Exam 3: Governmental Operating Statement Accounts; Budgetary Accounting

Exam 1: Introduction to Accounting and Financial Reporting for Governmental and Not-For-Profit Entities48 Questions

Exam 2: Principles of Accounting and Financial Reporting for State and Local Governments50 Questions

Exam 3: Governmental Operating Statement Accounts; Budgetary Accounting67 Questions

Exam 4: Accounting for Governmental Operating Activitiesillustrative Transactions and Financial Statements85 Questions

Exam 5: Accounting for General Capital Assets and Capital Projects87 Questions

Exam 6: Accounting for General Long-Term Liabilities and Debt Service82 Questions

Exam 7: Accounting for the Business-Type Activities of State and Local Governments85 Questions

Exam 8: Accounting for Fiduciary Activities Agency and Trust Funds56 Questions

Exam 9: Financial Reporting of State and Local Governments50 Questions

Exam 10: Analysis of Governmental Financial Performance48 Questions

Exam 11: Auditing of Governmental and Not-For-Profit Organizations51 Questions

Exam 12: Budgeting and Performance Measurement58 Questions

Exam 13: Accounting for Not-For-Profit Organizations65 Questions

Exam 14: Not-For-Profit Organizations Regulatory, taxation, and Performance Issues56 Questions

Exam 15: Accounting for Colleges and Universities41 Questions

Exam 16: Accounting for Health Care Organizations46 Questions

Exam 17: Accounting and Reporting for the Federal Government52 Questions

Select questions type

GASB standards require that all state and local governments present a statement of revenues,expenditures,and changes in fund balances-budget and actual for the General Fund,and major special revenue funds for which annual budgets have been legally adopted.

(True/False)

5.0/5  (40)

(40)

When computers are ordered by the mayor's office,the purchase order should be recorded in the General Fund as a debit to:

(Multiple Choice)

4.7/5  (32)

(32)

When the budget for the General Fund is recorded,the required journal entry will include

(Multiple Choice)

5.0/5  (39)

(39)

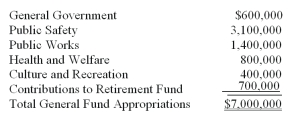

The Board of Aldermen of Fitchburg approved the appropriations budget for its General Fund for the year ending December 31,as shown below.  1)Explain the legal significance of an appropriation and why auditors engaged for a financial and compliance audit need to know the meaning of the term.

2)It is illegal for a government to spend money for any purpose unless a valid appropriation for that purpose exists.Does this legal rule assure good financial management for each government? Why or why not?

1)Explain the legal significance of an appropriation and why auditors engaged for a financial and compliance audit need to know the meaning of the term.

2)It is illegal for a government to spend money for any purpose unless a valid appropriation for that purpose exists.Does this legal rule assure good financial management for each government? Why or why not?

(Essay)

4.8/5  (35)

(35)

The Appropriations account of a governmental fund is credited when

(Multiple Choice)

4.9/5  (36)

(36)

Encumbrances outstanding at year-end in the General Fund should be reported as a

(Multiple Choice)

4.7/5  (47)

(47)

Which of the following is true regarding other financing sources and other financing uses?

(Multiple Choice)

4.8/5  (35)

(35)

GASB standards suggest the following classification scheme for expenditures:

A.Function

B.Program

C.Organization unit

D.Activity

E.Character

F.Object

For each of the following expenditure items,indicate its correct classification by placing the appropriate letter in the blank space next to the item.____ 1.Solid waste collection-residential

____ 2.City clerk

____ 3.Supplies

____ 4.Transportation

____ 5.Health and welfare

(Short Answer)

4.8/5  (31)

(31)

The Expenditures control account of a government is debited when

(Multiple Choice)

4.8/5  (39)

(39)

The County Commission of Benton County adopted its General Fund budget for the year ending June 30,comprising estimated revenues of $3,200,000 and appropriations of $2,900,000.Benton County utilizes the budgetary accounts required by GASB standards.The journal entry to record budgeted appropriations will include

(Multiple Choice)

4.9/5  (37)

(37)

All decreases in fund financial resources,other than for repayment of fund liabilities,are termed "expenditures."

(True/False)

4.7/5  (33)

(33)

When supplies ordered for use in an activity accounted for in the General Fund are received at an actual price that is more than the estimated price on the purchase order,the Encumbrance account is

(Multiple Choice)

4.9/5  (34)

(34)

Expenditures for supplies ordered by a special revenue fund were inadvertently recorded in the accounts of the General Fund in the amount of $100.Upon reimbursement of the $100,later the same month,the journal entry for the General Fund would include

(Multiple Choice)

4.8/5  (38)

(38)

When the budget of a government is adopted and Estimated Revenues exceed Appropriations,the excess is

(Multiple Choice)

4.7/5  (40)

(40)

When the budget for the General Fund is recorded,the required journal entry will include

(Multiple Choice)

4.8/5  (34)

(34)

Interfund transfers and debt issue proceeds received by the General Fund should be recorded as other financing sources.

(True/False)

4.9/5  (36)

(36)

Which of the following will increase the fund balance of a government at the end of the fiscal year?

(Multiple Choice)

4.9/5  (42)

(42)

The Expenditures control account of a government is credited when:

(Multiple Choice)

4.9/5  (35)

(35)

Showing 41 - 60 of 67

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)