Exam 21: Flexible Budgets and Standard Costs

Exam 1: Accounting in Business285 Questions

Exam 2: Accounting for Business Transactions251 Questions

Exam 3: Adjusting Accounts for Financial Statements403 Questions

Exam 4: Accounting for Merchandising Operations252 Questions

Exam 5: Inventories and Cost of Sales238 Questions

Exam 6: Cash,fraud,and Internal Controls228 Questions

Exam 7: Accounting for Receivables219 Questions

Exam 8: Accounting for Long-Term Assets258 Questions

Exam 9: Accounting for Current Liabilities219 Questions

Exam 10: Accounting for Long-Term Liabilities231 Questions

Exam 11: Corporate Reporting and Analysis247 Questions

Exam 12: Reporting Cash Flows247 Questions

Exam 13: Analysis of Financial Statements245 Questions

Exam 14: Managerial Accounting Concepts and Principles252 Questions

Exam 15: Job Order Costing and Analysis215 Questions

Exam 16: Process Costing and Analysis225 Questions

Exam 17: Activity-Based Costing and Analysis223 Questions

Exam 18: Cost Behavior and Cost-Volume-Profit Analysis247 Questions

Exam 19: Variable Costing and Analysis202 Questions

Exam 20: Master Budgets and Performance Planning224 Questions

Exam 21: Flexible Budgets and Standard Costs223 Questions

Exam 22: Performance Measurement and Responsibility Accounting210 Questions

Exam 23: Relevant Costing for Managerial Decisions149 Questions

Exam 24: Capital Budgeting and Investment Analysis161 Questions

Exam 25: Time Value of Money84 Questions

Exam 26: Investments217 Questions

Exam 27: Lean Principles and Accounting30 Questions

Select questions type

The difference between the total actual overhead cost incurred and the total standard overhead cost applied is the ________.

(Short Answer)

4.9/5  (38)

(38)

All of the following are associated with the volume variance except:

(Multiple Choice)

4.7/5  (33)

(33)

Regent,Inc.uses the following standard to produce a single unit of its product: overhead $6 (2 hrs.@ $3/hr.).The flexible budget for overhead is $100,000 plus $1 per direct labor hour.Actual data for the month show overhead costs of $150,000,and 24,000 units produced.The overhead volume variance is:

(Multiple Choice)

4.8/5  (36)

(36)

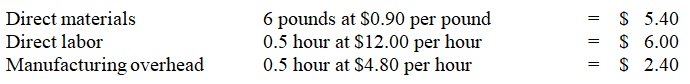

A company uses the following standard costs to produce a single unit of output.  During the latest month,the company purchased and used 58,000 pounds of direct materials at a price of $1.00 per pound to produce 10,000 units of output.Direct labor costs for the month totaled $56,350 based on 4,900 direct labor hours worked.Variable manufacturing overhead costs incurred totaled $15,000 and fixed manufacturing overhead incurred was $10,400.

-Based on this information,the total direct materials cost variance for the month was:

During the latest month,the company purchased and used 58,000 pounds of direct materials at a price of $1.00 per pound to produce 10,000 units of output.Direct labor costs for the month totaled $56,350 based on 4,900 direct labor hours worked.Variable manufacturing overhead costs incurred totaled $15,000 and fixed manufacturing overhead incurred was $10,400.

-Based on this information,the total direct materials cost variance for the month was:

(Multiple Choice)

4.8/5  (36)

(36)

A company uses the following standard costs to produce a single unit of output.  During the latest month,the company purchased and used 58,000 pounds of direct materials at a price of $1.00 per pound to produce 10,000 units of output.Direct labor costs for the month totaled $56,350 based on 4,900 direct labor hours worked.Variable manufacturing overhead costs incurred totaled $15,000 and fixed manufacturing overhead incurred was $10,400.

-Based on this information,the direct labor efficiency variance for the month was:

During the latest month,the company purchased and used 58,000 pounds of direct materials at a price of $1.00 per pound to produce 10,000 units of output.Direct labor costs for the month totaled $56,350 based on 4,900 direct labor hours worked.Variable manufacturing overhead costs incurred totaled $15,000 and fixed manufacturing overhead incurred was $10,400.

-Based on this information,the direct labor efficiency variance for the month was:

(Multiple Choice)

4.9/5  (50)

(50)

Management by exception means that managers focus on the most significant differences between actual costs and standard costs.

(True/False)

4.8/5  (38)

(38)

A standard that takes into account the reality that some loss usually occurs with any process under normal application of the process is known as a ________ standard.

(Short Answer)

4.9/5  (46)

(46)

Job #411 was budgeted to require 3.5 hours of labor at $11.00 per hour.However,it was completed in 3 hours by a person who worked for $14.00 per hour.What is the total labor cost variance for Job #4115?

