Exam 9: Deductions: Employee and Self-Employed-Related Expenses

Exam 1: An Introduction to Taxation and Understanding the Federal Tax Law195 Questions

Exam 2: Working With the Tax Law86 Questions

Exam 3: Computing the Tax187 Questions

Exam 4: Gross Income: Concepts and Inclusions124 Questions

Exam 5: Gross Income: Exclusions113 Questions

Exam 6: Deductions and Losses: in General146 Questions

Exam 7: Deductions and Losses: Certain Business Expenses and Losses95 Questions

Exam 8: Depreciation, cost Recovery, amortization, and Depletion103 Questions

Exam 9: Deductions: Employee and Self-Employed-Related Expenses181 Questions

Exam 10: Deductions and Losses: Certain Itemized Deductions105 Questions

Exam 11: Investor Losses111 Questions

Exam 12: Tax Credits and Payments118 Questions

Exam 13: Property Transactions: Determination of Gain or Loss, basis Considerations, and Nontaxable Exchanges280 Questions

Exam 14: Property Transactions, capital Gains and Losses, sec1231, and Recapture Provisions145 Questions

Exam 15: Alternative Minimum Tax132 Questions

Exam 16: Accounting Periods and Methods91 Questions

Exam 17: Corporations: Introduction and Operating Rules112 Questions

Exam 18: Corporations: Organization and Capital Structure93 Questions

Exam 19: Corporations: Distributions Not in Complete Liquidation192 Questions

Exam 20: Corporations: Distributions in Complete Liquidation and an Overview of Reorganization72 Questions

Exam 21: Partnerships163 Questions

Exam 22: S Corporations145 Questions

Exam 23: Exempt Entities141 Questions

Exam 24: Multistate Corporate Taxation196 Questions

Exam 25: Taxation of International Transactions164 Questions

Exam 26: Tax Practice and Ethics183 Questions

Exam 27: The Federal Gift and Estate Taxes167 Questions

Exam 28: Income Taxation of Trusts and Estates167 Questions

Select questions type

For the current football season,Tern Corporation pays $40,000 for a skybox (containing 12 seats) at Veterans Stadium for eight home games.Regular nonskybox seats at each game range from $120 to $150 a seat.In November,a Tern employee and ten clients use the skybox to attend a game.The event is preceded by a bona fide business discussion,and Tern spent $1,000 for food and drinks during the game.What is Tern's deduction?

Free

(Essay)

5.0/5  (45)

(45)

Correct Answer:

$1,400.(12 seats × $150) + $1,000 = $2,800 × 50% (cutback adjustment) = $1,400.Even though only ten clients attended,all available seats are considered.The highest cost of a regular seat ($150) is used in the computation.

Match the statements that relate to each other. (Note: Choice L may be used more than once.)

a.Must involve the same trade or business

b.Must be for the convenience of the employer

c.Meals while in route

d.Lodging while in route

e.Out-of-town job assignment lasts for more than one year

f.Can include actual cost of parking

g.Payment for services rendered based on tasks performed

h.Excludes use of MACRS depreciation

i.Taxpayer has tools and helper provided for him

j.Transportation must be allocated if taxpayer spends two weeks on business and one week sightseeing

k.Paralegal obtains a law degree

l.Correct match not provided

-Characteristic of a taxpayer who is self-employed

Free

(Short Answer)

4.9/5  (40)

(40)

Correct Answer:

g

Aiden performs services for Lucas.Which,if any,of the following factors indicate that Aiden is an employee,rather than an independent contractor?

Free

(Multiple Choice)

4.8/5  (43)

(43)

Correct Answer:

C

Sue performs services for Lynn. Regarding this arrangement, use the legend provided to classify each statement.

a.Indicates employee status.

b.Indicates independent contractor status.

-Sue uses her own helpers.

(Short Answer)

4.8/5  (36)

(36)

When is a taxpayer's work assignment in a new locale temporary? Permanent? What difference does it make?

