Exam 5: Inventories and Cost of Sales

Exam 1: Accounting in Business285 Questions

Exam 2: Accounting for Business Transactions251 Questions

Exam 3: Adjusting Accounts for Financial Statements403 Questions

Exam 4: Accounting for Merchandising Operations252 Questions

Exam 5: Inventories and Cost of Sales238 Questions

Exam 6: Cash,fraud,and Internal Controls228 Questions

Exam 7: Accounting for Receivables219 Questions

Exam 8: Accounting for Long-Term Assets258 Questions

Exam 9: Accounting for Current Liabilities219 Questions

Exam 10: Accounting for Long-Term Liabilities231 Questions

Exam 11: Corporate Reporting and Analysis247 Questions

Exam 12: Reporting Cash Flows247 Questions

Exam 13: Analysis of Financial Statements245 Questions

Exam 14: Managerial Accounting Concepts and Principles252 Questions

Exam 15: Job Order Costing and Analysis215 Questions

Exam 16: Process Costing and Analysis225 Questions

Exam 17: Activity-Based Costing and Analysis223 Questions

Exam 18: Cost Behavior and Cost-Volume-Profit Analysis247 Questions

Exam 19: Variable Costing and Analysis202 Questions

Exam 20: Master Budgets and Performance Planning224 Questions

Exam 21: Flexible Budgets and Standard Costs223 Questions

Exam 22: Performance Measurement and Responsibility Accounting210 Questions

Exam 23: Relevant Costing for Managerial Decisions149 Questions

Exam 24: Capital Budgeting and Investment Analysis161 Questions

Exam 25: Time Value of Money84 Questions

Exam 26: Investments217 Questions

Exam 27: Lean Principles and Accounting30 Questions

Select questions type

A company's current LIFO inventory consists of 5,000 units purchased at $6 per unit.Replacement cost has now fallen to $5 per unit.What is the entry the company must record to adjust inventory to market?

(Multiple Choice)

4.8/5  (33)

(33)

On September 1 of the current year,Scots Company experienced a flood that destroyed the company's entire inventory.Because the company had not completed its month end reporting for August,it must estimate the amount of inventory lost using the gross profit method.At the beginning of August,the company reported beginning inventory of $215,450.Inventory purchased during August was $192,530.Sales for the month of August were $542,500.Assuming the company's typical gross profit ratio is 40%,estimate the amount of inventory destroyed in the flood.

(Multiple Choice)

4.8/5  (39)

(39)

What specific costs and deductions are used to determine the final cost of merchandise inventory? Identify all costs including the incidental costs.

(Essay)

5.0/5  (40)

(40)

If obsolete or damaged goods can be sold,they will be included in inventory at their original cost.

(True/False)

4.7/5  (39)

(39)

Jefferson Company has sales of $300,000 and cost of goods available for sale of $270,000.If the gross profit ratio is typically 30%,the estimated cost of the ending inventory under the gross profit method would be:

(Multiple Choice)

4.8/5  (31)

(31)

Match the following terms with the appropriate definition.

Correct Answer:

Premises:

Responses:

(Matching)

4.8/5  (31)

(31)

A company's cost of inventory was $219,500.Due to phenomenal demand the market value of its inventory increased to $221,700.This company should record the inventory at its market value.

(True/False)

4.9/5  (35)

(35)

The reasoning behind the retail inventory method is that if we can get a good estimate of the cost-to-retail ratio,we can multiply ending inventory at retail by this ratio to estimate ending inventory at cost.

(True/False)

4.8/5  (31)

(31)

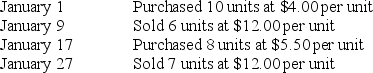

A company had the following purchases and sales during its first month of operations:  Using the Periodic weighted average method,what is the value of cost of goods sold? (Round weighted average cost per unit to 2 decimal places,and final answer to the nearest whole dollar.)

Using the Periodic weighted average method,what is the value of cost of goods sold? (Round weighted average cost per unit to 2 decimal places,and final answer to the nearest whole dollar.)

(Multiple Choice)

4.8/5  (43)

(43)

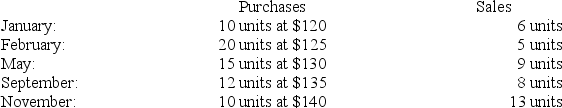

A company had the following purchases and sales during its first year of operations:  On December 31,there were 26 units remaining in ending inventory.

-Using the periodic FIFO inventory costing method,what is the value of cost of goods sold? (Assume all sales were made on the last day of the month.)

On December 31,there were 26 units remaining in ending inventory.

-Using the periodic FIFO inventory costing method,what is the value of cost of goods sold? (Assume all sales were made on the last day of the month.)

(Multiple Choice)

4.9/5  (39)

(39)

Bedrock Company reported a December 31 ending inventory balance of $412,000.The following additional information is also available: -The ending inventory balance of $412,000 included $72,000 of consigned inventory for which Bedrock was the consignor.

-The ending inventory balance of $412,000 included $22,000 of office supplies that were stored in the warehouse and were to be used by the company's supervisors and managers during the coming year.

Based on this information,the correct balance for ending inventory on December 31 is:

(Multiple Choice)

4.7/5  (28)

(28)

Incidental costs for acquiring merchandise inventory,such as import duties,freight,storage,and insurance,should not be added to the cost of inventory.

(True/False)

4.8/5  (34)

(34)

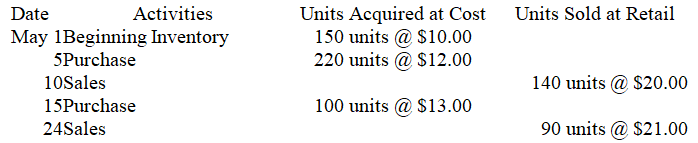

Salmone Company reported the following purchases and sales of its only product.Salmone uses a perpetual inventory system.

-Determine the cost assigned to cost of goods sold using FIFO.

-Determine the cost assigned to cost of goods sold using FIFO.

(Multiple Choice)

4.8/5  (44)

(44)

Starlight Company has inventory of 8 units at a cost of $200 each on October 1.On October 2,it purchased 20 units at $205 each.11 units are sold on October 4.Using the LIFO perpetual inventory method,

-What amount will be reported in cost of goods sold for the 11 units that were sold?

(Multiple Choice)

4.9/5  (37)

(37)

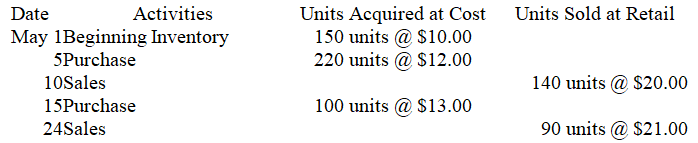

Salmone Company reported the following purchases and sales of its only product.Salmone uses a perpetual inventory system.

-Determine the cost assigned to ending inventory using LIFO.

-Determine the cost assigned to ending inventory using LIFO.

(Multiple Choice)

4.8/5  (46)

(46)

An overstated beginning inventory will ________ cost of goods sold and ________ net income.

(Essay)

4.9/5  (28)

(28)

Understating ending inventory understates both current and total assets.

(True/False)

4.8/5  (32)

(32)

The simple rule for inventory turnover is that a low ratio is preferable.

(True/False)

4.8/5  (37)

(37)

Costs included in the Merchandise Inventory account can include all of the following except:

(Multiple Choice)

4.9/5  (31)

(31)

Showing 61 - 80 of 238

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)