Exam 7: Deductions and Losses: Certain Business Expenses and Losses

Exam 1: An Introduction to Taxation and Understanding the Federal Tax Law195 Questions

Exam 2: Working With the Tax Law86 Questions

Exam 3: Computing the Tax187 Questions

Exam 4: Gross Income: Concepts and Inclusions124 Questions

Exam 5: Gross Income: Exclusions113 Questions

Exam 6: Deductions and Losses: in General146 Questions

Exam 7: Deductions and Losses: Certain Business Expenses and Losses95 Questions

Exam 8: Depreciation, cost Recovery, amortization, and Depletion103 Questions

Exam 9: Deductions: Employee and Self-Employed-Related Expenses181 Questions

Exam 10: Deductions and Losses: Certain Itemized Deductions105 Questions

Exam 11: Investor Losses111 Questions

Exam 12: Tax Credits and Payments118 Questions

Exam 13: Property Transactions: Determination of Gain or Loss, basis Considerations, and Nontaxable Exchanges280 Questions

Exam 14: Property Transactions, capital Gains and Losses, sec1231, and Recapture Provisions145 Questions

Exam 15: Alternative Minimum Tax132 Questions

Exam 16: Accounting Periods and Methods91 Questions

Exam 17: Corporations: Introduction and Operating Rules112 Questions

Exam 18: Corporations: Organization and Capital Structure93 Questions

Exam 19: Corporations: Distributions Not in Complete Liquidation192 Questions

Exam 20: Corporations: Distributions in Complete Liquidation and an Overview of Reorganization72 Questions

Exam 21: Partnerships163 Questions

Exam 22: S Corporations145 Questions

Exam 23: Exempt Entities141 Questions

Exam 24: Multistate Corporate Taxation196 Questions

Exam 25: Taxation of International Transactions164 Questions

Exam 26: Tax Practice and Ethics183 Questions

Exam 27: The Federal Gift and Estate Taxes167 Questions

Exam 28: Income Taxation of Trusts and Estates167 Questions

Select questions type

A taxpayer who sustains a casualty loss in an area designated by the President of the United States as a disaster area may take the loss in the year in which the loss occurred or elect to take the loss in the previous year.Identify factors that should be considered in deciding in which year to take the loss.

(Essay)

4.9/5  (41)

(41)

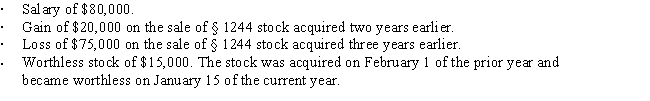

Bruce,who is single,had the following items for the current year:

Determine Bruce's AGI for the current year.

(Multiple Choice)

4.9/5  (31)

(31)

Al,who is single,has a gain of $40,000 on the sale of § 1244 stock (small business stock) and a loss of $80,000 on the sale of § 1244 stock.As a result,Al has a $40,000 ordinary loss.

(True/False)

4.8/5  (42)

(42)

If an account receivable written off during a prior year is subsequently collected during the current year,the amount collected must be included in the gross income of the current year to the extent it created a tax benefit in the prior year.

(True/False)

4.8/5  (42)

(42)

The amount of partial worthlessness on a nonbusiness bad debt is deducted in the year partial worthlessness is determined.

(True/False)

4.8/5  (34)

(34)

Peggy is in the business of factoring accounts receivable.Last year,she purchased a $30,000 account receivable for $25,000.This year,the account was settled for $25,000.How much loss can Peggy deduct and in which year?

(Multiple Choice)

4.9/5  (26)

(26)

A taxpayer can elect to forgo the NOL carryback period of 2 years.

(True/False)

4.9/5  (36)

(36)

In the current year,Amber Corporation has taxable income of $880,000,alternative minimum taxable income of $600,000,and qualified production activities income (QPAI) of $640,000.The total W-2 wages paid to employees engaged in qualified domestic production activities are $116,000.Amber's DPAD for the current year is:

(Multiple Choice)

4.9/5  (36)

(36)

Several years ago,John purchased 2,000 shares of Red Corporation § 1244 stock from Mark for $40,000.Last year,John sold one-half of his Red Corporation stock to Mike for $12,000.During the current year,John sold the remaining Red Corporation stock for $3,000.John has a $17,000 ($3,000 - $20,000) ordinary loss for the current year.

(True/False)

5.0/5  (35)

(35)

Last year,Lucy purchased a $100,000 account receivable for $90,000.During the current year,Lucy collected $97,000 on the account.What are the tax consequences to Lucy associated with the collection of the account receivable? No subsequent collections are expected.

(Multiple Choice)

4.9/5  (38)

(38)

A father cannot claim a loss on his daughter's rental use property.

(True/False)

4.9/5  (39)

(39)

When a nonbusiness casualty loss is spread between two taxable years,the loss in the second year is reduced by 10% of adjusted gross income for the first year.

(True/False)

4.8/5  (43)

(43)

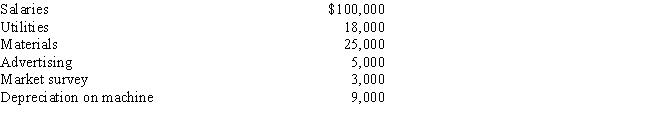

Blue Corporation incurred the following expenses in connection with the development of a new product:

Blue expects to begin selling the product next year.If Blue elects to amortize research and experimental expenditures over 60 months,determine the amount of the deduction for research and experimental expenditures for the current year.

(Multiple Choice)

4.8/5  (29)

(29)

Last year,Amos had AGI of $50,000.Amos also had a diamond ring stolen which cost $20,000 and was worth $17,000 at the time of the theft.He itemized deductions on last year's tax return.In the current year,Amos recovered $17,000 from the insurance company.Therefore,he must include $11,900 in gross income on the tax return for the current year.

(True/False)

4.8/5  (38)

(38)

Alma is in the business of dairy farming.During the year,one of her barns was completely destroyed by fire.The adjusted basis of the barn was $90,000.The fair market value of the barn before the fire was $75,000.The barn was insured for 95% of its fair market value,and Alma recovered this amount under the insurance policy.Alma has adjusted gross income for the year of $40,000 (before considering the casualty).Determine the amount of loss she can deduct on her tax return for the current year.

(Multiple Choice)

4.7/5  (33)

(33)

If an election is made to defer deduction of research expenditures,the amortization period is based on the expected life of the research project if less than 60 months.

(True/False)

4.9/5  (37)

(37)

If a taxpayer sells their § 1244 stock at a loss,all of the loss will be ordinary loss.

(True/False)

4.9/5  (47)

(47)

A corporation which makes a loan to a shareholder can have a nonbusiness bad debt deduction.

(True/False)

4.9/5  (35)

(35)

The limit for the domestic production activities deduction (DPAD) uses all W-2 wages paid to employees by the taxpayer during the tax year.

(True/False)

4.8/5  (39)

(39)

Showing 21 - 40 of 95

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)