Exam 9: Inventory Costing and Capacity Analysis

Exam 1: The Accountants Role in the Organization195 Questions

Exam 2: An Introduction to Cost Terms and Purposes224 Questions

Exam 3: Cost-Volume-Profit Analysis207 Questions

Exam 4: Job Costing199 Questions

Exam 5: Activity-Based Costing and Activity-Based Management175 Questions

Exam 6: Master Budget and Responsibility Accounting229 Questions

Exam 7: Flexible Budgets, Direct-Cost Variances, and Management Control180 Questions

Exam 8: Flexible Budgets, Overhead Cost Variances, and Management Control171 Questions

Exam 9: Inventory Costing and Capacity Analysis208 Questions

Exam 10: Determining How Costs Behave182 Questions

Exam 11: Decision Making and Relevant Information220 Questions

Exam 12: Pricing Decisions and Cost Management210 Questions

Exam 13: Strategy, Balanced Scorecard, and Strategic Profitability Analysis171 Questions

Exam 14: Cost Allocation, Customer-Profitability Analysis, and Sales-Variance Analysis170 Questions

Exam 15: Allocation of Support-Department Costs, Common Costs, and Revenues144 Questions

Exam 16: Cost Allocation: Joint Products and Byproducts125 Questions

Exam 17: Process Costing126 Questions

Exam 18: Spoilage, Rework, and Scrap125 Questions

Exam 19: Balanced Scorecard: Quality, Time, and the Theory of Constraints124 Questions

Exam 20: Inventory Management, Just-In-Time, and Simplified Costing Methods125 Questions

Exam 21: Capital Budgeting and Cost Analysis130 Questions

Exam 22: Management Control Systems, Transfer Pricing, and Multinational Considerations123 Questions

Exam 23: Performance Measurement, Compensation, and Multinational Considerations139 Questions

Select questions type

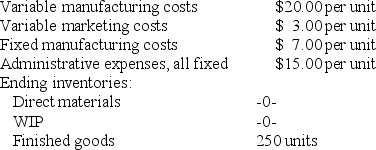

Answer the following questions using the information below:

Peggy's Pillows produces and sells a decorative pillow for $75.00 per unit. In the first month of operation, 2,000 units were produced and 1,750 units were sold. Actual fixed costs are the same as the amount budgeted for the month. Other information for the month includes:

-What is cost of goods sold per unit using variable costing?

-What is cost of goods sold per unit using variable costing?

(Multiple Choice)

4.9/5  (32)

(32)

There is NOT an output-level variance for variable costing, because:

(Multiple Choice)

4.8/5  (32)

(32)

________ method(s)expense(s)direct material costs as cost of goods sold.

(Multiple Choice)

4.7/5  (30)

(30)

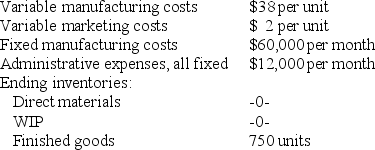

Answer the following questions using the information below:

Barry's Hobbies produces and sells a luxury animal pillow for $80.00 per unit. In the first month of operation, 3,000 units were produced and 2,250 units were sold. Actual fixed costs are the same as the amount budgeted for the month. Other information for the month includes:

-What is cost of goods sold per unit when using absorption costing?

-What is cost of goods sold per unit when using absorption costing?

(Multiple Choice)

4.8/5  (26)

(26)

If the unit level of inventory increases during an accounting period, then:

(Multiple Choice)

4.9/5  (32)

(32)

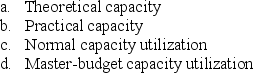

Match each of the following items with one or more of the denominator-level capacity concepts by putting the appropriate letter(s)by each item:

