Exam 8: Depreciation, cost Recovery, amortization, and Depletion

Exam 1: An Introduction to Taxation and Understanding the Federal Tax Law195 Questions

Exam 2: Working With the Tax Law86 Questions

Exam 3: Tax Formula and Tax Determination;an Overview of Property Transactions188 Questions

Exam 4: Gross Income: Concepts and Inclusions124 Questions

Exam 5: Gross Income: Exclusions114 Questions

Exam 6: Deductions and Losses: in General142 Questions

Exam 7: Deductions and Losses: Certain Business Expenses and Losses120 Questions

Exam 8: Depreciation, cost Recovery, amortization, and Depletion115 Questions

Exam 9: Deductions: Employee and Self-Employed-Related Expenses177 Questions

Exam 10: Deductions and Losses: Certain Itemized Deductions104 Questions

Exam 11: Investor Losses110 Questions

Exam 12: Alternative Minimum Tax119 Questions

Exam 13: Tax Credits and Payment Procedures124 Questions

Exam 14: Property Transactions: Determination of Gain or Loss and Basis Considerations142 Questions

Exam 15: Property Transactions: Nontaxable Exchanges120 Questions

Exam 16: Property Transactions: Capital Gains and Losses72 Questions

Exam 17: Property Transactions: 1231 and Recapture Provisions70 Questions

Exam 18: Accounting Periods and Methods108 Questions

Exam 19: Deferred Compensation102 Questions

Exam 20: Corporations and Partnerships207 Questions

Select questions type

In a farming business,MACRS straight-line cost recovery is required for all fruit bearing trees.

Free

(True/False)

4.9/5  (32)

(32)

Correct Answer:

True

In 2013,Gail had a § 179 deduction carryover of $30,000.In 2014,she elected § 179 for an asset acquired at a cost of $115,000.Gail's § 179 business income limitation for 2014 is $140,000.Determine Gail's § 179 deduction for 2014.

Free

(Multiple Choice)

4.8/5  (46)

(46)

Correct Answer:

A

In 2013,the costs of qualified leasehold improvements qualify for additional first-year depreciation.

Free

(True/False)

4.9/5  (33)

(33)

Correct Answer:

True

Intangible drilling costs must be capitalized and written off through depletion.

(True/False)

4.9/5  (33)

(33)

George purchases used sevenyear class property at a cost of $200,000 on April 20,2014.Determine George's cost recovery deduction for 2014 for alternative minimum tax purposes,assuming George does not elect § 179.

(Multiple Choice)

5.0/5  (38)

(38)

James purchased a new business asset (three-year personalty)on July 23,2013,at a cost of $40,000.James takes additional first-year depreciation Determine the cost recovery deduction for 2013.

(Multiple Choice)

4.7/5  (33)

(33)

On April 15,2014,Sam placed in service a storage facility (a single-purpose agricultural structure)costing $80,000.Sam also purchased and planted fruit trees costing $40,000.Sam does not elect to expense any of the acquisitions under § 179 and he elects not to take additional firstyear depreciation (if available).Determine Sam's cost recovery from these two items for 2014.

(Essay)

4.9/5  (37)

(37)

Discuss the requirements in order for startup expenditures to be amortized under § 195.

(Essay)

4.7/5  (39)

(39)

Nora purchased a new automobile on July 20,2013,for $29,000.The car was used 60% for business and 40% for personal use.In 2014,the car was used 30% for business and 70% for personal use.Nora elects not to take additional first-year depreciation.Determine the cost recovery recapture and the cost recovery deduction for 2014.

(Essay)

4.8/5  (34)

(34)

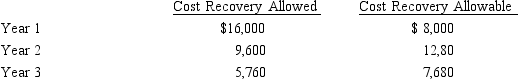

Tara purchased a machine for $40,000 to be used in her business.The cost recovery allowed and allowable for the three years the machine was used are as follows:  If Tara sells the machine after three years for $15,000,how much gain should she recognize?

If Tara sells the machine after three years for $15,000,how much gain should she recognize?

(Multiple Choice)

4.7/5  (35)

(35)

The amortization period in 2014 for $58,000 of startup expenses is 180 months.

(True/False)

4.8/5  (27)

(27)

Any § 179 expense amount that is carried forward is subject to the business income limitation in the carryforward year.

(True/False)

4.8/5  (32)

(32)

The statutory dollar cost recovery limits under § 280F does apply to all automobiles.

(True/False)

4.8/5  (38)

(38)

Percentage depletion enables the taxpayer to recover more than the cost of an asset.

(True/False)

4.8/5  (38)

(38)

Discuss the difference between the half-year convention and the mid-quarter convention.

(Essay)

4.8/5  (43)

(43)

Joe purchased a new five-year class asset on June 1,2014.The asset is listed property (not an automobile).It was used 55% for business and 45% for the production of income.The asset cost $100,000.Joe made the § 179 election.Joe's taxable income would not create a limitation for purposes of the § 179 deduction.Joe does not take additional firstyear depreciation (if available).Determine Joe's total cost recovery (including the § 179 deduction)for the year.

(Essay)

4.8/5  (34)

(34)

Taxpayers may elect to use the straight-line method under MACRS for personalty.

(True/False)

4.7/5  (46)

(46)

On March 1,2014,Lana leases and places in service a passenger automobile.The lease will run for five years and the payments are $500 per month.During 2014,she uses her car 60% for business and 40% for personal activities.Assuming the dollar amount from the IRS table is $20,determine Lana's inclusion as a result of the lease.

(Multiple Choice)

4.8/5  (35)

(35)

On March 3,2014,Sally purchased and placed in service a building costing $12,000,000.The building has 10 floors.The bottom three floors are rented out to businesses.The top seven floors are residential apartments.The gross rents from the businesses are $60,000 and the gross rents from the apartments are $110,000.Determine Sally's cost recovery for the building in 2014.

(Essay)

4.8/5  (35)

(35)

If a new car that is used predominantly in business is placed in service in 2014,the statutory dollar cost recovery limit under § 280F will depend on whether the taxpayer takes MACRS or straightline depreciation.

(True/False)

5.0/5  (40)

(40)

Showing 1 - 20 of 115

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)