Exam 3: An Introduction to Consolidated Financial Statements

Exam 1: Business Combinations36 Questions

Exam 2: Stock Investments Investor Accounting and Reporting39 Questions

Exam 3: An Introduction to Consolidated Financial Statements39 Questions

Exam 4: Consolidated Techniques and Procedures38 Questions

Exam 5: Intercompany Profit Transactions - Inventories40 Questions

Exam 6: Intercompany Profit Transactions - Plant Assets39 Questions

Exam 7: Intercompany Profit Transactions - Bonds40 Questions

Exam 8: Consolidations - Changes in Ownership Interests38 Questions

Exam 9: Indirect and Mutual Holdings37 Questions

Exam 11: Consolidation Theories, Push-Down Accounting, and Corporate Joint Ventures41 Questions

Exam 12: Derivatives and Foreign Currency: Concepts and Common Transactions40 Questions

Exam 13: Accounting for Derivatives and Hedging Activities40 Questions

Exam 14: Foreign Currency Financial Statements39 Questions

Exam 15: Segment and Interim Financial Reporting40 Questions

Exam 16: Partnerships - Formation, Operations, and Changes in Ownership Interests39 Questions

Exam 17: Partnership Liquidation40 Questions

Exam 18: Corporate Liquidations and Reorganizations38 Questions

Exam 19: An Introduction to Accounting for State and Local Governmental Units38 Questions

Exam 20: Accounting for State and Local Governmental Units - Governmental Funds38 Questions

Exam 21: Accounting for State and Local Governmental Units - Proprietary and Fiduciary Funds39 Questions

Exam 22: Accounting for Not-For-Profit Organizations39 Questions

Exam 23: Estates and Trusts39 Questions

Select questions type

Pental Corporation bought 90% of Sedacor Company's common stock at its book value of $400,000 on January 1, 2011.During 2011, Sedacor reported net income of $130,000 and paid dividends of $40,000.At what amount should Pental's Investment in Sedacor account be reported on December 31, 2011?

Free

(Multiple Choice)

4.8/5  (41)

(41)

Correct Answer:

B

Pregler Inc.has 70% ownership of Sach Company, but should exclude Sach from its consolidated financial statements if

Free

(Multiple Choice)

4.9/5  (40)

(40)

Correct Answer:

C

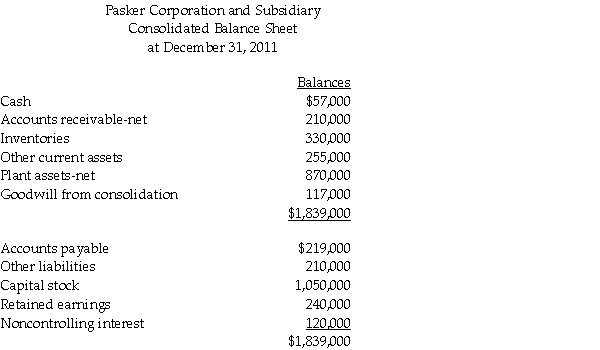

The consolidated balance sheet of Pasker Corporation and Shishobee Farm, its 80% owned subsidiary, as of December 31, 2011, contains the following accounts and balances:

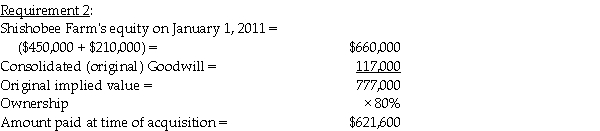

Pasker Corporation acquired its interest in Shishobee Farm on January 1, 2011, when Shishobee Farm had $450,000 of Capital Stock and $210,000 of Retained Earnings.Shishobee Farm's net assets had fair values equal to their book values when Pasker acquired its interest.No changes have occurred in the amount of outstanding stock since the date of the business combination.Pasker uses the equity method of accounting for its investment.

Required: Determine the following amounts:

1.The balance of Pasker's Capital Stock and Retained Earnings accounts at December 31, 2011.

2.Cost of Pasker's purchase of Shishobee Farm on January 1, 2011.

