Exam 12: Alternative Minimum Tax

Exam 1: An Introduction to Taxation and Understanding Federal Tax Law194 Questions

Exam 2: Working With the Tax Law86 Questions

Exam 3: Tax Formula and Tax Determination; an Overview of Property Transactions187 Questions

Exam 4: Gross Income: Concepts and Inclusions124 Questions

Exam 5: Gross Income: Exclusions114 Questions

Exam 6: Deductions and Losses: in General155 Questions

Exam 7: Deductions and Losses: Certain Business Expenses and Losses124 Questions

Exam 8: Depreciation, Cost Recovery, Amortization, and Depletion103 Questions

Exam 9: Deductions: Employee and Self-Employed-Related Expenses178 Questions

Exam 10: Deductions and Losses: Certain Itemized Deductions106 Questions

Exam 11: Investor Losses111 Questions

Exam 12: Alternative Minimum Tax134 Questions

Exam 13: Tax Credits and Payment Procedures120 Questions

Exam 14: Property Transactions: Determination of Gain or Loss and Basis Considerations148 Questions

Exam 15: Property Transactions: Nontaxable Exchanges138 Questions

Exam 16: Property Transactions: Capital Gains and Losses78 Questions

Exam 17: Property Transactions: 1231 and Recapture Provisions74 Questions

Exam 18: Accounting Periods and Methods110 Questions

Exam 19: Deferred Compensation101 Questions

Exam 20: Corporations and Partnerships198 Questions

Select questions type

In the current tax year, for regular tax purposes, Avery reports $65,000 of income and $190,000 of deductions from passive activities. For AMT purposes, the passive activity income amount is unchanged, but deductions from passive activities total $150,000.

What is Avery's suspended passive loss for regular tax and for AMT purposes?

Free

(Multiple Choice)

4.9/5  (36)

(36)

Correct Answer:

C

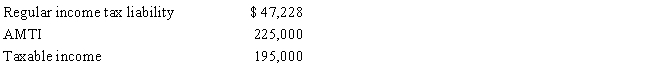

Ashby, who is single and age 30, provides you with the following information from his financial records for 2017.

Calculate his AMT exemption for 2017.

Calculate his AMT exemption for 2017.

Free

(Multiple Choice)

4.8/5  (39)

(39)

Correct Answer:

C

Interest income on private activity bonds issued before 2009 and after 2010, reduced by expenses incurred in carrying the bonds, is a preference item that is included in computing AMTI.

Free

(True/False)

4.9/5  (35)

(35)

Correct Answer:

True

Because passive losses are not deductible in computing either taxable income or AMTI, no AMT adjustment for passive losses is required.

(True/False)

4.9/5  (42)

(42)

The required adjustment for AMT purposes for pollution control facilities placed in service this year is equal to the difference between the amortization deduction allowed for regular income tax purposes and the depreciation deduction computed under ADS.

(True/False)

4.8/5  (33)

(33)

What itemized deductions are allowed for both regular income tax purposes and for AMT purposes?

(Essay)

4.8/5  (45)

(45)

The recognized gain for regular income tax purposes and the recognized gain for AMT purposes on the sale of stock acquired with an incentive stock option (ISO) are always the same, because the adjusted basis is the same.

(True/False)

4.8/5  (36)

(36)

On February 1, 2017, Omar acquires used 7-year personal property for $100,000 for use in his business. Omar does not elect § 179 expensing, but he does take the maximum regular cost recovery deduction. As a result, Omar incurs a positive AMT adjustment in 2017 of what amount?

(Multiple Choice)

4.8/5  (38)

(38)

Which of the following statements regarding differences in the corporate and the individual AMT calculation is most correct?

(Multiple Choice)

4.9/5  (33)

(33)

Which of the following statements describing the alternative minimum tax (AMT) is most correct?

(Multiple Choice)

4.9/5  (44)

(44)

Wallace owns a construction company that builds both commercial and residential buildings. He contracts to build a residential building for $800,000, and for which he is eligible to use the completed contract method of accounting. In the current year for regular income tax purposes, Wallace does not recognize any gross income on the contract. Under the percentage of completion method, the income recognized under the contract would have been $60,000. Wallace's AMT effect is:

(Multiple Choice)

4.9/5  (41)

(41)

Are the AMT rates for the individual taxpayer the same as those for a corporate taxpayer?

(Essay)

4.8/5  (34)

(34)

AMT adjustments can be positive or negative, whereas AMT preferences are always positive.

(True/False)

4.8/5  (35)

(35)

Sand Corporation, a calendar year C corporation, reports alternative minimum taxable income of $900,000 for 2017. Sand's tentative minimum tax for 2017 is:

(Multiple Choice)

4.8/5  (42)

(42)

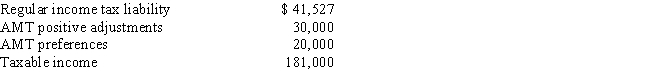

Robin, who is a head of household and age 42, provides you with the following information from his financial records for 2017. Robert itemizes deductions.

Calculate Robin's AMT for 2017.

Calculate Robin's AMT for 2017.

(Multiple Choice)

4.8/5  (42)

(42)

If the AMT base is greater than $187,800, the AMT rate for an individual taxpayer is the same as the AMT rate for a C corporation.

(True/False)

4.7/5  (31)

(31)

The net capital gain included in an individual taxpayer's AMT base is eligible for the lower tax rate on net capital gain. This favorable alternative rate applies both in calculating the regular income tax and the AMT.

(True/False)

4.7/5  (45)

(45)

How can interest on a private activity bond issued in 2013 result in both an AMT adjustment that decreases AMTI and an AMT preference that increases AMTI?

(Essay)

4.9/5  (43)

(43)

How can an AMT adjustment be avoided by a taxpayer who incurs circulation expenditures in the current tax year?

(Essay)

4.8/5  (36)

(36)

Showing 1 - 20 of 134

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)