Exam 6: Deductions and Losses: in General

All domestic bribes (i.e. ,to a U.S.official)are disallowed as deductions.

True

How can an individual's consultation with a lawyer be classified as a deduction for AGI in some cases and a deduction from AGI in other instances?

Legal expenses are deductible when they are directly related to a trade or business (for AGI);an income-producing activity (either for AGI or from AGI);or the determination,collection,or refund of a tax (either for AGI or from AGI).Ordinary and necessary legal expenses incurred in conjunction with a trade/business or in conjunction with rental/royalty property are deductible for AGI.All other deductible legal expenses are deductions from AGI.

In a related party transaction where realized loss is disallowed,when can the disallowed loss be used by the buyer on the subsequent sale of the property? In the case of a related party disallowed loss transaction,can the related party seller's disallowed loss be used by a taxpayer other than the related party buyer?

The related party buyer is permitted to use as much of the disallowed loss of the seller as is needed to reduce any realized gain on the subsequent sale of the property.If the property in the hands of the buyer appreciates to at least the amount of the seller's adjusted basis at the date of the original sale,all of the disallowed loss can be used by the buyer on the subsequent sale.The related party seller's disallowed loss can be used only by the related party buyer.

Expenses incurred for the production or collection of income generally are deductions from adjusted gross income.

The portion of property tax on a vacation home that is attributable to personal use is an itemized deduction.

The cost of legal advice associated with the preparation of an individual's Federal income tax return is not deductible because it is a personal expense.

Which of the following can be claimed as a deduction for AGI?

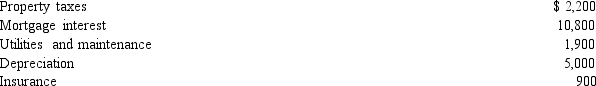

During the year,Rita rented her vacation home for twelve days for $2,400 and she used it personally for three months.The following expenses were incurred on the home:

Calculate her rental gain or loss and itemized deductions.

Calculate her rental gain or loss and itemized deductions.

If a taxpayer operated an illegal business (not drug trafficking),what expenses can be deducted and what expenses are disallowed?

Why are there restrictions on the recognition of gains and losses resulting from transactions between related parties?

Kitty runs a brothel (illegal under state law)and has the following items of income and expense.What is the amount that she must include in taxable income from her operation?

Income \2 00,000 Expenses: Rent 8,000 Utilities 2,000 Bribes to police 10,000 Medical expense 5,000 Legal fees 20,000 Depreciation 14,000 Illegal kickbacks 15,000

Jacques,who is not a U.S.citizen,makes a contribution to the campaign of a candidate for governor.Cassie,a

U.S.citizen,also makes a contribution to the same campaign fund.If contributions by noncitizens are illegal under state law,the contribution by Cassie is deductible,while that by Jacques is not.

A hobby activity can result in all of the hobby income being included in AGI and no deductions being allowed.

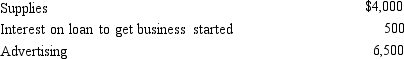

Priscella pursued a hobby of making bedspreads in her spare time.Her AGI before considering the hobby is $40,000.During the year she sold the bedspreads for $10,000.She incurred expenses as follows:  Assuming that the activity is deemed a hobby,how should she report these items on her tax return?

Assuming that the activity is deemed a hobby,how should she report these items on her tax return?

Sammy,a calendar year cash basis taxpayer who is age 66,has the following transactions:

Salary from job \ 90,000 Alimony received from ex-wife 10,000 Medical expenses 8,000 Based on this information Sammy

Legal fees incurred in connection with a criminal defense are not deductible even if the crime is associated with a trade or business.

Paula is the sole shareholder of Violet,Inc.For 2014,she receives from Violet a salary of $300,000 and dividends of $100,000.Violet's taxable income for 2014 is $500,000.On audit,the IRS treats $100,000 of Paula's salary as unreasonable.Which of the following statements is correct?

While she was a college student,Angel lived by a bookstore located near campus.She thinks a bookstore located on the other side of campus would be successful.She incurs expenses of $42,800 (legal fees,accounting fees,marketing survey,etc. )in exploring its business potential.Her parents have agreed to loan her the money required to start the business.What amount of these investigation costs can Angel deduct if:

a.She opens the bookstore on August 1,2014.

b.She decides not to open the bookstore.

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)