Exam 11: Partnerships: Distributions, Transfer of Interests, and Terminations

Exam 1: Understanding and Working With the Federal Tax Law74 Questions

Exam 2: Corporations: Introduction and Operating Rules113 Questions

Exam 3: Corporations: Special Situations111 Questions

Exam 4: Corporations: Organization and Capital Structure93 Questions

Exam 5: Corporations: Earnings Profits and Dividend Distributions89 Questions

Exam 6: Corporations: Redemptions and Liquidations112 Questions

Exam 7: Corporations: Reorganizations121 Questions

Exam 8: Consolidated Tax Returns145 Questions

Exam 9: Taxation of International Transactions159 Questions

Exam 10: Partnerships: Formation, Operation, and Basis100 Questions

Exam 11: Partnerships: Distributions, Transfer of Interests, and Terminations97 Questions

Exam 12: S: Corporations157 Questions

Exam 13: Comparative Forms of Doing Business143 Questions

Exam 14: Taxes on the Financial Statements87 Questions

Exam 15: Exempt Entities151 Questions

Exam 16: Multistate Corporate Taxation160 Questions

Exam 17: Tax Practice and Ethics153 Questions

Exam 18: The Federal Gift and Estate Taxes173 Questions

Exam 19: Family Tax Planning145 Questions

Exam 20: Income Taxation of Trusts and Estates156 Questions

Select questions type

In a liquidating distribution, a partnership need not distribute all of its property to all of its partners.

(True/False)

4.9/5  (39)

(39)

In a proportionate liquidating distribution, Scott receives a distribution of $20,000 cash, accounts receivable (basis of $0 and fair market value of $40,000), and land (basis of $30,000 and fair market value of $60,000). In addition, the partnership repays all liabilities, of which Scott's share was $20,000. Scott's basis in the entity immediately before the distribution was $100,000. As a result of the distribution, what is Scott's basis in the accounts receivable and land, and how much gain or loss does he recognize?

(Multiple Choice)

4.8/5  (33)

(33)

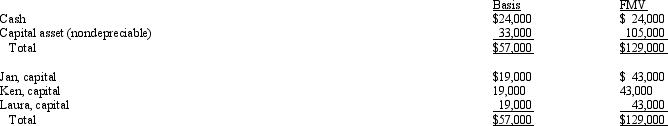

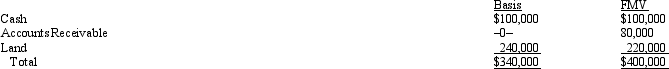

The December 31, 2011, balance sheet of the calendar-year JKL Partnership reads as follows.

Each partner shares in 1/3 of the partnership capital, income, gain, loss, deduction and credit. On December 31, 2011, Jan sells her 1/3 partnership interest to Jennifer for $43,000 cash. Assume the partnership makes a § 754 election for 2010.

Each partner shares in 1/3 of the partnership capital, income, gain, loss, deduction and credit. On December 31, 2011, Jan sells her 1/3 partnership interest to Jennifer for $43,000 cash. Assume the partnership makes a § 754 election for 2010.

(Essay)

4.8/5  (35)

(35)

The MBA Partnership makes a § 736(b) cash payment of $20,000 to partner Amanda in liquidation of her interest in the partnership. The partnership owns no hot assets. Amanda's basis in her partnership interest before the distribution was $50,000. If the partnership has a § 754 election in effect, it will record a $30,000 decrease in its inside basis in partnership assets, affecting all the remaining partners in the partnership.

(True/False)

4.9/5  (37)

(37)

At the beginning of the year, Elsie's basis in the E&G Partnership interest is $60,000. She receives a proportionate nonliquidating distribution from the partnership consisting of $10,000 of cash, unrealized accounts receivable (basis of $0, fair market value $30,000), and inventory (basis of $10,000, fair market value of $20,000). After the distribution, Elsie's bases in the accounts receivable, inventory, and partnership interest are:

(Multiple Choice)

4.9/5  (38)

(38)

The Crimson Partnership is a service provider. Its assets consist of unrealized receivables (basis $0, value $200,000), cash of $200,000, and land (basis of $280,000, value of $400,000). Assume 25% general partner Jill has a basis in her partnership interest of $130,000. If the ongoing partnership distributes the $200,000 cash to Jill in liquidation of her interest in the partnership, she will recognize ordinary income of $50,000 and a capital gain of $20,000.

