Exam 17: Property Transactions: 1231 and Recapture Provisions

Exam 1: An Introduction to Taxation and Understanding Federal Tax Law194 Questions

Exam 2: Working With the Tax Law86 Questions

Exam 3: Tax Formula and Tax Determination; an Overview of Property Transactions187 Questions

Exam 4: Gross Income: Concepts and Inclusions124 Questions

Exam 5: Gross Income: Exclusions114 Questions

Exam 6: Deductions and Losses: in General155 Questions

Exam 7: Deductions and Losses: Certain Business Expenses and Losses124 Questions

Exam 8: Depreciation, Cost Recovery, Amortization, and Depletion103 Questions

Exam 9: Deductions: Employee and Self-Employed-Related Expenses178 Questions

Exam 10: Deductions and Losses: Certain Itemized Deductions106 Questions

Exam 11: Investor Losses111 Questions

Exam 12: Alternative Minimum Tax134 Questions

Exam 13: Tax Credits and Payment Procedures120 Questions

Exam 14: Property Transactions: Determination of Gain or Loss and Basis Considerations148 Questions

Exam 15: Property Transactions: Nontaxable Exchanges138 Questions

Exam 16: Property Transactions: Capital Gains and Losses78 Questions

Exam 17: Property Transactions: 1231 and Recapture Provisions74 Questions

Exam 18: Accounting Periods and Methods110 Questions

Exam 19: Deferred Compensation101 Questions

Exam 20: Corporations and Partnerships198 Questions

Select questions type

Residential real estate was purchased in 2014 for $345,000, held as rental property, and depreciated straight-line. Assume the land cost was $45,000 and the building cost was $300,000. Depreciation totaled $34,089. The building and land were sold on June 10, 2017, for $683,000 total. What is the tax status of the property, the nature of the gain from the disposition, and is any of it § 1250 depreciation recapture gain or unrecaptured § 1250 gain?

(Essay)

4.9/5  (30)

(30)

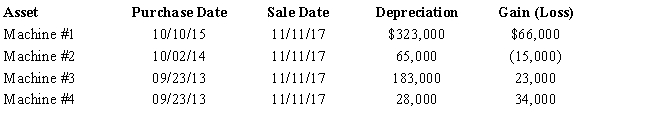

A business taxpayer sold all the depreciable assets of the business, calculated the gains and losses, and would like to know the final character of those gains and losses. The taxpayer had $353,000 of adjusted gross income before considering the gains and losses from sale of the business assets. The taxpayer had unrecaptured § 1231 lookback loss of $22,000. What is the treatment of the gains and losses summarized in the chart below after all possible netting and reclassification has been completed? What is the taxpayer's adjusted gross income? (Ignore the self-employment tax deduction.)

(Essay)

4.7/5  (33)

(33)

Section 1239 (relating to the sale of certain property between related taxpayers) does not apply unless the property:

(Multiple Choice)

4.8/5  (47)

(47)

Blue Company sold machinery for $45,000 on December 23, 2017. The machinery had been acquired on April 1, 2015, for $69,000 and its adjusted basis was $34,200. The § 1231 gain, § 1245 recapture gain, and § 1231 loss from this transaction are:

(Multiple Choice)

4.8/5  (30)

(30)

A retail building used in the business of a sole proprietor is sold on March 10, 2017, for $342,000. The building was acquired in 2007 for $400,000 and straight-line depreciation of $104,000 had been taken on the building. What is the maximum unrecaptured § 1250 gain from the disposition of this building?

(Multiple Choice)

4.8/5  (35)

(35)

An individual had the following gains and losses during 2017 on property held for the long-term holding period: sale of Orange common stock ($8,000 gain); sale of real property used in the taxpayer's business ($1,800 loss); destruction of real property used in the taxpayer's business by fire ($1,000 loss). Which of the following statements is correct?

(Multiple Choice)

4.8/5  (40)

(40)

If § 1231 asset casualty gains and losses net to a gain, the gain is treated as a § 1231 gain.

(True/False)

4.9/5  (35)

(35)

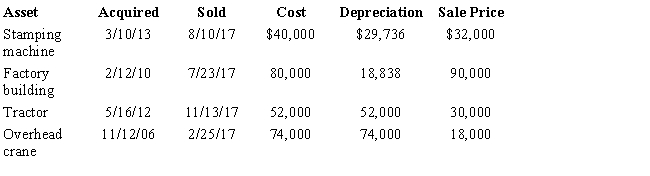

The chart below describes the § 1231 assets sold by the Ecru Company (a sole proprietorship) this year. Compute the gain or loss from each asset disposition and determine the net § 1231 gain treated as long-term capital gain for the year. Assume there is a § 1231 lookback loss of $4,000.

(Essay)

4.8/5  (38)

(38)

Describe the circumstances in which the maximum unrecaptured § 1250 gain (25% gain) does not become part of the Schedule D netting process for an individual taxpayer?

(Essay)

4.9/5  (37)

(37)

An individual has a $40,000 § 1245 gain, a $35,000 § 1231 gain, a $33,000 § 1231 loss, a $3,000 § 1231 lookback loss, and a $15,000 long-term capital gain. The net long-term capital gain is:

(Multiple Choice)

4.8/5  (42)

(42)

Which of the following would be included in the netting of § 1231 gains and losses?

(Multiple Choice)

4.8/5  (43)

(43)

Lynne owns depreciable residential rental real estate which has accumulated depreciation (all from straight-line) of $65,000. If Lynne sold the property, she would have a $53,000 gain. The initial characterization of the gain would be:

(Multiple Choice)

4.8/5  (40)

(40)

Verway, Inc., has a 2017 net § 1231 gain of $55,000 and had a $62,000 net § 1231 loss in 2016. For 2017, Verway's net § 1231 gain is treated as:

(Multiple Choice)

4.8/5  (37)

(37)

Business equipment is purchased on March 10, 2016, used in the business until September 29, 2016, and sold at a $23,000 loss on October 10, 2016. The equipment was not suitable for the work the business had purchased it for. The loss on the disposition should have been reported in the 2016 Form 4797, Part:

(Multiple Choice)

4.9/5  (32)

(32)

Showing 61 - 74 of 74

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)