Pasker Corporation acquired its interest in Shishobee Farm on January 1, 2011, when Shishobee Farm had $450,000 of Capital Stock and $210,000 of Retained Earnings.Shishobee Farm's net assets had fair values equal to their book values when Pasker acquired its interest.No changes have occurred in the amount of outstanding stock since the date of the business combination.Pasker uses the equity method of accounting for its investment.

Required: Determine the following amounts:

1.The balance of Pasker's Capital Stock and Retained Earnings accounts at December 31, 2011.

2.Cost of Pasker's purchase of Shishobee Farm on January 1, 2011.

Free

(Essay)

4.9/5  (29)

(29)

Correct Answer:

Requirement 1:

On the consolidated balance sheet, the balance in the Capital Stock and Retained Earnings accounts will be those of the parent, so the Capital Stock balance is $1,050,000, and the Retained Earnings balance is $240,000.

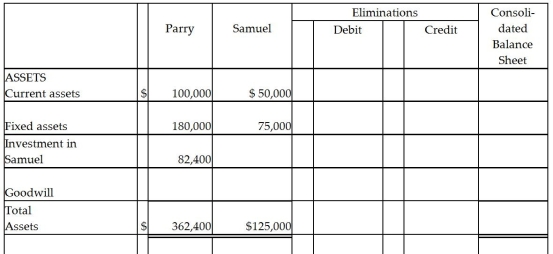

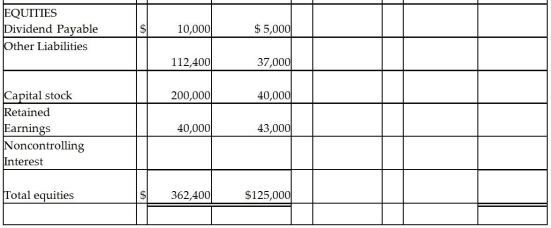

On January 1, 2011, Parry Incorporated paid $72,000 cash for 80% of Samuel Company's common stock.At that time Samuel had $40,000 capital stock and $30,000 retained earnings.The book values of Samuel's assets and liabilities were equal to fair values, and any excess amount is allocated to goodwill.Samuel reported net income of $18,000 during 2011 and declared $5,000 of dividends on December 31, 2011.At the time the dividends were declared, Parry recorded a receivable for the amount they expected to receive the following month.A summary of the balance sheets of Parry and Samuel are shown below.

Required:

Complete the consolidated balance sheet working papers for Parry Corporation and Subsidiary at December 31, 2011.

Required:

Complete the consolidated balance sheet working papers for Parry Corporation and Subsidiary at December 31, 2011.

(Essay)

4.9/5  (34)

(34)

On July 1, 2011, Polliwog Incorporated paid cash for 21,000 shares of Salamander Company's $10 par value stock, when it was trading at $22 per share.At that time, Salamander's total stockholders' equity was $597,000, and they had 30,000 shares of stock outstanding, both before and after the purchase.The book value of Salamander's net assets is believed to approximate the fair values.

Requirement 1: Prepare the journal entry that Polliwog would record at the date of acquisition on their general ledger.

Requirement 2: Calculate the balance of the goodwill that would be recorded on Polliwog's general ledger, on Salamander's general ledger, and in the consolidated financial statements.

(Essay)

4.9/5  (41)

(41)

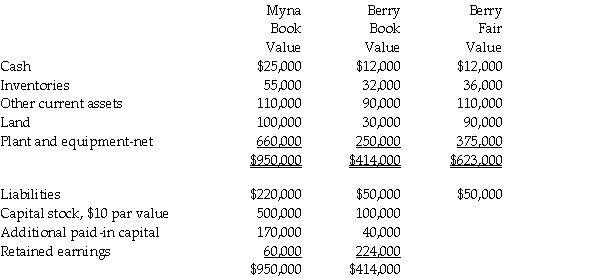

On January 1, 2005, Myna Corporation issued 10,000 shares of its own $10 par value common stock for 9,000 shares of the outstanding stock of Berry Corporation in an acquisition.Myna common stock at January 1, 2005 was selling at $70 per share.Just before the business combination, balance sheet information of the two corporations was as follows:

Required:

1.Prepare the journal entry on Myna Corporation's books to account for the investment in Berry Company.

