Exam 11: Partnerships: Distributions, Transfer of Interests, and Terminations

Exam 1: Understanding and Working With the Federal Tax Law74 Questions

Exam 2: Corporations: Introduction and Operating Rules113 Questions

Exam 3: Corporations: Special Situations111 Questions

Exam 4: Corporations: Organization and Capital Structure93 Questions

Exam 5: Corporations: Earnings Profits and Dividend Distributions89 Questions

Exam 6: Corporations: Redemptions and Liquidations112 Questions

Exam 7: Corporations: Reorganizations121 Questions

Exam 8: Consolidated Tax Returns145 Questions

Exam 9: Taxation of International Transactions159 Questions

Exam 10: Partnerships: Formation, Operation, and Basis100 Questions

Exam 11: Partnerships: Distributions, Transfer of Interests, and Terminations97 Questions

Exam 12: S: Corporations157 Questions

Exam 13: Comparative Forms of Doing Business143 Questions

Exam 14: Taxes on the Financial Statements87 Questions

Exam 15: Exempt Entities151 Questions

Exam 16: Multistate Corporate Taxation160 Questions

Exam 17: Tax Practice and Ethics153 Questions

Exam 18: The Federal Gift and Estate Taxes173 Questions

Exam 19: Family Tax Planning145 Questions

Exam 20: Income Taxation of Trusts and Estates156 Questions

Select questions type

A partnership has accounts receivable with a basis of $0 and a fair market value of $20,000 and depreciation recapture potential of $30,000. All other assets of the partnership are either cash, capital assets, or § 1231 assets. If a purchaser acquires a 40% interest in the partnership from another partner, the selling partner will be required to recognize ordinary income of $20,000.

(True/False)

4.8/5  (27)

(27)

Carlos receives a proportionate liquidating distribution consisting of $8,000 cash and inventory with a basis to the partnership of $5,000 and a fair market value of $6,000. His basis in his partnership interest was $15,000 immediately before the distribution. Carlos assigns a basis of $5,000 to the inventory, and recognizes a $2,000 capital loss.

(True/False)

4.8/5  (41)

(41)

Jeremy sold his 40% interest in the HIJ Partnership to Ashley for $400,000. The inside basis of all partnership assets was $600,000 at the time of the sale. If the partnership makes a § 754 election, it will record a $160,000 step-up in the basis of the partnership assets, and the step-up will be attributed solely to Ashley.

(True/False)

4.9/5  (42)

(42)

A partnership is required to make a downward adjustment to the basis of its assets if a partnership interest is sold and if the total decline in value of partnership assets is more than $250,000.

(True/False)

5.0/5  (43)

(43)

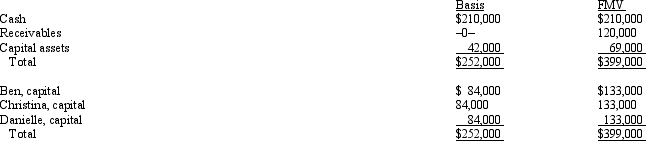

The December 31, 2011, balance sheet of the BCD General Partnership reads as follows.

Each partner shares in 1/3 of the partnership capital, income, gain, loss, deduction and credit. Capital is not a material income-producing factor to the partnership. On December 31, 2011, general partner Christina receives a distribution of $140,000 cash in liquidation of her partnership interest under § 736. Nothing is stated in the partnership agreement about goodwill. Christina's outside basis for the partnership interest immediately before the distribution is $84,000.

How much is Christina's recognized gain from the distribution and what is the character of the gain?

Each partner shares in 1/3 of the partnership capital, income, gain, loss, deduction and credit. Capital is not a material income-producing factor to the partnership. On December 31, 2011, general partner Christina receives a distribution of $140,000 cash in liquidation of her partnership interest under § 736. Nothing is stated in the partnership agreement about goodwill. Christina's outside basis for the partnership interest immediately before the distribution is $84,000.

How much is Christina's recognized gain from the distribution and what is the character of the gain?

(Essay)

4.8/5  (40)

(40)

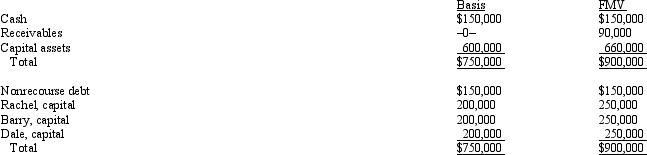

On August 31 of the current tax year, the balance sheet of the RBD General Partnership is as follows:

On that date, Rachel sells her one-third partnership interest to Lisa for $300,000, including cash and relief of Rachel's share of the nonrecourse debt. The nonrecourse debt is shared equally among the partners. Rachel's outside basis for her partnership interest is $250,000. How much capital gain and/or ordinary income will Rachel recognize on the sale?

On that date, Rachel sells her one-third partnership interest to Lisa for $300,000, including cash and relief of Rachel's share of the nonrecourse debt. The nonrecourse debt is shared equally among the partners. Rachel's outside basis for her partnership interest is $250,000. How much capital gain and/or ordinary income will Rachel recognize on the sale?

(Essay)

4.8/5  (46)

(46)

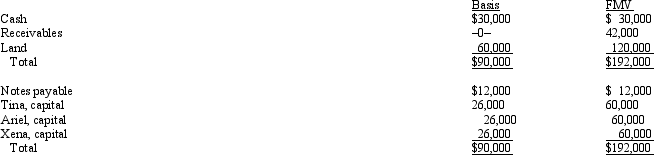

Tina sells her 1/3 interest in the TAX Partnership to James for $60,000 cash plus the assumption of Tina's $4,000 share of partnership debt. On the sale date, the partnership balance sheet and agreed-upon fair market values were as follows:  As a result of the sale, Tina recognizes:

As a result of the sale, Tina recognizes:

(Multiple Choice)

4.8/5  (46)

(46)

In a proportionate liquidating distribution, UVW Partnership distributes to partner William cash of $25,000, accounts receivable (basis of $10,000 and fair market value of $8,000), and land (basis of $50,000 and fair market value of $60,000). William's basis was $75,000 before the distribution. On the liquidation, William recognizes no gain or loss, and he takes a basis of $10,000 in the accounts receivable, and $50,000 in the land.

