Exam 10: The Basics of Capital Budgeting: Evaluating Cash Flows

Exam 1: An Overview of Financial Management and the Financial Environment41 Questions

Exam 3: Analysis of Financial Statements104 Questions

Exam 4: Time Value of Money168 Questions

Exam 5: Bonds, Bond Valuation, and Interest Rates101 Questions

Exam 6: Risk, Return, and the Capital Asset Pricing Model146 Questions

Exam 7: Stocks, Stock Valuation, and Stock Market Equilibrium91 Questions

Exam 8: Financial Options and Applications in Corporate Finance28 Questions

Exam 9: The Cost of Capital92 Questions

Exam 10: The Basics of Capital Budgeting: Evaluating Cash Flows108 Questions

Exam 11: Cash Flow Estimation and Risk Analysis78 Questions

Exam 12: Financial Planning and Forecasting Financial Statements46 Questions

Exam 13: Corporate Valuation, Value-Based Management and Corporate Governance6 Questions

Exam 15: Capital Structure Decisions87 Questions

Exam 16: Working Capital Management138 Questions

Exam 17: Multinational Financial Management49 Questions

Select questions type

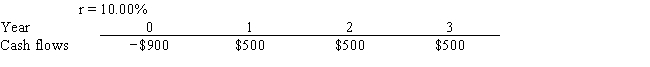

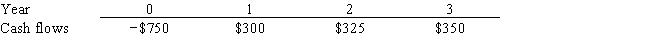

Craig's Car Wash Inc. is considering a project that has the following cash flow and cost of capital (r) data. What is the project's discounted payback?

(Multiple Choice)

4.8/5  (40)

(40)

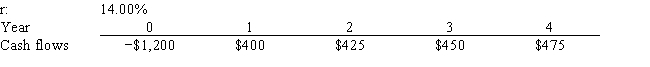

Yoga Center Inc. is considering a project that has the following cash flow and cost of capital (r) data. What is the project's NPV? Note that a project's expected NPV can be negative, in which case it will be rejected.

(Multiple Choice)

4.8/5  (40)

(40)

Pet World is considering a project that has the following cash flow data. What is the project's IRR? Note that a project's IRR can be less than the cost of capital (and even negative), in which case it will be rejected.

(Multiple Choice)

4.8/5  (41)

(41)

A project's IRR is independent of the firm's cost of capital. In other words, a project's IRR doesn't change with a change in the firm's cost of capital.

(True/False)

4.9/5  (38)

(38)

Projects S and L are equally risky, mutually exclusive, and have normal cash flows. Project S has an IRR of 15%, while Project L's IRR is 12%. The two projects have the same NPV when the cost of capital is 7%. Which of the following statements is CORRECT?

(Multiple Choice)

4.9/5  (46)

(46)

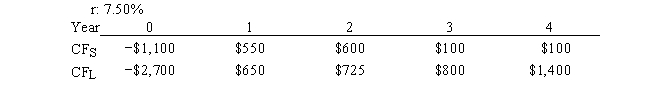

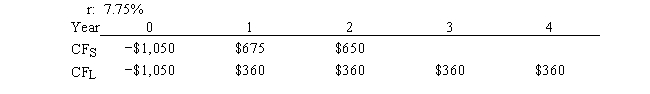

Current Design Co. is considering two mutually exclusive, equally risky, and not repeatable projects, S and L. Their cash flows are shown below. The CEO believes the IRR is the best selection criterion, while the CFO advocates the NPV. If the decision is made by choosing the project with the higher IRR rather than the one with the higher NPV, how much, if any, value will be forgone, i.e., what's the chosen NPV versus the maximum possible NPV? Note that (1) "true value" is measured by NPV, and (2) under some conditions the choice of IRR vs. NPV will have no effect on the value gained or lost.

