Exam 6: Deductions and Losses: in General

Exam 1: An Introduction to Taxation and Understanding the Federal Tax Law155 Questions

Exam 2: Working With the Tax Law83 Questions

Exam 3: Tax Formula and Tax Determination; an Overview of Property Transactions153 Questions

Exam 4: Gross Income: Concepts and Inclusions125 Questions

Exam 5: Gross Income: Exclusions115 Questions

Exam 6: Deductions and Losses: in General154 Questions

Exam 7: Deductions and Losses: Certain Business Expenses and Losses115 Questions

Exam 8: Depreciation, cost Recovery, amortization, and Depletion116 Questions

Exam 9: Deductions: Employee and Self-Employed-Related Expenses140 Questions

Exam 10: Deductions and Losses: Certain Itemized Deductions106 Questions

Exam 11: Investor Losses105 Questions

Exam 12: Alternative Minimum Tax125 Questions

Exam 13: Tax Credits and Payment Procedures123 Questions

Exam 14: Property Transactions: Determination of Gain or Loss and Basis Considerations154 Questions

Exam 15: Property Transactions: Nontaxable Exchanges139 Questions

Exam 16: Property Transactions: Capital Gains and Losses76 Questions

Exam 17: Property Transactions: Section 1231 and Recapture Provisions74 Questions

Exam 18: Accounting Periods and Methods107 Questions

Exam 19: Deferred Compensation104 Questions

Exam 20: Corporations and Partnerships165 Questions

Select questions type

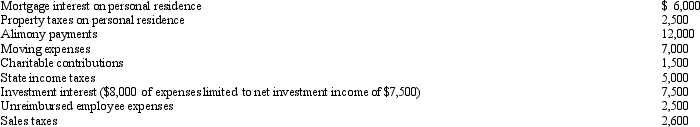

Arnold and Beth file a joint return.Use the following data to calculate their deduction for AGI.

(Essay)

4.8/5  (41)

(41)

Briefly discuss the disallowance of deductions for capital expenditures.

(Essay)

4.8/5  (34)

(34)

Amos,a shareholder-employee of Pigeon,Inc.,receives a $400,000 salary.The IRS classifies $125,000 of this amount as unreasonable compensation.The effect of this reclassification is to decrease Amos' gross income by $125,000 and increase Pigeon's gross income by $125,000.

(True/False)

4.9/5  (35)

(35)

For an activity classified as a hobby,the expenses are categorized as follows: (1) Amounts that affect adjusted basis and would be deductible under other Code sections if the activity had been engaged in for profit (e.g.,depreciation,amortization,and depletion).

(2) Amounts deductible under other Code sections without regard to the nature of the activity,such as property taxes and home mortgage interest.

(3) Amounts deductible under other Code sections if the activity had been engaged in for profit,but only if those amounts do not affect adjusted basis (e.g.,maintenance,utilities,and supplies).

If these expenses exceed the gross income from the activity and are thus limited,the sequence in which they are deductible is:

(Multiple Choice)

4.8/5  (36)

(36)

Which of the following expenses associated with the illegal sale of whiskey (i.e.,bootlegging)can be deducted?

(Multiple Choice)

4.7/5  (39)

(39)

Olive,Inc.,an accrual method taxpayer,is a corporation that is equally owned by Maurice and Alex,who are brothers.The corporation uses the accrual method of accounting and the shareholders use the cash method.To provide Olive with funds to acquire additional working capital,the shareholders each loan Olive $100,000 with a 6% interest rate.At the end of the tax year,there is unpaid accrued interest of $3,000 due to each shareholder.From a timing perspective,when should Olive deduct this $6,000 and when should Maurice and Alex include the $3,000 in gross income? Olive pays the $3,000 to each shareholder early next year.

(Essay)

4.8/5  (34)

(34)

If a vacation home is classified as primarily rental use,a deduction for all of the rental expenses is allowed.

(True/False)

4.9/5  (35)

(35)

In applying the $1 million limit on deducting executive compensation,what corporations are subject to the deduction limit? What executives are covered?

(Essay)

4.8/5  (38)

(38)

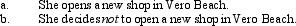

Gladys owns a retail hardware store in Tangipahoa.She is considering opening a business in Hammond,a community located 25 miles away.She incurs expenses of $60,000 in 2012 in investigating the feasibility and desirability of doing so.What amount can Gladys deduct in 2012 if the business is:

(Essay)

4.9/5  (34)

(34)

Fines and penalties paid for violations of the law (e.g.,illegal dumping of hazardous waste)are deductible only if they relate to a trade or business.

(True/False)

4.9/5  (37)

(37)

Expenses incurred for the production or collection of income generally are deductions from adjusted gross income.

(True/False)

4.8/5  (34)

(34)

Emelie and Taylor are employed by the Federal government and own their home in Washington,

(Essay)

4.8/5  (49)

(49)

Which of the following statements is correct in connection with the investigation of a business?

(Multiple Choice)

4.9/5  (37)

(37)

Hobby activity expenses are deductible from AGI to the extent of hobby income.Such expenses not in excess of hobby income are not subject to the 2% of AGI floor.

(True/False)

4.8/5  (37)

(37)

A hobby activity can result in all of the hobby income being included in AGI and no deductions being allowed.

(True/False)

4.9/5  (46)

(46)

Which of the following is relevant in deciding whether an activity is profit-seeking or a hobby?

(Multiple Choice)

4.9/5  (42)

(42)

Which of the following is not a related party for constructive ownership purposes under § 267?

(Multiple Choice)

4.7/5  (25)

(25)

Showing 21 - 40 of 154

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)