(True/False)

4.7/5  (27)

(27)

Susan is a one-fourth limited partner in the SJ Partnership in which capital is not a material income-producing factor. Partnership assets consist of land (fair market value of $100,000, basis of $80,000), accounts receivable (fair market value of $100,000, basis of $0) and cash of $200,000. SJ distributes $100,000 of the cash to Susan in liquidation of her interest. Susan's basis in the partnership interest was $70,000 immediately before the distribution. How much gain or loss does Susan recognize and what is its character? How much can the partnership deduct?

(Essay)

4.9/5  (41)

(41)

Aaron owns a 30% interest in a continuing partnership. The partnership distributes a $35,000 year-end cash bonus to all the partners. In a proportionate nonliquidating distribution, the partnership also distributed property (basis of $15,000; fair market value of $20,000) to Aaron. Immediately before the distribution, Aaron's basis in the partnership interest was $50,000. As a result of the distribution, Aaron recognizes:

(Multiple Choice)

4.8/5  (40)

(40)

Eric receives a proportionate nonliquidating distribution when the basis of his partnership interest is $80,000. The distribution consists of $20,000 in cash and property with an adjusted basis to the partnership of $45,000 and a fair market value of $40,000. Eric's basis in the noncash property and his remaining basis in the partnership interest are:

(Multiple Choice)

4.8/5  (33)

(33)

Beth sells her 25% partnership interest to Katie for $50,000 cash on July 1 of the current tax year. Katie also assumed Beth's share of the partnership's liabilities. Beth's basis in her partnership interest at the beginning of the year was $40,000, including a $15,000 share of partnership liabilities. The partnership's income for the entire year was $100,000, and Beth's share of partnership debt was $10,000 as of the date she sold the partnership interest. Assume the partnership has no hot assets and that its income is earned evenly throughout the year. Beth recognizes a gain of $12,500 on the sale.

(True/False)

4.9/5  (49)

(49)

In a proportionate liquidating distribution, Alexandria receives a distribution of $70,000 cash, accounts receivable (basis of $0 and fair market value of $20,000), and land (basis of $30,000 and fair market value of $60,000). In addition, the partnership repays all liabilities, of which Alexandria's share was $40,000. Alexandria's basis in the entity immediately before the distribution was $90,000. As a result of the distribution, what is Alexandria's basis in the accounts receivable and land, and how much gain or loss does she recognize?

(Multiple Choice)

4.7/5  (43)

(43)

Generally, gain is recognized on a proportionate current or liquidating distribution if the fair market value of property distributed exceeds the partner's basis in the partnership interest.

(True/False)

4.8/5  (47)

(47)

In a proportionate liquidating distribution in which the partnership is also liquidated, Ralph received cash of $30,000, accounts receivable (basis of $0 and fair market value of $20,000), and a desk (basis of $0 and fair market value of $1,000). Immediately before the distribution, Ralph's basis in the partnership interest was $40,000. Ralph realizes and recognizes a loss of $10,000, and his basis is $0 in both the accounts receivable and the desk.

(True/False)

4.8/5  (40)

(40)

Melissa is a partner in a continuing partnership. At the end of the current year, the partnership makes a proportionate, nonliquidating distribution to Melissa of $50,000 cash, inventory (basis of $22,000, fair market value of $20,000), and land (basis of $30,000, fair market value of $60,000). Melissa's basis in the partnership interest was $90,000 before the distribution. What is Melissa's basis in the inventory, land, and partnership interest following the distribution?

(Essay)

4.8/5  (34)

(34)

Landon received $50,000 cash and a capital asset (basis of $70,000 and fair market value of $80,000) in a proportionate liquidating distribution. His basis in his partnership interest was $100,000 prior to the distribution. How much gain or loss does Landon recognize and what is his basis in the asset received?

(Multiple Choice)

4.8/5  (22)

(22)

Beth has an outside basis of $60,000 in the BBDE Partnership as of December 31 of the current year. On that date the partnership liquidates and distributes to Beth a proportionate distribution of $20,000 cash and inventory with an inside basis to the partnership of $18,000 and a fair market value of $22,000. In addition, Beth receives a desk (not inventory) which has an inside basis and fair market value of $200 and $350, respectively. None of the distribution is for partnership goodwill. How much gain or loss will Beth recognize on the distribution, and what basis will she take in the desk?

(Multiple Choice)

4.7/5  (27)

(27)

Last year, Darby contributed land (basis of $60,000 and fair market value of $80,000) to the Seagull LLC in exchange for a 25% interest in the LLC. In the current year, the LLC distributes the land (now worth $82,000) to Shelby, who is also a 25% owner. Immediately prior to the distribution, Darby's basis in the LLC was $70,000, while Shelby's basis in the LLC was $110,000. How much gain or loss must be recognized and by whom? What is Shelby's basis in the property she receives and Darby's basis in her partnership interest following the distribution?

(Multiple Choice)

4.9/5  (46)

(46)

A § 754 election is made for a tax year in which the partner recognizes gain or loss on a distribution from the partnership or the basis in distributed property is increased or decreased from the inside basis the partnership held in those assets. The election is made by a partner any time it is necessary to adjust his or her share of the inside basis of partnership assets.

(True/False)

5.0/5  (33)

(33)

Showing 21 - 40 of 97

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)