(True/False)

4.8/5  (42)

(42)

Nicholas is a 25% owner in the DDBN LLC (a calendar year entity). At the end of the last tax year, Nicholas's basis in his interest was $50,000, including his $20,000 share of LLC liabilities. On July 1 of the current tax year, Nicholas sells his LLC interest to Anna for $80,000 cash. In addition, Anna assumes Nicholas's share of LLC liabilities, which, at that date, was $15,000. During the current tax year, DDBN's taxable income is $120,000 (earned evenly during the year). Nicholas's share of the LLC's unrealized receivables is valued at $6,000 ($0 basis). At the sale date, what is Nicholas's basis in his LLC interest, how much gain or loss must he recognize, and what is the character of the gain or loss?

(Multiple Choice)

4.8/5  (36)

(36)

Partner Jordan received a distribution of $80,000 cash from the JKL Partnership in complete liquidation of his partnership interest. If Jordan's outside basis immediately before the distribution was $90,000, and if the partnership has made (and not revoked) a § 754 election in a prior year, which of the following statements is true? (Assume the partnership owns no "hot assets.")

(Multiple Choice)

4.8/5  (37)

(37)

Normally a distribution of property from a partnership does not result in gain recognition. However, a distribution of marketable securities may be treated, in part, as a distribution of cash that could result in gain recognition.

(True/False)

5.0/5  (38)

(38)

The December 31, 2011, balance sheet of the RST General Partnership reads as follows.  The partners share equally in partnership capital, income, gain, loss, deduction and credit. Ted's adjusted basis for his partnership interest is $40,000. On December 31, 2011, he retires from the partnership, receiving a $60,000 cash payment in liquidation of his interest. The partnership agreement states that $2,500 of the payment is for goodwill. Which of the following statements about this distribution is false?

The partners share equally in partnership capital, income, gain, loss, deduction and credit. Ted's adjusted basis for his partnership interest is $40,000. On December 31, 2011, he retires from the partnership, receiving a $60,000 cash payment in liquidation of his interest. The partnership agreement states that $2,500 of the payment is for goodwill. Which of the following statements about this distribution is false?

(Multiple Choice)

4.7/5  (35)

(35)

In the year a donor gives a partnership interest to a donee, their share of the partnership's income is prorated between the donor and donee.

(True/False)

4.8/5  (40)

(40)

For income tax purposes, proportionate and disproportionate distributions from a partnership are treated similarly.

(True/False)

4.9/5  (35)

(35)

Nick sells his 25% interest in the LMNO Partnership to new partner Katrina for $57,500. The partnership's assets consist of cash ($100,000), land (basis of $90,000; fair market value of $70,000), and inventory (basis of $40,000; fair market value of $60,000). Nick's basis in his partnership interest was $57,500. On the sale, Nick will recognize ordinary income of $5,000 and a capital loss of $5,000.

(True/False)

4.9/5  (31)

(31)

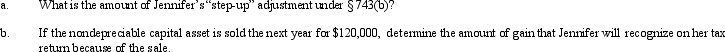

In a proportionate liquidating distribution in which the partnership is liquidated, Greg received cash of $20,000, inventory (basis of $2,000, fair market value of $3,000), and a capital asset (basis and fair market value of $4,000). Immediately before the distribution, Greg's basis in the partnership interest was $30,000.

(Essay)

4.9/5  (32)

(32)

Anthony's basis in the WAM Partnership interest was $200,000 just before he received a proportionate liquidating distribution consisting of investment land (basis of $90,000, fair market value $100,000), and inventory (basis of $30,000, fair market value $70,000). After the distribution, Anthony's recognized gain or loss and his basis in the land and inventory are:

(Multiple Choice)

4.8/5  (40)

(40)

Hannah sells her 25% interest in the HIJK Partnership to Alyssa for $120,000 cash. At the end of the year prior to the sale, Hannah's basis in HIJK was $70,000. The partnership allocates $15,000 of income to Hannah for the portion of the year she was a partner. On the date of the sale, the partnership assets and the agreed fair market values were as follows.

Determine the amount and character of any gain that Hannah recognizes on the sale.

Determine the amount and character of any gain that Hannah recognizes on the sale.

(Essay)

4.9/5  (30)

(30)

A disproportionate distribution occurs when a cash distribution is not made in proportion to the partners' ownership interests in the partnership. (Assume the partnership's only assets are cash and land held for investment).

(True/False)

4.8/5  (26)

(26)

Showing 81 - 97 of 97

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)