(Essay)

4.7/5  (31)

(31)

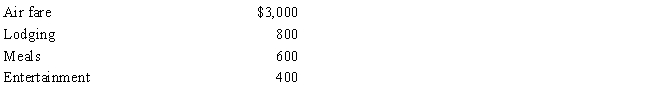

During the year,Sophie went from Omaha to Lima (Peru) on business.She spent four days on business,two days on travel,and four days on vacation.Disregarding the vacation costs,Sophie's unreimbursed expenses are:

Sophie's deductible expenses are:

Sophie's deductible expenses are:

(Multiple Choice)

4.7/5  (48)

(48)

Tracy,the regional sales director for a manufacturer of exercise equipment,pays $2,500 to rent a skybox for a visiting performance of the Harlem Globetrotters.The skybox holds 10 seats,and Tracy invites 7 clients to the event.Nonluxury seats range in price from $80 to $120.The refreshments provided during the event cost $600.If Tracy meets all of the requirements for deductibility (i.e.,business discussion,substantiation),she may deduct:

(Multiple Choice)

4.7/5  (29)

(29)

Under the right circumstances,a taxpayer's meals and lodging expense can qualify as a deductible education expense.

(True/False)

4.8/5  (44)

(44)

For tax year 2016,Taylor used the simplified method of determining her office in the home deduction.For 2017,Taylor must continue to use the simplified method and cannot switch to the regular (actual expense) method.

(True/False)

4.8/5  (39)

(39)

In contrasting the reporting procedures of employees and self-employed persons regarding job-related transactions,which of the following items involve self-employed?

(Multiple Choice)

4.8/5  (37)

(37)

Jacob is a landscape architect who works out of his home.He wonders whether or not he will have nondeductible commuting expenses when he drives to the locations of his clients.Please comment.

(Essay)

4.8/5  (33)

(33)

Match the statements that relate to each other. (Note: Choice L may be used more than once.)

a.Cover charge paid to entertain client at a night club.

b.Deductible even if taxpayer does not take the new job

c.Company picnic sponsored by employer

d.Use of Federal per diem allowance to substantiate meals while in travel status

e.Does not have to be job related

f.Can include cost of car insurance and automobile club dues

g.Distribution from plan is taxable

h.Distribution from plan is not taxable

i.Expatriate (U.S. person who is employed overseas) returns home to retire

j.Taxpayer moves to a new residence 55 miles closer to his present job

k.Country club membership fee

l.Correct match not provided

-Cutback adjustment does not apply

(Short Answer)

4.7/5  (34)

(34)

During 2017,Eva used her car as follows: 12,000 miles (business),1,400 miles (commuting),and 4,000 miles (personal).In addition,she spent $440 for tolls (business) and $620 for parking (business).If Eva uses the automatic mileage method,what is the amount of her deduction?

(Essay)

4.8/5  (40)

(40)

After she finishes working at her main job,Ann returns home,has dinner,then drives to her second job.Ann may deduct the mileage between her first and second job.

(True/False)

4.9/5  (37)

(37)

Match the statements that relate to each other. (Note: Choice L may be used more than once.)

a.Must involve the same trade or business

b.Must be for the convenience of the employer

c.Meals while in route

d.Lodging while in route

e.Out-of-town job assignment lasts for more than one year

f.Can include actual cost of parking

g.Payment for services rendered based on tasks performed

h.Excludes use of MACRS depreciation

i.Taxpayer has tools and helper provided for him

j.Transportation must be allocated if taxpayer spends two weeks on business and one week sightseeing

k.Paralegal obtains a law degree

l.Correct match not provided

-Actual cost method of determining auto expense

(Short Answer)

4.8/5  (45)

(45)

Sue performs services for Lynn. Regarding this arrangement, use the legend provided to classify each statement.

a.Indicates employee status.

b.Indicates independent contractor status.

-Sue has unreimbursed expenses.

(Short Answer)

4.9/5  (35)

(35)

Myra's classification of those who work for her as independent contractors is being questioned by the IRS.It is the position of the IRS that these workers are really employees.What type of factors can Myra utilize to justify her classification?

(Essay)

4.9/5  (34)

(34)

Amy works as an auditor for a large major CPA firm.During the months of September through November of each year,she is permanently assigned to the team auditing Garnet Corporation.As a result,every day she drives from her home to Garnet and returns home after work.Mileage is as follows:

For these three months,Amy's deductible mileage for each workday is:

For these three months,Amy's deductible mileage for each workday is:

(Multiple Choice)

4.8/5  (43)

(43)

Sue performs services for Lynn. Regarding this arrangement, use the legend provided to classify each statement.

a.Indicates employee status.

b.Indicates independent contractor status.

-Sue was trained by Lynn.

(Short Answer)

4.9/5  (38)

(38)

At age 65,Camilla retires from her job in Boston and moves to Florida.As a retiree,she is not subject to the time test in deducting her moving expenses.

(True/False)

4.9/5  (37)

(37)

Showing 1 - 20 of 181

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)