Exam 17: Corporations: Introduction and Operating Rules

Exam 1: An Introduction to Taxation and Understanding the Federal Tax Law195 Questions

Exam 2: Working With the Tax Law86 Questions

Exam 3: Computing the Tax187 Questions

Exam 4: Gross Income: Concepts and Inclusions124 Questions

Exam 5: Gross Income: Exclusions113 Questions

Exam 6: Deductions and Losses: in General146 Questions

Exam 7: Deductions and Losses: Certain Business Expenses and Losses95 Questions

Exam 8: Depreciation, cost Recovery, amortization, and Depletion103 Questions

Exam 9: Deductions: Employee and Self-Employed-Related Expenses181 Questions

Exam 10: Deductions and Losses: Certain Itemized Deductions105 Questions

Exam 11: Investor Losses111 Questions

Exam 12: Tax Credits and Payments118 Questions

Exam 13: Property Transactions: Determination of Gain or Loss, basis Considerations, and Nontaxable Exchanges280 Questions

Exam 14: Property Transactions, capital Gains and Losses, sec1231, and Recapture Provisions145 Questions

Exam 15: Alternative Minimum Tax132 Questions

Exam 16: Accounting Periods and Methods91 Questions

Exam 17: Corporations: Introduction and Operating Rules112 Questions

Exam 18: Corporations: Organization and Capital Structure93 Questions

Exam 19: Corporations: Distributions Not in Complete Liquidation192 Questions

Exam 20: Corporations: Distributions in Complete Liquidation and an Overview of Reorganization72 Questions

Exam 21: Partnerships163 Questions

Exam 22: S Corporations145 Questions

Exam 23: Exempt Entities141 Questions

Exam 24: Multistate Corporate Taxation196 Questions

Exam 25: Taxation of International Transactions164 Questions

Exam 26: Tax Practice and Ethics183 Questions

Exam 27: The Federal Gift and Estate Taxes167 Questions

Exam 28: Income Taxation of Trusts and Estates167 Questions

Select questions type

Which of the following statements is correct regarding the taxation of C corporations?

Free

(Multiple Choice)

4.9/5  (28)

(28)

Correct Answer:

E

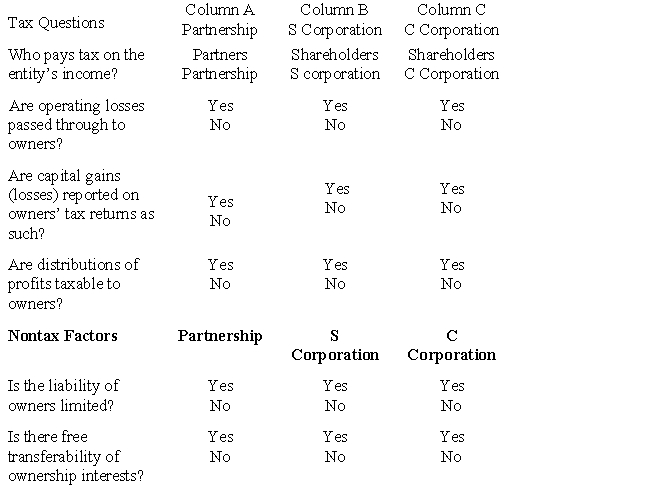

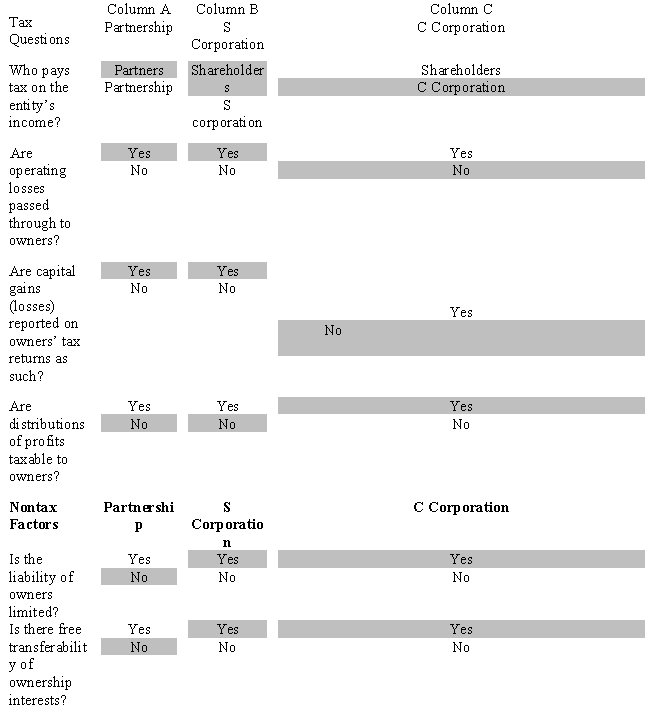

Compare the basic tax and nontax factors of doing business as a partnership,an S corporation,and a C corporation.Circle the correct answers.

Free

(Essay)

4.9/5  (43)

(43)

Correct Answer:

The correct answers are shaded.

