Exam 19: Variable Costing and Analysis

Exam 1: Accounting in Business285 Questions

Exam 2: Accounting for Business Transactions251 Questions

Exam 3: Adjusting Accounts for Financial Statements403 Questions

Exam 4: Accounting for Merchandising Operations252 Questions

Exam 5: Inventories and Cost of Sales238 Questions

Exam 6: Cash,fraud,and Internal Controls228 Questions

Exam 7: Accounting for Receivables219 Questions

Exam 8: Accounting for Long-Term Assets258 Questions

Exam 9: Accounting for Current Liabilities219 Questions

Exam 10: Accounting for Long-Term Liabilities231 Questions

Exam 11: Corporate Reporting and Analysis247 Questions

Exam 12: Reporting Cash Flows247 Questions

Exam 13: Analysis of Financial Statements245 Questions

Exam 14: Managerial Accounting Concepts and Principles252 Questions

Exam 15: Job Order Costing and Analysis215 Questions

Exam 16: Process Costing and Analysis225 Questions

Exam 17: Activity-Based Costing and Analysis223 Questions

Exam 18: Cost Behavior and Cost-Volume-Profit Analysis247 Questions

Exam 19: Variable Costing and Analysis202 Questions

Exam 20: Master Budgets and Performance Planning224 Questions

Exam 21: Flexible Budgets and Standard Costs223 Questions

Exam 22: Performance Measurement and Responsibility Accounting210 Questions

Exam 23: Relevant Costing for Managerial Decisions149 Questions

Exam 24: Capital Budgeting and Investment Analysis161 Questions

Exam 25: Time Value of Money84 Questions

Exam 26: Investments217 Questions

Exam 27: Lean Principles and Accounting30 Questions

Select questions type

Managers should accept special orders provided the special order price exceeds the product cost per unit under absorption costing.

Free

(True/False)

4.8/5  (32)

(32)

Correct Answer:

False

________ and ________ are product costs that can be directly traced to the product.

Free

(Essay)

4.8/5  (42)

(42)

Correct Answer:

Direct labor; direct materials (either order)

Which of the following would be reported on a variable costing income statement?

Free

(Multiple Choice)

4.8/5  (35)

(35)

Correct Answer:

D

A company reports the following information for its first year of operations:  If the company's cost per unit of finished goods using variable costing is $2,375,what is total variable overhead?

If the company's cost per unit of finished goods using variable costing is $2,375,what is total variable overhead?

(Multiple Choice)

4.7/5  (33)

(33)

Which of the following statements is true regarding variable costing?

(Multiple Choice)

4.9/5  (38)

(38)

When units produced are less than units sold,income under absorption costing is higher than income under variable costing.

(True/False)

4.8/5  (42)

(42)

What is the benefit of using variable costing in short-term pricing decisions? Is this benefit available under absorption costing?

(Essay)

4.9/5  (40)

(40)

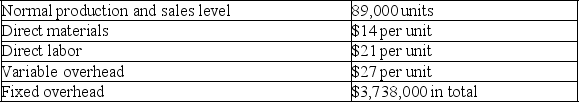

Dataport Company reports the following annual cost data for its single product:

This product is normally sold for $230 per unit.If Dataport increases its production to 100,000 units,while sales remain at the current 89,000 unit level,by how much would the company's gross margin increase or decrease under absorption costing? Assume the company has idle capacity to increase current production.

This product is normally sold for $230 per unit.If Dataport increases its production to 100,000 units,while sales remain at the current 89,000 unit level,by how much would the company's gross margin increase or decrease under absorption costing? Assume the company has idle capacity to increase current production.

(Essay)

4.8/5  (46)

(46)

Assuming fixed costs remain constant,and a company produces more units than it sells,then income under absorption costing is less than income under variable costing.

(True/False)

5.0/5  (39)

(39)

When excess capacity exists,what is the minimum special order price a manager should accept to increase net income?

(Essay)

4.8/5  (39)

(39)

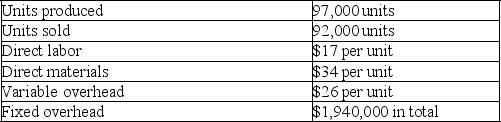

Home Base,Inc.reports the following production cost information:

a.Compute production cost per unit under variable costing.

b.Compute production cost per unit under absorption costing.

c.Determine the cost of ending inventory using variable costing.

d.Determine the cost of ending inventory using absorption costing.

a.Compute production cost per unit under variable costing.

b.Compute production cost per unit under absorption costing.

c.Determine the cost of ending inventory using variable costing.

d.Determine the cost of ending inventory using absorption costing.

(Essay)

4.8/5  (43)

(43)

Cavalier Corporation sold 26,000 units of its product at a price of $225 per unit.Total variable cost per unit is $188,consisting of $103 in variable production cost and $85 in variable selling and administrative cost.Compute the manufacturing margin for the company under variable costing.

(Short Answer)

4.9/5  (42)

(42)

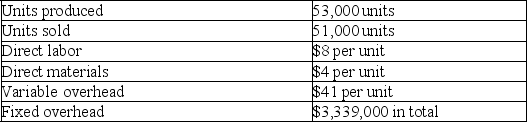

Castaway Company reports the following first year production cost information:

a.Compute production cost per unit under variable costing.

b.Compute production cost per unit under absorption costing.

c.Determine the cost of ending inventory using variable costing.

d.Determine the cost of ending inventory using absorption costing.

a.Compute production cost per unit under variable costing.

b.Compute production cost per unit under absorption costing.

c.Determine the cost of ending inventory using variable costing.

d.Determine the cost of ending inventory using absorption costing.

(Essay)

4.8/5  (34)

(34)

The data needed for cost-volume-profit analysis is readily available if the income statement is prepared using a contribution format.

(True/False)

4.8/5  (38)

(38)

Given the Scavenger Company data,what is net income using absorption costing?

(Multiple Choice)

4.9/5  (31)

(31)

A per unit cost that is constant at all production levels is a ________ cost per unit.

(Short Answer)

4.7/5  (42)

(42)

Given the following data,total product cost per unit under absorption costing is $11.40.

(True/False)

4.7/5  (33)

(33)

Assuming fixed costs remain constant,and a company produces and sells the same number of units,then income under absorption costing is less than income under variable costing.

(True/False)

4.7/5  (38)

(38)

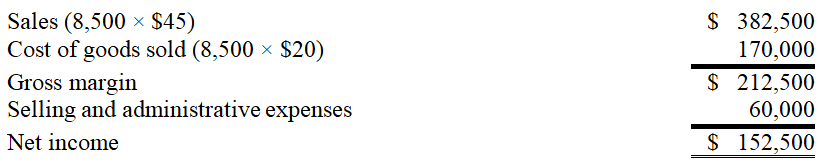

Wind Fall,a manufacturer of leaf blowers,began operations this year.During this year,the company produced 10,000 leaf blowers and sold 8,500.At year-end,the company reported the following income statement using absorption costing:  Production costs per leaf blower total $20,which consists of $16 in variable production costs and $4 in fixed production costs (based on the 10,000 units produced).Fifteen percent of total selling and administrative expenses are variable.Compute net income under variable costing.

Production costs per leaf blower total $20,which consists of $16 in variable production costs and $4 in fixed production costs (based on the 10,000 units produced).Fifteen percent of total selling and administrative expenses are variable.Compute net income under variable costing.

(Multiple Choice)

4.9/5  (38)

(38)

Showing 1 - 20 of 202

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)