Exam 1: Business Combinations

Exam 1: Business Combinations36 Questions

Exam 2: Stock Investments Investor Accounting and Reporting41 Questions

Exam 3: An Introduction to Consolidated Financial Statements39 Questions

Exam 4: Consolidated Techniques and Procedures38 Questions

Exam 5: Intercompany Profit Transactions - Inventories39 Questions

Exam 6: Intercompany Profit Transactions - Plant Assets39 Questions

Exam 7: Intercompany Profit Transactions - Bonds40 Questions

Exam 8: Consolidations - Changes in Ownership Interests38 Questions

Exam 9: Indirect and Mutual Holdings37 Questions

Exam 11: Consolidation Theories,push-Down Accounting,and Corporate Joint Ventures39 Questions

Exam 12: Derivatives and Foreign Currency: Concepts and Common Transactions40 Questions

Exam 13: Accounting for Derivatives and Hedging Activities40 Questions

Exam 14: Foreign Currency Financial Statements39 Questions

Exam 15: Segment and Interim Financial Reporting38 Questions

Exam 16: Partnerships - Formation,operations,and Changes in Ownership Interests38 Questions

Exam 17: Partnership Liquidation40 Questions

Exam 18: Corporate Liquidations and Reorganizations38 Questions

Exam 19: An Introduction to Accounting for State and Local Governmental Units38 Questions

Exam 20: Accounting for State and Local Governmental Units - Governmental Funds34 Questions

Exam 21: Accounting for State and Local Governmental Units - Proprietary and Fiduciary Funds39 Questions

Exam 22: Accounting for Not-For-Profit Organizations39 Questions

Exam 23: Estates and Trusts36 Questions

Select questions type

According to FASB Statement No.141,liabilities assumed in an acquisition will be valued at the ________.

(Multiple Choice)

4.8/5  (38)

(38)

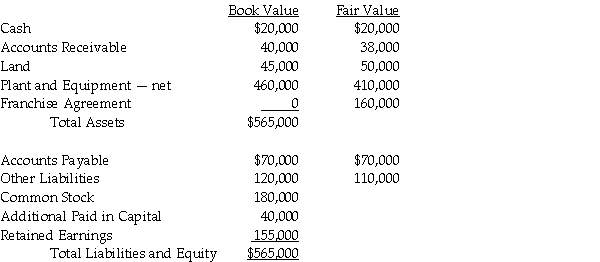

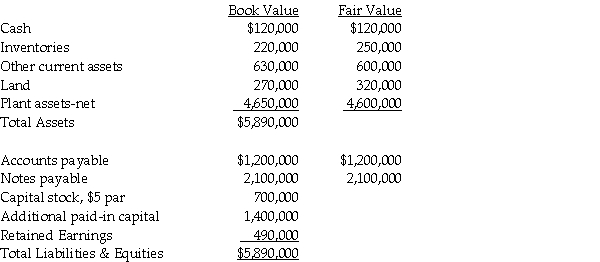

Pony acquired Spur Corporation's assets and liabilities for $500,000 cash on December 31,2013.Spur dissolved on the date of the acquisition.Spur's balance sheet and related fair values are shown as of that date,below.  Required: Prepare the journal entry recorded by Pony as a result of this transaction.

Required: Prepare the journal entry recorded by Pony as a result of this transaction.

(Essay)

4.8/5  (39)

(39)

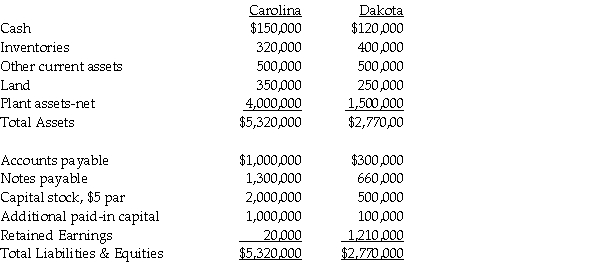

On January 2,2013 Carolina Clothing issued 100,000 new shares of its $5 par value common stock valued at $19 a share for all of Dakota Dressing Company's outstanding common shares in an acquisition.Carolina paid $15,000 for registering and issuing securities and $10,000 for other direct costs of the business combination.The fair value and book value of Dakota's identifiable assets and liabilities were the same.Assume Dakota Company is dissolved on the date of the acquisition.Summarized balance sheet information for both companies just before the acquisition on January 2,2013 is as follows:  Required:

Prepare a balance sheet for Carolina Clothing immediately after the business combination.

Required:

Prepare a balance sheet for Carolina Clothing immediately after the business combination.

(Essay)

4.9/5  (44)

(44)

Which of the following methods does the FASB consider the best indicator of fair values in the evaluation of goodwill impairment?

(Multiple Choice)

4.8/5  (47)

(47)

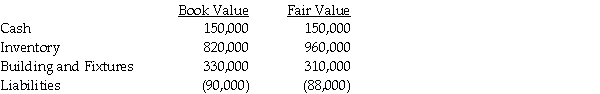

Samantha's Sporting Goods had net assets consisting of the following:  Pedic Incorporated purchased Samantha's Sporting Goods,and immediately dissolved Samantha's as a separate legal entity.

Requirement 1: If Samantha's was purchased for $1,000,000 cash,prepare the entry recorded by Pedic.

Requirement 2: If Samantha's was purchased for $1,500,000 cash,prepare the entry recorded by Pedic.

Pedic Incorporated purchased Samantha's Sporting Goods,and immediately dissolved Samantha's as a separate legal entity.

