Exam 22: Performance Measurement and Responsibility Accounting

Exam 1: Accounting in Business285 Questions

Exam 2: Accounting for Business Transactions251 Questions

Exam 3: Adjusting Accounts for Financial Statements403 Questions

Exam 4: Accounting for Merchandising Operations252 Questions

Exam 5: Inventories and Cost of Sales238 Questions

Exam 6: Cash,fraud,and Internal Controls228 Questions

Exam 7: Accounting for Receivables219 Questions

Exam 8: Accounting for Long-Term Assets258 Questions

Exam 9: Accounting for Current Liabilities219 Questions

Exam 10: Accounting for Long-Term Liabilities231 Questions

Exam 11: Corporate Reporting and Analysis247 Questions

Exam 12: Reporting Cash Flows247 Questions

Exam 13: Analysis of Financial Statements245 Questions

Exam 14: Managerial Accounting Concepts and Principles252 Questions

Exam 15: Job Order Costing and Analysis215 Questions

Exam 16: Process Costing and Analysis225 Questions

Exam 17: Activity-Based Costing and Analysis223 Questions

Exam 18: Cost Behavior and Cost-Volume-Profit Analysis247 Questions

Exam 19: Variable Costing and Analysis202 Questions

Exam 20: Master Budgets and Performance Planning224 Questions

Exam 21: Flexible Budgets and Standard Costs223 Questions

Exam 22: Performance Measurement and Responsibility Accounting210 Questions

Exam 23: Relevant Costing for Managerial Decisions149 Questions

Exam 24: Capital Budgeting and Investment Analysis161 Questions

Exam 25: Time Value of Money84 Questions

Exam 26: Investments217 Questions

Exam 27: Lean Principles and Accounting30 Questions

Select questions type

In regard to joint cost allocation,the "split-off point" is:

(Multiple Choice)

5.0/5  (35)

(35)

No standard rule identifies the best basis of allocating expenses across departments.

(True/False)

4.8/5  (33)

(33)

A company pays $15,000 per period to rent a small building that has 10,000 square feet of space.This cost is allocated to the company's three departments on the basis of the amount of the space occupied by each.Department One occupies 2,000 square feet of floor space,Department Two occupies 3,000 square feet of floor space,and Department Three occupies 5,000 square feet of floor space.If the rent is allocated based on the total square footage of the space,Department One should be charged rent expense for the period of:

(Multiple Choice)

4.9/5  (29)

(29)

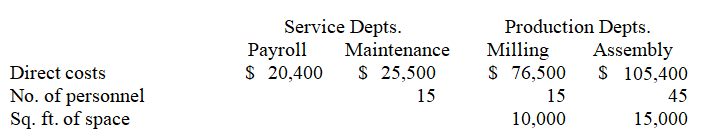

Brownley Company has two service departments and two operating (production)departments.The Payroll Department services all three of the other departments in proportion to the number of employees in each.The Maintenance Department costs are allocated to the two operating departments in proportion to the floor space used by each.Listed below are the operating data for the current period:  -The total cost of operating the Maintenance Department for the current period is:

-The total cost of operating the Maintenance Department for the current period is:

(Multiple Choice)

5.0/5  (40)

(40)

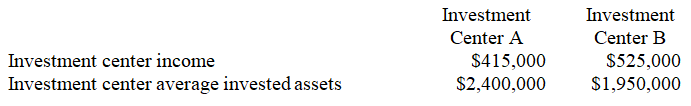

Two investment centers at Marshman Corporation have the following current-year income and asset data:

The return on investment (ROI)for Investment Center A is:

The return on investment (ROI)for Investment Center A is:

(Multiple Choice)

4.8/5  (47)

(47)

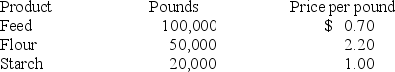

A granary allocates the cost of unprocessed wheat to the production of feed,flour,and starch.For the current period,unprocessed wheat was purchased for $120,000,and the following quantities of product and sales revenues were produced.  How much of the $120,000 cost should be allocated to flour if the value basis is used?

How much of the $120,000 cost should be allocated to flour if the value basis is used?

(Multiple Choice)

4.8/5  (40)

(40)

Departmental contribution to overhead is the same as gross profit generated by that department.

(True/False)

4.7/5  (46)

(46)

In producing oat bran,the joint cost of milling the oats into bran,oatmeal,and animal feed is considered a direct cost to the oat bran,because the oat bran cannot be produced without incurring the joint cost.

(True/False)

4.8/5  (39)

(39)

If a company reports profit margin of 31.6% and investment turnover of 1.30 for one of its investment centers,the return on investment must be:

(Multiple Choice)

4.9/5  (38)

(38)

Kragle Corporation reported the following financial data for one of its divisions for the year; average invested assets of $470,000; sales of $930,000; and income of $105,000.The investment turnover is:

(Multiple Choice)

4.9/5  (33)

(33)

Departmental contribution to overhead is the amount of sales for that department,less its direct expenses.

(True/False)

4.8/5  (41)

(41)

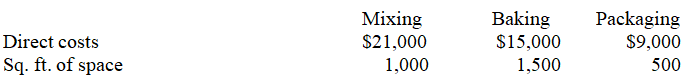

CakeCo,Inc.has three operating departments.Information about these departments is listed below.Maintenance is service department at CakeCo that incurred $12,000 of costs during the period.If allocated maintenance cost is based on floor space occupied by each of the operating departments,compute the amount of maintenance cost allocated to the Baking Department.

(Multiple Choice)

4.9/5  (33)

(33)

No standard rule identifies the best basis of allocating expenses across departments,so it is impossible to allocate costs in a manner that will be perceived as fair.

(True/False)

4.9/5  (42)

(42)

Holo Company reported the following financial numbers for one of its divisions for the year; average total assets of $5,800,000; sales of $5,375,000; cost of goods sold of $3,225,000; and operating expenses of $1,147,000.Compute the division's return on investment:

(Multiple Choice)

4.8/5  (44)

(44)

A system of performance measures,including nonfinancial measures,used to assess company and division manager performance is:

(Multiple Choice)

4.9/5  (36)

(36)

Pleasant Hills Properties is developing a golf course subdivision that includes 250 home lots; 100 lots are golf course lots and will sell for $95,000 each; 150 are street frontage lots and will sell for $65,000.The developer acquired the land for $1,800,000 and spent another $1,400,000 on street and utilities improvement.Compute the amount of joint cost to be allocated to the street frontage lots using value basis.(Round your intermediate percentages to 2 decimal places.)

(Multiple Choice)

5.0/5  (34)

(34)

The amount by which a department's sales exceed its direct expenses is:

(Multiple Choice)

4.7/5  (36)

(36)

Division P of Launch Corporation has the capacity for making 75,000 wheel sets per year and regularly sells 60,000 each year on the outside market.The regular sales price is $100 per wheel set,and the variable production cost per unit is $65.Division Q of Launch Corporation currently buys 30,000 wheel sets (of the kind made by Division P)yearly from an outside supplier at a price of $90 per wheel set.If Division Q were to buy the 30,000 wheel sets it needs annually from Division P at $87 per wheel set,the change in annual net operating income for the company as a whole,compared to what it is currently,would be:

(Multiple Choice)

4.8/5  (30)

(30)

Showing 21 - 40 of 210

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)