2.Prepare a consolidated balance sheet for Myna Corporation and Subsidiary immediately after the business combination.

Required:

1.Prepare the journal entry on Myna Corporation's books to account for the investment in Berry Company.

2.Prepare a consolidated balance sheet for Myna Corporation and Subsidiary immediately after the business combination.

(Essay)

4.9/5  (38)

(38)

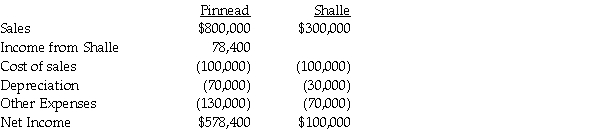

On January 1, 2011, Pinnead Incorporated paid $300,000 for an 80% interest in Shalle Company.At that time, Shalle's total book value was $300,000.Patents were undervalued in the amount of $10,000.Patents had a 5-year remaining useful life, and any remaining excess value was attributed to goodwill.The income statements for the year ended December 31, 2011 of Pinnead and Shalle are summarized below:

Requirements:

1.Calculate the goodwill that will appear in the consolidated balance sheet of Pinnead and Subsidiary at December 31, 2011.

2.Calculate consolidated net income for 2011.

3.Calculate the noncontrolling interest share for 2011.

Requirements:

1.Calculate the goodwill that will appear in the consolidated balance sheet of Pinnead and Subsidiary at December 31, 2011.

2.Calculate consolidated net income for 2011.

3.Calculate the noncontrolling interest share for 2011.

(Essay)

4.9/5  (38)

(38)

A newly acquired subsidiary had pre-existing goodwill on its books.The parent company's consolidated balance sheet will

(Multiple Choice)

4.7/5  (34)

(34)

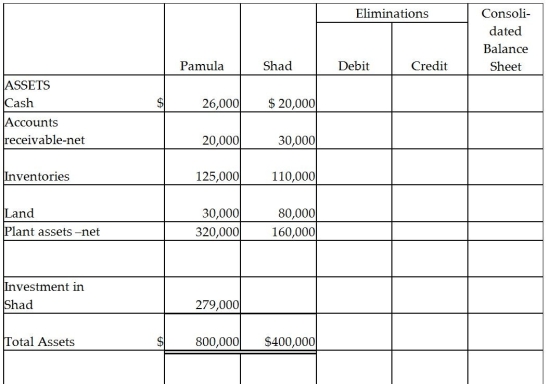

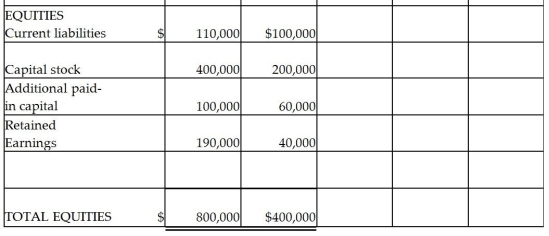

Pamula Corporation paid $279,000 for 90% of Shad Corporation's $10 par common stock on December 31, 2011, when Shad Corporation's stockholders' equity was made up of $200,000 of Common Stock, $60,000 Additional Paid-in Capital and $40,000 of Retained Earnings.Shad's identifiable assets and liabilities reflected their fair values on December 31, 2011, except for Shad's inventory which was undervalued by $5,000 and their land which was undervalued by $2,000.Balance sheets for Pamula and Shad immediately after the business combination are presented in the partially completed working papers.

Required:

Complete the consolidated balance sheet working papers for Pamula Corporation and Subsidiary.

Required:

Complete the consolidated balance sheet working papers for Pamula Corporation and Subsidiary.

(Essay)

4.7/5  (34)

(34)

Pomograte Corporation bought 75% of Sycamore Company's common stock, with a book value of $900,000, on January 2, 2011 for $750,000.The law firm of Dewey, Cheatam and Howe was paid $55,000 to facilitate the purchase.At what amount should Pomograte's Investment in Sycamore account be reported on January 2, 2011?