Schedule M-3 is similar to Schedule M-1 in that the form is designed to reconcile net income per books with taxable income.However,an objective of Schedule M-3 is more transparency between financial statements and tax returns than that provided by Schedule M-1.

Free

(True/False)

4.7/5  (37)

(37)

Correct Answer:

True

Norma formed Hyacinth Enterprises,a proprietorship,in the current year.During the year,Hyacinth had operating income of $400,000 and operating expenses of $240,000.In addition,Hyacinth had a long-term capital loss of $10,000.Norma withdrew $75,000 from Hyacinth during the year.Assuming Norma has no other capital gains or losses,and ignoring any self-employment taxes,how does this information affect her adjusted gross income for the year?

(Multiple Choice)

4.9/5  (33)

(33)

Briefly describe the accounting methods available for adoption by a C corporation.

(Essay)

4.9/5  (35)

(35)

Azul Corporation,a calendar year C corporation,received a dividend of $30,000 from Naranja Corporation.Azul owns 25% of the Naranja Corporation stock.Assuming it is not subject to the taxable income limitation,Azul's dividends received deduction is $21,000.

(True/False)

4.8/5  (37)

(37)

Pink,Inc.,a calendar year C corporation,manufactures golf gloves.For the current year,Pink had taxable income (before DPAD) of $900,000,qualified domestic production activities income of $750,000,and W-2 wages related to qualified production activities income of $140,000.Pink's domestic production activities deduction for the current year is:

(Multiple Choice)

4.9/5  (33)

(33)

During the current year,Woodchuck,Inc.,a closely held personal service corporation,has $115,000 of net active income,$40,000 of portfolio income,and $135,000 of passive activity loss.What is Woodchuck's taxable income for the current year?

(Multiple Choice)

4.9/5  (42)

(42)

A personal service corporation must use a calendar year,and is not permitted to use a fiscal year.

(True/False)

4.9/5  (39)

(39)

Don,the sole shareholder of Pastel Corporation (a C corporation),has the corporation pay him a salary of $600,000 in the current year.The Tax Court has held that $200,000 represents unreasonable compensation.Don must report a salary of $400,000 and a dividend of $200,000 on his individual tax return.

(True/False)

4.8/5  (36)

(36)

Briefly describe the charitable contribution deduction rules applicable to C corporations.

(Essay)

4.8/5  (37)

(37)

During the current year,Sparrow Corporation,a calendar year C corporation,had operating income of $425,000,operating expenses of $280,000,a short-term capital loss of $10,000,and a long-term capital gain of $25,000.How much is Sparrow's income tax liability for the year?

(Multiple Choice)

4.9/5  (38)

(38)

Azure Corporation,a C corporation,had a long-term capital gain of $50,000 in the current year.The maximum amount of tax applicable to the capital gain is $7,500 ($50,000 × 15%).

(True/False)

4.9/5  (39)

(39)

Jake,the sole shareholder of Peach Corporation,a C corporation,has the corporation pay him $100,000.For income tax purposes,Jake would prefer to have the payment treated as dividend instead of salary.

(True/False)

4.8/5  (45)

(45)

Briefly discuss the requirements for the dividends received deduction.

(Essay)

4.8/5  (39)

(39)

Donald owns a 45% interest in a partnership that earned $130,000 in the current year.He also owns 45% of the stock in a C corporation that earned $130,000 during the year.Donald received $20,000 in distributions from each of the two entities during the year.With respect to this information,Donald must report $78,500 of income on his individual income tax return for the year.

(True/False)

5.0/5  (30)

(30)

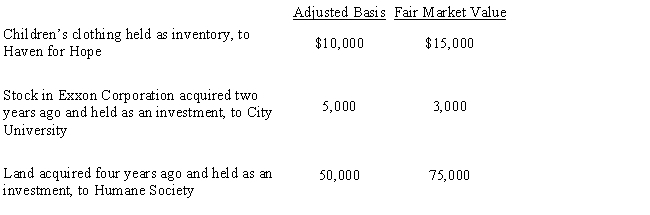

During the current year,Owl Corporation (a C corporation),a retailer of children's apparel,made the following donations to qualified charitable organizations.

How much qualifies for the charitable contribution deduction (ignoring the taxable income limitation)?

How much qualifies for the charitable contribution deduction (ignoring the taxable income limitation)?

(Multiple Choice)

4.8/5  (40)

(40)

Which of the following statements is incorrect regarding the taxation of C corporations?

(Multiple Choice)

4.9/5  (48)

(48)

Contrast the tax treatment of capital gains and losses of C corporations with that of individual taxpayers.

(Essay)

4.9/5  (36)

(36)

Rachel is the sole member of an LLC,and Jordan is the sole shareholder of a C corporation.Both businesses were started in the current year,and each business has a long-term capital gain of $10,000 for the year.Neither business made any distributions during the year.With respect to this information,which of the following statements is correct?

(Multiple Choice)

4.8/5  (42)

(42)

Showing 1 - 20 of 112

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)