazing Widget Company issues $500,000 of 6%, 10-year bonds at 103 on March 31, 2014. The bond pays interest on March 31 and September 30. The market rate of interest on the issuance date was 4%. Assume the company uses the straight-line method for amortization. The journal entry to record the issuance would include a:

(Multiple Choice)

4.9/5  (36)

(36)

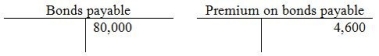

On October 15, 2013, Rural Sales has a bond with balances as shown below.  If Rural Sales wishes to retire the bonds for $82,000, what will be the effect on the income statement?

If Rural Sales wishes to retire the bonds for $82,000, what will be the effect on the income statement?

(Multiple Choice)

4.7/5  (31)

(31)

A bond is sold for an amount less than its face value. Which of the following statements would explain why?

(Multiple Choice)

4.7/5  (43)

(43)

The time value of money is based on the concept that money earns interest over time.

(True/False)

4.8/5  (23)

(23)

On January 1, 2014, Partridge Company issued $50,000 of 6-year bonds with a stated rate of 3%. The market rate at time of issue was 4%, so the bonds were discounted and sold for $47,331. Partridge uses the effective-interest rate of amortization for bond discount. Semiannual interest payments are made on June 30 and December 31 of each year. How much interest expense will be recorded when the first interest payment is made? (Please round to the nearest whole dollar.)

(Multiple Choice)

4.7/5  (33)

(33)

Blanding Company issues $1,000,000 of 8%, 10-year bonds at 98 on February 28, 2014. The bond pays interest on February 28 and August 31. The market rate of interest on the issuance date was 10%. Assume Blanding uses the straight-line method for amortization. The interest accrual entry at December 31, 2014 would include:

(Multiple Choice)

4.9/5  (33)

(33)

The balance in the Bonds payable account is a credit of $50,000. The balance in the Discount on bonds payable account is a debit of $1,500. The bond carrying amount is $51,500.

(True/False)

4.8/5  (35)

(35)

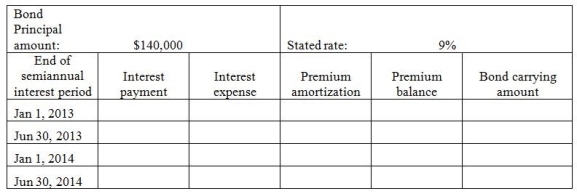

On January 1, 2013, Diab Services issued $140,000 of 4-year bonds with a stated rate of 9%. The market rate at time of issue was 8%, so the bonds were issued at a premium and sold for $144,758. Diab uses the effective-interest method to amortize bond premium. Semiannual interest payments are made on June 30 and December 31 of each year. Please complete the amortization table for the first four interest payments.

(Essay)

4.9/5  (41)

(41)

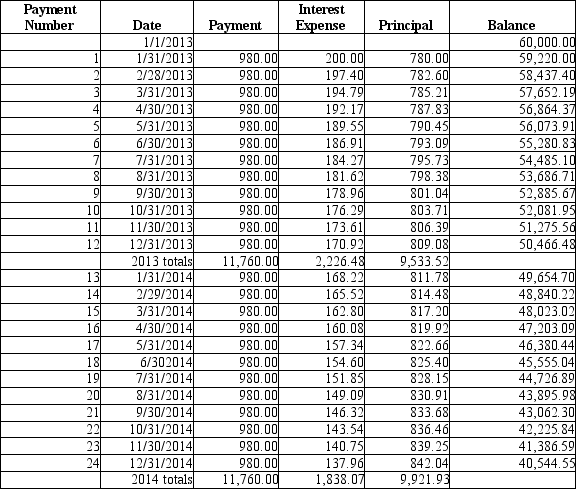

On January 1, 2013, Thames Company purchases property and signs a 6-year mortgage note $60,000 at 4%. Please see the partial amortization schedule below.  At the end of 2013, what amount would be shown on the balance sheet for mortgage payable (excluding the current portion)?

At the end of 2013, what amount would be shown on the balance sheet for mortgage payable (excluding the current portion)?

(Multiple Choice)

4.9/5  (37)

(37)

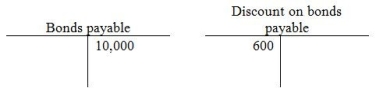

On January 2, 2014, Mahoney Sales issued $10,000 in bonds for $9,400. They were 5-year bonds with a stated rate of 4%, and pay semiannual interest payments. Mahoney Sales uses straight-line method to amortize bond discount. Immediately after issue of the bonds, the ledger balances appeared as follows:  After the second interest payment on December 31, 2014, what was the balance in the discount account?

After the second interest payment on December 31, 2014, what was the balance in the discount account?

(Multiple Choice)

4.9/5  (37)

(37)

On January 1, 2013, Davie Services issued $20,000 of 8% bonds that mature in five years. They were issued at par-for the same amount as the face value. Please provide the journal entry to issue the bonds.

(Essay)

4.9/5  (35)

(35)

On January 1, 2013, Diab Services issued $140,000 of 4-year bonds with a stated rate of 9%. The market rate at time of issue was 8%, so the bonds were issued with a premium and sold for $144,758. Diab uses the effective-interest method to amortize bond premium. Semiannual interest payments are made on June 30 and December 31 of each year. How much interest expense will be recorded when the first interest payment is made?

(Multiple Choice)

4.9/5  (39)

(39)

Premium on bonds payable is spread over the term of the bonds and reduces total interest expense.

(True/False)

4.8/5  (34)

(34)

On January 1, 2012, Davie Services issued $20,000 of 8% bonds that mature in five years. They were sold at a premium, for a total of $20,750. On January 1, 2017, when the bonds mature, Davie Services will make the final principal payment. That entry will include which of the following?

(Multiple Choice)

5.0/5  (26)

(26)

On January 1, 2013, Davie Services issued $20,000 of 8% bonds that mature in five years. They were sold at discount, for a total of $19,000. Please provide the journal entry to issue the bonds.

(Essay)

4.8/5  (42)

(42)

On November 1, 2012, EZ Products borrowed $48,000 on a 5%, 10-year note with annual installment payments of $4,800 plus interest due on November 1 of each succeeding year. On December 31, 2013, what will the balance be in the account titled Current portion of long-term notes payable?

(Multiple Choice)

4.8/5  (40)

(40)

Premium on bonds payable is considered to be additional interest expense of the company that issues the bond.

(True/False)

4.8/5  (31)

(31)

The Amazing Widget Company issues $500,000 of 6%, 10-year bonds at 103 on March 31, 2014. The bond pays interest on March 31 and September 30. The market rate of interest on the issuance date was 4%. Assume the company uses the straight-line method for amortization. What net balance will be reported for the bonds on the balance sheet on September 30, 2014?

(Multiple Choice)

4.8/5  (36)

(36)

The current portion of notes payable would normally be shown on the balance sheet in long-term liabilities.

(True/False)

4.8/5  (47)

(47)

Showing 141 - 160 of 161

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)