(Multiple Choice)

5.0/5  (39)

(39)

On June 1, 2011, Puell Company acquired 100% of the stock of Sorrell Inc.On this date, Puell had Retained Earnings of $100,000 and Sorrell had Retained Earnings of $50,000.On December 31, 2011, Puell had Retained Earnings of $120,000 and Sorrell had Retained Earnings of $60,000.The amount of Retained Earnings that appeared in the December 31, 2011 consolidated balance sheet was

(Multiple Choice)

4.7/5  (32)

(32)

Subsequent to an acquisition, the parent company and consolidated financial statement amounts would not be the same for

(Multiple Choice)

4.8/5  (36)

(36)

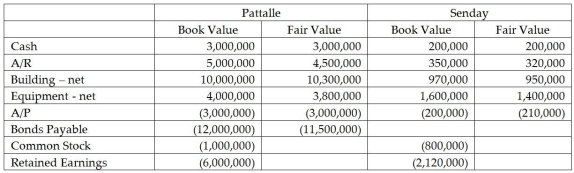

Pattalle Co purchases Senday, Inc.on January 1 of the current year for $70,000 more than the fair value of Senday's net assets.Push-down accounting is used.At that date, the following values exist:

Requirement: Determine what amounts will appear in the listed accounts on Pattalle's general ledger, on Senday's general ledger, and on the consolidated balance sheet immediately following the acquisition.Make sure you post the entry to record the investment on Pattalle's books.

Requirement: Determine what amounts will appear in the listed accounts on Pattalle's general ledger, on Senday's general ledger, and on the consolidated balance sheet immediately following the acquisition.Make sure you post the entry to record the investment on Pattalle's books.

(Essay)

4.8/5  (36)

(36)

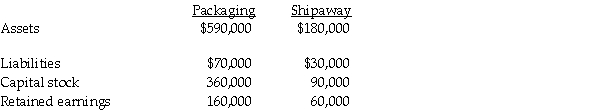

On January 1, 2012, Packaging International purchased 90% of Shipaway Corporation's outstanding shares for $135,000 when the fair value of Shipaway's net assets were equal to the book values.The balance sheets of Packaging and Shipaway Corporations at year-end 2011 are summarized as follows:  If a consolidated balance sheet was prepared immediately after the business combination, the noncontrolling interest would be

If a consolidated balance sheet was prepared immediately after the business combination, the noncontrolling interest would be

(Multiple Choice)

4.9/5  (32)

(32)

Pardo Corporation paid $140,000 for a 70% interest in Spedeal Inc.on January 1, 2011, when Spedeal had Capital Stock of $50,000 and Retained Earnings of $100,000.Fair values of identifiable net assets were the same as recorded book values.During 2011, Spedeal had income of $40,000, declared dividends of $15,000, and paid $10,000 of dividends.On December 31, 2011, the consolidated financial statements will show

(Multiple Choice)

4.9/5  (32)

(32)

On July 1, 2011, when Salaby Company's total stockholders' equity was $360,000, Pogana Corporation purchased 14,000 shares of Salaby's common stock at $30 per share.Salaby had 20,000 shares of common stock outstanding both before and after the purchase by Pogana, and the book value of Salaby's net assets on July 1, 2011 was equal to the fair value.On a consolidated balance sheet prepared at July 1, 2011, goodwill would be

(Multiple Choice)

4.9/5  (41)

(41)

What method must be used if FASB Statement No.94 prohibits full consolidation of a 70% owned subsidiary?

(Multiple Choice)

4.8/5  (40)

(40)

Percy Inc.acquired 80% of the outstanding stock of Sillson Company in a business combination.The book values of Sillson's net assets are equal to the fair values except for the building, whose net book value and fair value are $500,000 and $800,000, respectively.At what amount is the building reported on the consolidated balance sheet?

(Multiple Choice)

4.9/5  (32)

(32)

Panini Corporation owns 85% of the outstanding voting stock of Strathmore Company and Malone Corporation owns the remaining 15% of Strathmore's voting stock.On the consolidated financial statements of Panini Corporation and Strathmore, Malone is

(Multiple Choice)

4.9/5  (43)

(43)

Showing 1 - 20 of 39

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)