Exam 5: Adjusting Entries and the Work Sheet

Exam 1: Introduction to Accounting97 Questions

Exam 2: Analyzing Transactions: the Accounting Equation80 Questions

Exam 3: The Double-Entry Framework94 Questions

Exam 4: Journalizing and Posting Transactions93 Questions

Exam 5: Adjusting Entries and the Work Sheet113 Questions

Exam 6: Financial Statements and the Closing Process110 Questions

Exam 7: Accounting for Cash122 Questions

Exam 8: Payroll Accounting: Employee Earnings and Deductions105 Questions

Exam 9: Payroll Accounting: Employer Taxes and Reports97 Questions

Exam 10: Module Accounting For A Professional Service Business The Combination Journal69 Questions

Select questions type

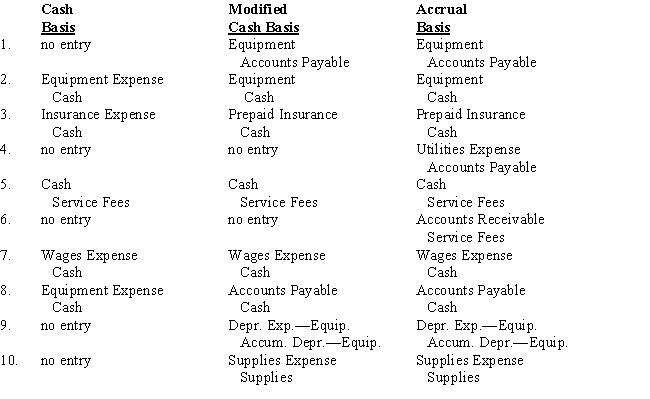

In the columns below,insert the entry that would be made for each transaction under each accounting basis,using appropriate debit and credit account titles.

1. Purchased equipment on account

2. Paid cash for new equipment.

3. Purchased one-year insurance policy for cash.

4. Received bill for electricity.

5. Performed services for cash.

6. Performed services on account.

7. Paid cash for wages.

8. Paid for equipment purchased on account.

9. Depreciation on equipment.

10. Supplies are partly used.

Free

(Essay)

4.9/5  (23)

(23)

Correct Answer:

Adjusting entries may affect the cash account.

Free

(True/False)

4.8/5  (39)

(39)

Correct Answer:

False

A method of accounting under which revenues are recorded when cash is received and expenses are recorded when cash is paid is known as ____________________.

Free

(Short Answer)

4.9/5  (44)

(44)

Correct Answer:

cash basis accounting

The period of time that an asset is expected to help produce revenues is called its ____________________.

(Short Answer)

5.0/5  (43)

(43)

What does the credit balance in the Accumulated Depreciation account represent?

(Multiple Choice)

4.8/5  (36)

(36)

Supplies originally cost $600,but only $150 worth of supplies were used this period.The adjusting entry would be

(Multiple Choice)

4.8/5  (26)

(26)

The cost of plant assets less the accumulated depreciation is called the salvage value of the asset.

(True/False)

4.7/5  (46)

(46)

Adjusting entries does not always affect both the income statement and the balance sheet.

(True/False)

4.8/5  (36)

(36)

The amount of depreciation taken each period will be the same using the straight-line method.

(True/False)

4.9/5  (32)

(32)

The modified cash basis of accounting combines aspects of the cash method of accounting and the accrual method of accounting.

(True/False)

4.9/5  (29)

(29)

The 10-column work sheet is used to facilitate the preparation of the income statement,the statement of owner's equity,and the balance sheet.

(True/False)

4.9/5  (29)

(29)

Match the terms with the definitions.

-A principle that requires the matching of revenues earned during an accounting period with the expenses incurred to produce the revenues.

(Multiple Choice)

4.9/5  (44)

(44)

The net income or loss for the year can be found on the work sheet as the balance item at the bottom of either the Balance Sheet columns or the Income Statement columns.

(True/False)

4.9/5  (43)

(43)

Match the terms with the definitions.

-A twelve-month period for which financial reports are prepared.

(Multiple Choice)

4.9/5  (35)

(35)

An asset cost $33,000.It has an expected useful life of 5 years and an expected salvage value of $3,000.Depreciation expense for the first year of the asset's life using the straight-line method is

(Multiple Choice)

4.8/5  (46)

(46)

Depreciation matches the cost of an asset against the revenues it will produce.

(True/False)

4.8/5  (32)

(32)

The ____________________ method is a depreciation method in which the depreciable cost is divided by the estimated useful life.

(Short Answer)

4.8/5  (44)

(44)

Match the terms with the definitions.

-A principle that requires assets to be recorded at their actual cost.

(Multiple Choice)

4.7/5  (32)

(32)

The original cost of an asset added to its salvage value represents the depreciable cost of an asset.

(True/False)

4.7/5  (36)

(36)

Showing 1 - 20 of 113

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)