Requirement 1: If Samantha's was purchased for $1,000,000 cash,prepare the entry recorded by Pedic.

Requirement 2: If Samantha's was purchased for $1,500,000 cash,prepare the entry recorded by Pedic.

(Essay)

4.8/5  (31)

(31)

In reference to the FASB disclosure requirements about a business combination in the period in which the combination occurs,which of the following is correct?

(Multiple Choice)

4.9/5  (33)

(33)

In a business combination,which of the following will occur?

(Multiple Choice)

4.8/5  (32)

(32)

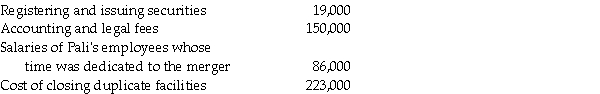

Pali Corporation exchanges 200,000 shares of newly issued $10 par value common stock with a fair market value of $40 per share for all the outstanding $5 par value common stock of Shingle Incorporated,which continues on as a legal entity.Fair value approximated book value for all assets and liabilities of Shingle.Pali paid the following costs and expenses related to the business combination:  Required: Prepare the journal entries relating to the above acquisition and payments incurred by Pali,assuming all costs were paid in cash.

Required: Prepare the journal entries relating to the above acquisition and payments incurred by Pali,assuming all costs were paid in cash.

(Essay)

4.7/5  (35)

(35)

Parrot Incorporated purchased the assets and liabilities of Sparrow Company at the close of business on December 31,2013.Parrot borrowed $2,000,000 to complete this transaction,in addition to the $640,000 cash that they paid directly.The fair value and book value of Sparrow's recorded assets and liabilities as of the date of acquisition are listed below.In addition,Sparrow had a patent that had a fair value of $50,000.  Required:

1.Prepare Parrot's general journal entry for the acquisition of Sparrow,assuming that Sparrow survives as a separate legal entity.

2.Prepare Parrot's general journal entry for the acquisition of Sparrow,assuming that Sparrow will dissolve as a separate legal entity.

Required:

1.Prepare Parrot's general journal entry for the acquisition of Sparrow,assuming that Sparrow survives as a separate legal entity.

2.Prepare Parrot's general journal entry for the acquisition of Sparrow,assuming that Sparrow will dissolve as a separate legal entity.

(Essay)

4.8/5  (40)

(40)

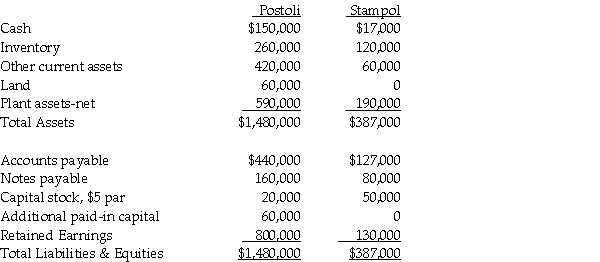

On June 30,2013,Stampol Company ceased operations and all of their assets and liabilities were purchased by Postoli Incorporated.Postoli paid $40,000 in cash to the owner of Stampol,and signed a five-year note payable to the owners of Stampol in the amount of $200,000.Their closing balance sheets as of June 30,2013 are shown below.In the purchase agreement,both parties noted that Inventory was undervalued on the books by $10,000,and Pistoli would also take possession of a customer list with a fair value of $18,000.Pistoli paid all legal costs of the acquisition,which amounted to $7,000.  Required:

1.Prepare the journal entry Postoli would record at the date of acquisition.

2.Prepare the journal entry Stampol would record at the date of acquisition.

Required:

1.Prepare the journal entry Postoli would record at the date of acquisition.

2.Prepare the journal entry Stampol would record at the date of acquisition.

(Essay)

4.9/5  (42)

(42)

Following the accounting concept of a business combination,a business combination occurs when a company acquires an equity interest in another entity and has

(Multiple Choice)

4.7/5  (45)

(45)

A business merger differs from a business consolidation because

(Multiple Choice)

5.0/5  (36)

(36)

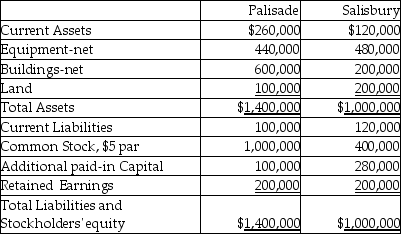

The balance sheets of Palisade Company and Salisbury Corporation were as follows on December 31,2013:

On January 1,2014 Palisade issued 30,000 of its shares with a market value of $40 per share in exchange for all of Salisbury's shares,and Salisbury was dissolved.Palisade paid $20,000 to register and issue the new common shares.It cost Palisade $50,000 in direct combination costs.Book values equal market values except that Salisbury's land is worth $250,000.

Required:

Prepare a Palisade balance sheet after the business combination on January 1,2014.

On January 1,2014 Palisade issued 30,000 of its shares with a market value of $40 per share in exchange for all of Salisbury's shares,and Salisbury was dissolved.Palisade paid $20,000 to register and issue the new common shares.It cost Palisade $50,000 in direct combination costs.Book values equal market values except that Salisbury's land is worth $250,000.

Required:

Prepare a Palisade balance sheet after the business combination on January 1,2014.

(Essay)

4.8/5  (36)

(36)

When considering an acquisition,which of the following is NOT a method by which one company may gain control of another company?

(Multiple Choice)

4.7/5  (39)

(39)

Under the current GAAP,Goodwill arising from a business combination is

(Multiple Choice)

4.8/5  (32)

(32)

Showing 21 - 36 of 36

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)