Exam 7: Special Issues in Accounting for an Investment in a Subsidiary

Exam 1: Business Combinations: New Rules for a Long-Standing Business Practice48 Questions

Exam 2: Consolidated Statements: Date of Acquisition44 Questions

Exam 3: Consolidated Statements: Subsequent to Acquisition37 Questions

Exam 4: Intercompany Transactions: Merchandise, Plant Assets, and Notes43 Questions

Exam 5: Intercompany Transactions: Bonds and Leases54 Questions

Exam 6: Cash Flow, Eps, and Taxation48 Questions

Exam 7: Special Issues in Accounting for an Investment in a Subsidiary42 Questions

Exam 9: The International Accounting Environment17 Questions

Exam 10: Foreign Currency Transactions75 Questions

Exam 11: Translation of Foreign Financial Statements79 Questions

Exam 12: Interim Reporting and Disclosures About Segments of an Enterprise63 Questions

Exam 13: Partnerships: Characteristics, Formation, and Accounting for Activities36 Questions

Exam 14: Partnerships: Ownership Changes and Liquidations47 Questions

Exam 15: Government and Not for Profit Accounting44 Questions

Exam 16: Governmental Accounting: Other Governmental Funds, Proprietary Funds, and Fiduciary Funds60 Questions

Exam 17: Financial Reporting Issues37 Questions

Exam 18: Accounting for Private Not-For-Profit Organizations61 Questions

Exam 19: Accounting for Not-For-Profit Colleges and Universities and Health Care Organizations83 Questions

Exam 20: Estates and Trusts: Their Nature and the Accountants Role56 Questions

Exam 21: Debt Restructuring, Corporate Reorganizations, and Liquidations49 Questions

Exam 22: Derivatives and Related Accounting Issues60 Questions

Exam 23: Equity Method for Unconsolidated Investments25 Questions

Exam 24: Variable Interest Entities10 Questions

Select questions type

Saddle Corporation is an 80%-owned subsidiary of Paso Company.On January 1, 2016, Saddle sold Paso a machine for $50,000.Saddle's cost was $60,000 and the book value was $40,000.The machine had a 5-year remaining life at the time of the sale.A consolidated balance sheet only is being prepared on December 31, 2019.The retained earnings of the controlling interest requires which of the following adjustments?

(Multiple Choice)

4.7/5  (37)

(37)

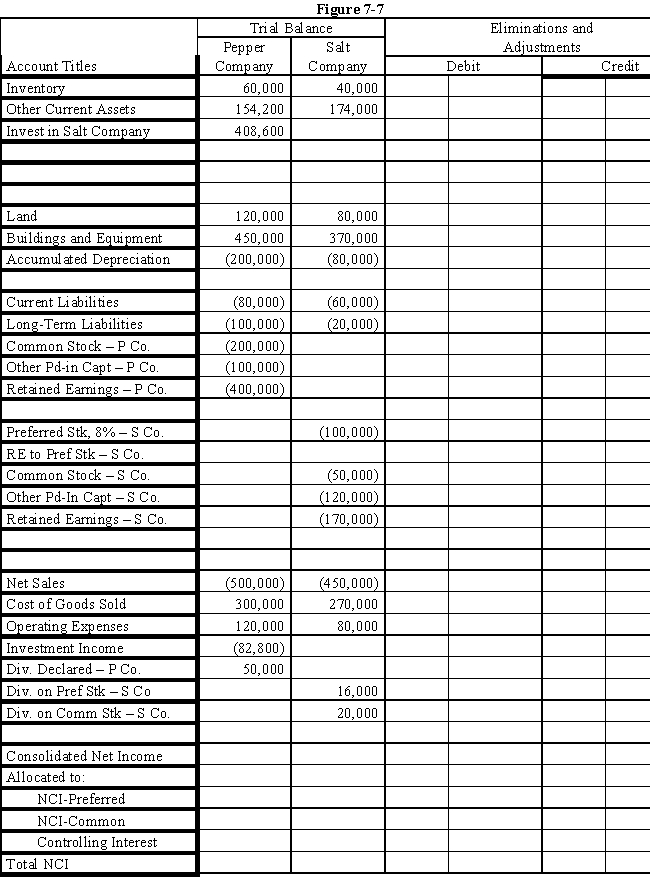

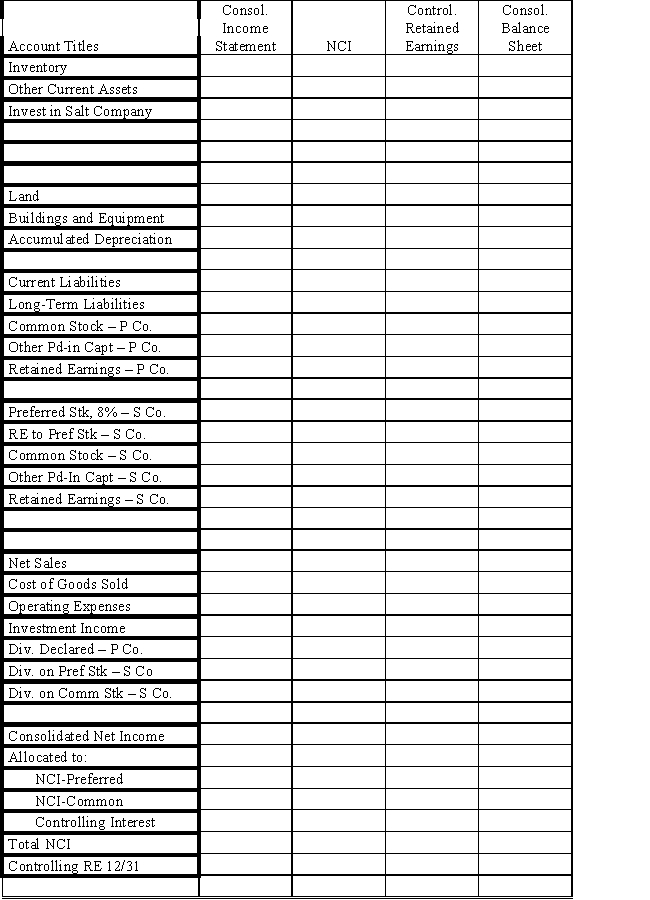

On January 1, 2016, Pepper Company purchased 90% of the common stock of Salt Company for $360,000 when Salt had total shareholders' equity as follows:

?

?

8\% Preferred Stock, \ 100 par \ 100,000 Common Stock, \ 10 par 50,000 Other Paid-in Capital 120,000 Retained Earnings 180,000 Total \ 450,000 Any excess of cost over book value on this date is attributed to a patent, to be amortized over 10 years.The 8% preferred stock is cumulative, non-participating, and has a liquidating value of par plus dividends in arrears.There were no preferred dividends in arrears on January 1, 2016.Pepper elected to account for its investment in Salt using the simple equity method.

?

During 2016, Salt had a net loss of $10,000 and paid no dividends.In 2017, Salt had net income of $100,000 and paid dividends totaling $36,000.

?

During 2017, Salt sold merchandise to Pepper for $40,000, of which $20,000 is still held by Pepper on December 31, 2017.Salt's usual gross profit is 40%.

?

Required:

?

Complete the Figure 7-7 worksheet for consolidated financial statements for the year ended December 31, 2017.

?

?

(Essay)

4.9/5  (38)

(38)

Showing 41 - 42 of 42

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)