1. Reduces theoretical capacity by considering unavoidable operating interruptions

2. Producing at full efficiency all the time

3. Measures capacity levels in terms of demand

4. Level of capacity utilization that satisfies average customer demand over a period

5. Does not allow for plant maintenance

6. Engineering and human resource factors are important when estimating capacity

7. Level of capacity utilization that managers expect for the current budget period

8. Ideal goal of capacity utilization

9. Takes into account seasonal, cyclical, and trend factors

10. Measures capacity levels in terms of what a plant can supply

1. Reduces theoretical capacity by considering unavoidable operating interruptions

2. Producing at full efficiency all the time

3. Measures capacity levels in terms of demand

4. Level of capacity utilization that satisfies average customer demand over a period

5. Does not allow for plant maintenance

6. Engineering and human resource factors are important when estimating capacity

7. Level of capacity utilization that managers expect for the current budget period

8. Ideal goal of capacity utilization

9. Takes into account seasonal, cyclical, and trend factors

10. Measures capacity levels in terms of what a plant can supply

(Essay)

4.9/5  (39)

(39)

Answer the following questions using the information below:

A manufacturing firm is able to produce 2,000 pairs of sneakers per hour, at maximum efficiency. There are three eight-hour shifts each day. Due to unavoidable operating interruptions, production averages 1,600 units per hour. The plant actually operates only 27 days per month.

-What is the theoretical capacity for the month of April?

(Multiple Choice)

4.8/5  (33)

(33)

Switching production to products that absorb the highest amount of fixed manufacturing costs is also called:

(Multiple Choice)

4.9/5  (39)

(39)

Nonfinancial measures such as comparing units in ending inventory this period to units in ending inventory last period can help reduce buildup of excess inventory.

(True/False)

4.8/5  (36)

(36)

________ is the level of capacity based on producing at full efficiency all the time.

(Multiple Choice)

4.8/5  (36)

(36)

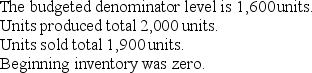

Answer the following questions using the information below:

Tunney Corporation incurred fixed manufacturing costs of $7,200 during 2011. Other information for 2011 includes:

The fixed manufacturing cost rate is based on the budgeted denominator level. Manufacturing variances are closed to cost of goods sold.

-Under absorption costing, the production-volume variance is:

The fixed manufacturing cost rate is based on the budgeted denominator level. Manufacturing variances are closed to cost of goods sold.

-Under absorption costing, the production-volume variance is:

(Multiple Choice)

4.8/5  (40)

(40)

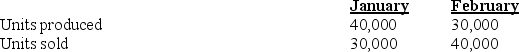

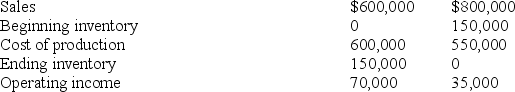

The manager of the manufacturing division of Iowa Windows does not understand why income went down when sales went up. Some of the information he has selected for evaluation include:

The division operated at normal capacity during January.

Variable manufacturing cost per unit was $5, and the fixed costs were $400,000.

Selling and administrative expenses were all fixed.

Required:

Explain the profit differences. How would variable costing income statements help the manager understand the division's operating income?

The division operated at normal capacity during January.

Variable manufacturing cost per unit was $5, and the fixed costs were $400,000.

Selling and administrative expenses were all fixed.

Required:

Explain the profit differences. How would variable costing income statements help the manager understand the division's operating income?

(Essay)

4.9/5  (40)

(40)

The contribution-margin format of the income statement distinguishes manufacturing costs from nonmanufacturing costs.

(True/False)

4.9/5  (31)

(31)

Using master-budget capacity for pricing purposes can lead to a downward demand spiral.

(True/False)

4.7/5  (37)

(37)

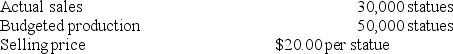

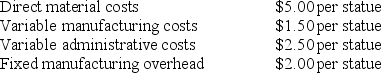

Answer the following questions using the information below:

Russert Company produces wood statues. Management has provided the following information:

-What is the cost per statue if throughput costing is used?

-What is the cost per statue if throughput costing is used?

(Multiple Choice)

4.8/5  (36)

(36)

If a company chooses practical capacity for planning purposes, it must also use practical capacity for performance evaluation.

(True/False)

4.9/5  (31)

(31)

The use of theoretical capacity results in an unrealistically low fixed manufacturing cost per unit because it is based on:

(Multiple Choice)

4.8/5  (35)

(35)

The difference between operating incomes under variable costing and absorption costing centers on how to account for:

(Multiple Choice)

4.7/5  (41)

(41)

Showing 101 - 120 of 208

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)