Exam 6: Deductions and Losses: in General

Exam 1: An Introduction to Taxation and Understanding the Federal Tax Law155 Questions

Exam 2: Working With the Tax Law83 Questions

Exam 3: Tax Formula and Tax Determination; an Overview of Property Transactions153 Questions

Exam 4: Gross Income: Concepts and Inclusions125 Questions

Exam 5: Gross Income: Exclusions115 Questions

Exam 6: Deductions and Losses: in General154 Questions

Exam 7: Deductions and Losses: Certain Business Expenses and Losses115 Questions

Exam 8: Depreciation, cost Recovery, amortization, and Depletion116 Questions

Exam 9: Deductions: Employee and Self-Employed-Related Expenses140 Questions

Exam 10: Deductions and Losses: Certain Itemized Deductions106 Questions

Exam 11: Investor Losses105 Questions

Exam 12: Alternative Minimum Tax125 Questions

Exam 13: Tax Credits and Payment Procedures123 Questions

Exam 14: Property Transactions: Determination of Gain or Loss and Basis Considerations154 Questions

Exam 15: Property Transactions: Nontaxable Exchanges139 Questions

Exam 16: Property Transactions: Capital Gains and Losses76 Questions

Exam 17: Property Transactions: Section 1231 and Recapture Provisions74 Questions

Exam 18: Accounting Periods and Methods107 Questions

Exam 19: Deferred Compensation104 Questions

Exam 20: Corporations and Partnerships165 Questions

Select questions type

Bobby operates a drug trafficking business.Because he has an accounting background,he keeps detailed financial records.What expenses can Bobby deduct on his Federal income tax return?

(Essay)

4.7/5  (37)

(37)

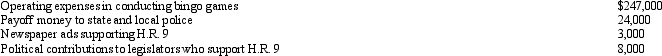

Rex,a cash basis calendar year taxpayer,runs a bingo operation which is illegal under state law.During 2012,a bill designated H.R.9 is introduced into the state legislature which,if enacted,would legitimize bingo games.In 2012,Rex had the following expenses:  Of these expenditures,Rex may deduct:

Of these expenditures,Rex may deduct:

(Multiple Choice)

4.7/5  (35)

(35)

Under what circumstances may a taxpayer deduct the expenses of investigating a possible business acquisition,if (1)the business is not acquired; and (2)the business is acquired?

(Essay)

4.8/5  (36)

(36)

Landscaping expenditures on new rental property are deductible in the year they are paid or incurred.

(True/False)

4.8/5  (37)

(37)

What are the relevant factors to be considered in determining whether an activity is profit-seeking or a hobby?

(Essay)

4.8/5  (39)

(39)

Which of the following is a deduction from AGI (itemized deduction)?

(Multiple Choice)

4.7/5  (38)

(38)

Because it has only one owner,any sole proprietorship is permitted to elect the cash method of accounting.

(True/False)

4.8/5  (37)

(37)

The cash method can be used even if inventory and cost of goods sold are an income producing factor in the business.

(True/False)

4.8/5  (40)

(40)

Susan is a sales representative for a U.S.weapons manufacturer.She makes a $100,000 "grease" payment to a U.S.government official associated with a weapons purchase by the U.S.Army.She makes a similar payment to a Saudi Arabian government official associated with a similar sale.Neither of these payments is deductible by Susan's employer.

(True/False)

5.0/5  (33)

(33)

Bruce owns several sole proprietorships.Must Bruce use the same accounting method for each of these businesses?

(Essay)

4.7/5  (36)

(36)

Abner contributes $1,000 to the campaign of the Tea Party candidate for governor,$750 to the campaign of the Tea Party candidate for senator,and $500 to the campaign of the Tea Party candidate for mayor.Can Abner deduct these political contributions?

(Essay)

4.8/5  (33)

(33)

Janet is the CEO for Silver,Inc.,a closely held corporation.Her total compensation for 2012 is $5 million.Of this amount,$2 million is a salary and $3 million is a bonus.The bonus was calculated as 5% of Silver's net income before the bonus and before taxes ($60 million X 5% = $3 million).The bonus provision has been in effect since Janet became CEO five years ago and is related to Silver's performance.It is approved annually by the entire board of directors (1 of the 5 directors is an outside director)of Silver.How much of Janet's compensation can Silver deduct for 2012?

(Essay)

4.8/5  (38)

(38)

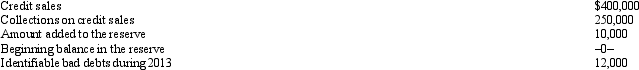

Petal,Inc.is an accrual basis taxpayer.Petal uses the aging approach to calculate the reserve for bad debts.During 2012,the following occur associated with bad debts.  The amount of the deduction for bad debt expense for Petal for 2012 is:

The amount of the deduction for bad debt expense for Petal for 2012 is:

(Multiple Choice)

4.8/5  (33)

(33)

Martha rents part of her personal residence in the summer for 3 weeks for $3,000.Anne rents all of her personal residence for one week in December for $2,500.Anne must include the $2,500 in her gross income whereas Martha is not required to include the $3,000 in her gross income.

(True/False)

4.9/5  (34)

(34)

Legal expenses incurred in connection with rental property are deductions from AGI.

(True/False)

4.8/5  (41)

(41)

Briefly explain the provisions regarding the deductibility of expenditures paid for another's benefit or obligation.

(Essay)

5.0/5  (39)

(39)

For an expense to be deducted as ordinary,it must be recurring in nature.

(True/False)

4.9/5  (27)

(27)

In distinguishing whether an activity is a hobby or a trade or business,discuss the presumptive rule.

(Essay)

4.9/5  (39)

(39)

Showing 41 - 60 of 154

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)