(Multiple Choice)

4.8/5  (32)

(32)

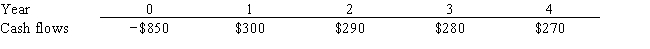

Carolina Company is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and are not repeatable. If the decision is made by choosing the project with the higher IRR, how much value will be forgone? Note that under some conditions choosing projects on the basis of the IRR will cause $0.00 value to be lost.

(Multiple Choice)

4.8/5  (29)

(29)

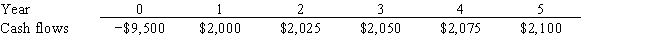

Modern Refurbishing Inc. is considering a project that has the following cash flow data. What is the project's IRR? Note that a project's IRR can be less than the cost of capital (and even negative), in which case it will be rejected.

(Multiple Choice)

4.9/5  (41)

(41)

Robbins Inc. is considering a project that has the following cash flow and cost of capital (r) data. What is the project's NPV? Note that if a project's expected NPV is negative, it should be rejected.

(Multiple Choice)

4.9/5  (38)

(38)

Project S has a pattern of high cash flows in its early life, while Project L has a longer life, with large cash flows late in its life. Neither has negative cash flows after Year 0, and at the current cost of capital, the two projects have identical NPVs. Now suppose interest rates and money costs decline. Other things held constant, this change will cause L to become preferred to S.

(True/False)

4.9/5  (37)

(37)

The cost of capital for two mutually exclusive projects that are being considered is 8%. Project K has an IRR of 20% while Project R's IRR is 15%. The projects have the same NPV at the 8% current cost of capital. However, you believe that money costs and thus your cost of capital will also increase. You also think that the projects will not be funded until the cost of capital has increased, and their cash flows will not be affected by the change in economic conditions. Under these conditions, which of the following statements is CORRECT?

(Multiple Choice)

4.9/5  (33)

(33)

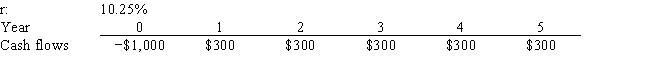

Watts Co. is considering a project that has the following cash flow and cost of capital (r) data. What is the project's MIRR? Note that a project's MIRR can be less than the cost of capital (and even negative), in which case it will be rejected.

(Multiple Choice)

4.9/5  (45)

(45)

If you were evaluating two mutually exclusive projects for a firm with a zero cost of capital, the payback method and NPV method would always lead to the same decision on which project to undertake.

(True/False)

5.0/5  (32)

(32)

Which of the following statements is CORRECT? Assume that the project being considered has normal cash flows, with one outflow followed by a series of inflows.

(Multiple Choice)

4.8/5  (51)

(51)

Conflicts between two mutually exclusive projects occasionally occur, where the NPV method ranks one project higher but the IRR method ranks the other one first. In theory, such conflicts should be resolved in favor of the project with the higher positive NPV.

(True/False)

4.8/5  (32)

(32)

Poder Inc. is considering a project that has the following cash flow data. What is the project's payback?

(Multiple Choice)

4.9/5  (31)

(31)

Assume a project has normal cash flows. All else equal, which of the following statements is CORRECT?

(Multiple Choice)

4.9/5  (27)

(27)

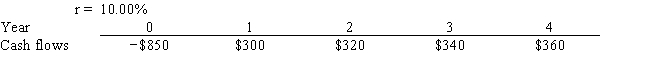

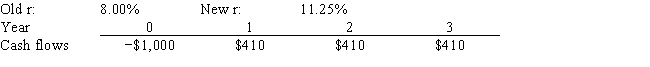

Corner Jewelers, Inc. recently analyzed the project whose cash flows are shown below. However, before the company decided to accept or reject the project, the Federal Reserve changed interest rates and therefore the firm's cost of capital (r). The Fed's action did not affect the forecasted cash flows. By how much did the change in the r affect the project's forecasted NPV? Note that a project's expected NPV can be negative, in which case it should be rejected.

(Multiple Choice)

4.8/5  (37)

(37)

Showing 21 - 40 of 108

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)