Exam 12: Alternative Minimum Tax

Exam 1: An Introduction to Taxation and Understanding the Federal Tax Law195 Questions

Exam 2: Working With the Tax Law86 Questions

Exam 3: Tax Formula and Tax Determination;an Overview of Property Transactions188 Questions

Exam 4: Gross Income: Concepts and Inclusions124 Questions

Exam 5: Gross Income: Exclusions114 Questions

Exam 6: Deductions and Losses: in General142 Questions

Exam 7: Deductions and Losses: Certain Business Expenses and Losses120 Questions

Exam 8: Depreciation, cost Recovery, amortization, and Depletion115 Questions

Exam 9: Deductions: Employee and Self-Employed-Related Expenses177 Questions

Exam 10: Deductions and Losses: Certain Itemized Deductions104 Questions

Exam 11: Investor Losses110 Questions

Exam 12: Alternative Minimum Tax119 Questions

Exam 13: Tax Credits and Payment Procedures124 Questions

Exam 14: Property Transactions: Determination of Gain or Loss and Basis Considerations142 Questions

Exam 15: Property Transactions: Nontaxable Exchanges120 Questions

Exam 16: Property Transactions: Capital Gains and Losses72 Questions

Exam 17: Property Transactions: 1231 and Recapture Provisions70 Questions

Exam 18: Accounting Periods and Methods108 Questions

Exam 19: Deferred Compensation102 Questions

Exam 20: Corporations and Partnerships207 Questions

Select questions type

Unless circulation expenditures are amortized over a three-year period for regular income tax purposes,there will be an AMT adjustment.

Free

(True/False)

4.9/5  (35)

(35)

Correct Answer:

True

What is the purpose of the AMT exemption amount? What is the maximum amount for each filing status for an individual taxpayer and for a corporate taxpayer?

Free

(Essay)

4.8/5  (36)

(36)

Correct Answer:

The AMT exemption amount can be thought of as a materiality provision.As such,it enables a taxpayer with a small amount of positive AMT adjustments and tax preferences to avoid being subject to the AMT.

For individual taxpayers,the maximum exemption amounts for 2014 are as follows:

For corporate taxpayers,the maximum exemption amount is $40,000.

In the current tax year,Ben exercised an incentive stock option (ISO),acquiring stock with a fair market value of $190,000 for $170,000.His AMT basis for the stock is $170,000,his regular income tax basis for the stock is $170,000,and his AMT adjustment is $0 ($170,000 - $170,000).

Free

(True/False)

4.8/5  (36)

(36)

Correct Answer:

False

A taxpayer has a passive activity loss for the current tax year for regular income tax purposes and for AMT purposes.Is it possible that the passive activity losses will be the same amount?

(Essay)

4.8/5  (43)

(43)

If a taxpayer deducts the standard deduction in calculating regular taxable income,what effect does this have in calculating AMTI?

(Essay)

4.9/5  (42)

(42)

Lilly is single and has no taxable income for 2014.She has positive timing adjustments of $600,000 and AMT exclusions of $200,000.

a.Calculate Lilly's tentative AMT.

b.Calculate Lilly's AMT credit carryover to 2015.

(Essay)

4.8/5  (36)

(36)

Madge's tentative AMT is $112,000.Her regular income tax liability is $99,000.Madge's AMT is $13,000.

(True/False)

4.7/5  (30)

(30)

Because passive losses are not deductible in computing either taxable income or AMTI,no adjustment for passive losses is required for AMT purposes.

(True/False)

4.9/5  (44)

(44)

If a gambling loss itemized deduction is permitted for regular income tax purposes,there will be no AMT adjustment associated with the gambling loss.

(True/False)

4.8/5  (31)

(31)

Sand Corporation,a calendar year taxpayer,has alternative minimum taxable income [before adjustment for adjusted current earnings (ACE)] of $900,000 for 2014.If Sand's (ACE)is $975,000,its tentative minimum tax for 2014 is:

(Multiple Choice)

4.7/5  (36)

(36)

Prior to the effect of tax credits,Clarence's regular income tax liability is $200,000 and his tentative AMT is

$180,000.Clarence has nonrefundable business tax credits of $35,000.His tax liability is $165,000.

(True/False)

4.9/5  (48)

(48)

Beige,Inc. ,has AMTI of $200,000.Calculate the amount of the AMT exemption if:

a.Beige is a small corporation for AMT purposes.

b.Beige is not a small corporation for AMT purposes.

(Essay)

4.7/5  (39)

(39)

Akeem,who does not itemize,incurred a net operating loss (NOL)of $50,000 in 2013.His deductions in 2013 included AMT tax preference items of $20,000,and he had no AMT adjustments.Assuming the NOL is not carried back,what is Akeem's ATNOLD carryover to 2014?

(Multiple Choice)

4.8/5  (33)

(33)

Celia and Christian,who are married filing jointly,have one dependent and do not itemize deductions.They have taxable income of $82,000 and tax preferences of $53,000 in 2014.What is their AMT base for 2014?

a.$0

b.$77,838

c.$94,450

d.$150,250

e.None of these

(Short Answer)

4.8/5  (36)

(36)

In 2014,Glenn had a $108,000 loss on a passive activity.None of the loss is attributable to AMT adjustments or preferences.She has no other passive activities.Which of the following statements is correct?

(Multiple Choice)

4.9/5  (43)

(43)

In deciding to enact the alternative minimum tax,Congress was concerned about the inequity that resulted when taxpayers with substantial economic incomes could avoid paying regular income tax.

(True/False)

4.9/5  (38)

(38)

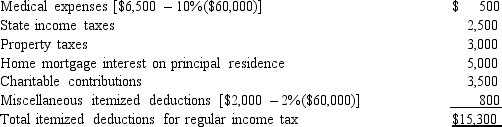

In calculating her 2014 taxable income,Rhonda,who is age 45,deducts the following itemized deductions.

Calculate Rhonda's AMT adjustment for itemized deductions.

Calculate Rhonda's AMT adjustment for itemized deductions.

(Essay)

4.9/5  (41)

(41)

In calculating the AMT using the indirect method,do AMT adjustments and AMT tax preferences increase or decrease AMTI?

(Essay)

4.8/5  (38)

(38)

Showing 1 - 20 of 119

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)