(Essay)

4.9/5  (37)

(37)

During November,Glime Company allocated overhead to products at the rate of $26.00 per direct labor hour.This figure was based on 80% of capacity or 1,600 direct labor hours.However,Glime Company operated at only 70% of capacity,or 1,400 direct labor hours.Budgeted overhead at 70% of capacity is $38,900,and overhead actually incurred was $38,000.What is the company's volume variance for November? (Indicate whether the variance is favorable or unfavorable)

(Essay)

4.8/5  (42)

(42)

A company has established 5 pounds of Material J at $2 per pound as the standard for the material in its Product Z.The company has just produced 1,000 units of this product,using 5,200 pounds of Material J that cost $9,880.The direct materials quantity variance is:

(Multiple Choice)

4.9/5  (35)

(35)

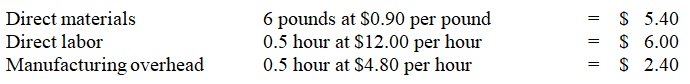

Georgia,Inc.has collected the following data on one of its products.The actual cost of direct materials used is:

(Multiple Choice)

4.9/5  (30)

(30)

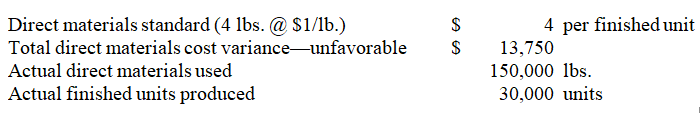

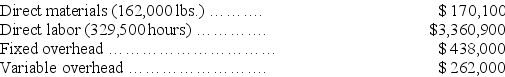

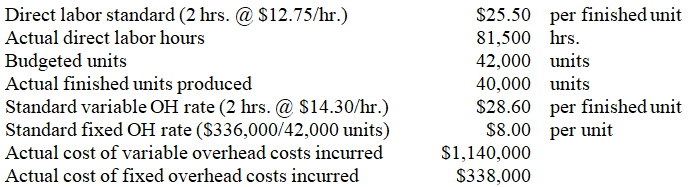

Beluga Corp.has developed standard costs based on a predicted operating level of 352,000 units of production,which is 80% of capacity.Variable overhead is $281,600 at this level of activity,or $0.80 per unit.Fixed overhead is $440,000.The standard costs per unit are:

Beluga actually produced 330,000 units at 75% of capacity and actual costs for the period were:

Beluga actually produced 330,000 units at 75% of capacity and actual costs for the period were:

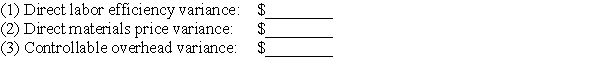

Calculate the following variances and indicate whether each variance is favorable or unfavorable:

Calculate the following variances and indicate whether each variance is favorable or unfavorable:

(Essay)

4.8/5  (40)

(40)

The difference between actual price per unit of input and the standard price per unit of input results in a:

(Multiple Choice)

5.0/5  (36)

(36)

A company provided the following direct materials cost information.Compute the total direct materials cost variance.

(Multiple Choice)

4.8/5  (30)

(30)

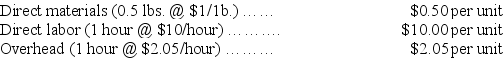

Fletcher Company collected the following data regarding production of one of its products.

-Compute the variable overhead cost variance.

-Compute the variable overhead cost variance.

(Multiple Choice)

4.7/5  (38)

(38)

Within the same flexible budget performance report,it is impossible to have both favorable and unfavorable variances.

(True/False)

4.7/5  (30)

(30)

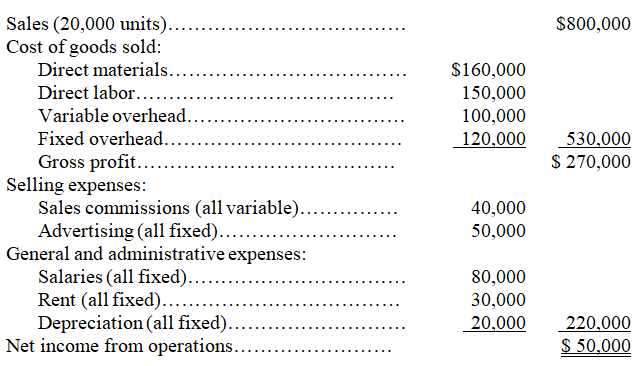

Firenze Company's fixed budget for the first quarter of the calendar year appears below.Prepare flexible budgets that show variable costs per unit,fixed costs and two different flexible budgets for sales volumes of 22,000 and 24,000.

(Essay)

4.9/5  (37)

(37)

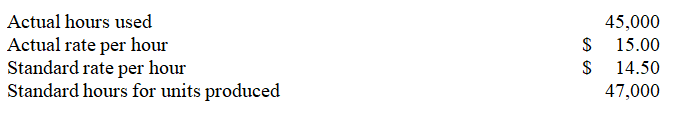

The following information describes a company's usage of direct labor in a recent period.The direct labor efficiency variance is:

(Multiple Choice)

4.9/5  (40)

(40)

The standard materials cost to produce 1 unit of Product R is 6 pounds of material at a standard price of $50 per pound.In manufacturing 8,000 units,47,000 pounds of material were used at a cost of $51 per pound.What is the direct materials price variance?

(Multiple Choice)

4.7/5  (35)

(35)

Hatter,Inc.allocates fixed overhead at a rate of $17 per direct labor hour.This amount is based on 90% of capacity or 3,600 direct labor hours for 6,000 units.During July,Hatter produced 5,500 units.Budgeted fixed overhead is $66,000,and overhead incurred was $67,000.

Required: Determine the volume variance for July.

(Essay)

4.7/5  (32)

(32)

Showing 181 - 200 of 223

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)