Exam 15: Job Order Costing and Analysis

Exam 1: Introducing Accounting in Business257 Questions

Exam 2: Analyzing and Recording Transactions216 Questions

Exam 3: Adjusting Accounts and Preparing Financial Statements236 Questions

Exam 4: Accounting for Merchandising Operations200 Questions

Exam 5: Inventories and Cost of Sales197 Questions

Exam 6: Cash and Internal Controls198 Questions

Exam 7: Accounts and Notes Receivable170 Questions

Exam 8: Long-Term Assets205 Questions

Exam 9: Current Liabilities191 Questions

Exam 10: Long-Term Liabilities189 Questions

Exam 11: Corporate Reporting and Analysis200 Questions

Exam 12: Reporting Cash Flows175 Questions

Exam 13: Analysis of Financial Statements185 Questions

Exam 14: Managerial Accounting Concepts and Principles198 Questions

Exam 15: Job Order Costing and Analysis155 Questions

Exam 16: Process Costing191 Questions

Exam 17: Activity-Based Costing and Analysis183 Questions

Exam 18: Cost-Volume-Profit Analysis181 Questions

Exam 19: Variable Costing and Performance Reporting178 Questions

Exam 20: Master Budgets and Performance Planning164 Questions

Exam 21: Flexible Budgets and Standard Costs179 Questions

Exam 22: Decentralization and Performance Measurement154 Questions

Exam 23: Relevant Costing for Managerial Decisions140 Questions

Exam 24: Capital Budgeting and Investment Analysis144 Questions

Exam 25: Accounting With Special Journals160 Questions

Exam 26: Time Value of Money58 Questions

Exam 27: Investments and International Operations181 Questions

Exam 28: Accounting for Partnerships126 Questions

Select questions type

Since a predetermined overhead allocation rate is established before a period begins,this rate is revised many times during the period to compensate for inaccurate estimates previously made.

(True/False)

4.9/5  (39)

(39)

In a job order cost accounting system,indirect labor costs are debited to the Factory Overhead account.

(True/False)

5.0/5  (31)

(31)

A manufacturing company uses a job order cost accounting system.Overhead is applied using pounds of direct materials used as an allocation base.Total costs for a particular job were $5,720.Of this amount $2,600 was direct labor and $1,040 was direct material.The company pays $26 per hour of direct labor and $2 per pound of direct materials.What is this company's overhead rate?

(Multiple Choice)

4.8/5  (37)

(37)

Overhead is applied as a percent of direct labor costs.Estimated overhead and direct labor costs for the year were $250,000 and $125,000,respectively.During the year,actual overhead was $248,000 and actual direct labor cost was $123,000.The entry to close the over- or underapplied overhead at year-end,assuming an immaterial amount,would include:

(Multiple Choice)

4.8/5  (37)

(37)

A company's manufacturing accounting system applies overhead based on direct labor cost.The company's manufacturing costs for the current year were: direct labor,$57,600; direct materials,$76,800; and factory overhead,$9,600.Calculate the company's overhead allocation rate.

(Short Answer)

4.8/5  (41)

(41)

In a job order cost accounting system,any immaterial underapplied overhead at the end of the period can be charged entirely to Cost of Goods Sold.

(True/False)

4.8/5  (37)

(37)

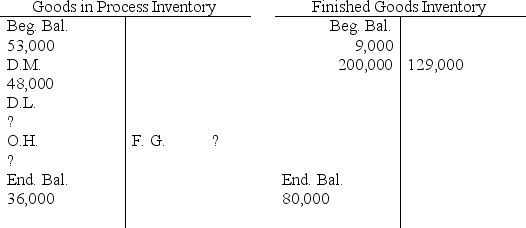

Using the following accounts and an overhead rate of 80% of direct labor cost,determine the amount of applied overhead.

(Multiple Choice)

4.9/5  (39)

(39)

A job order manufacturing system would be appropriate for a company that produces which one of the following items?

(Multiple Choice)

4.8/5  (37)

(37)

The Goods in Process Inventory account of a manufacturing company that uses an overhead rate based on direct labor cost has a $7,750 debit balance after all posting is completed.The cost sheet of the one job still in process shows direct material cost of $6,000 and direct labor cost of $1,000.Therefore,the company's overhead application rate is:

(Multiple Choice)

4.9/5  (41)

(41)

If one unit of Product X used $.75 of direct materials and $6.00 of direct labor,sold for $12.00,and was assigned overhead at the rate of 20% of direct labor costs,how much gross profit was realized from this sale?

(Multiple Choice)

4.9/5  (35)

(35)

A source document that an employee uses to record the number of hours at work and that is used to determine the total labor cost for each pay period is a:

(Multiple Choice)

4.8/5  (34)

(34)

Match the following terms to the appropriate definition:

(a)General accounting system

(b)Time ticket

(c)Clock card

(d)Materials requisition

(e)Underapplied overhead

(f) Job order manufacturing

(g) Overapplied overhead

(h) Job cost sheet

(i) Job order cost accounting system

(j) Predetermined overhead allocation rate

(k) Materials ledger card

_______ (1)The production of products in response to special orders; also called customized production.

_______ (2)A source document that is used to record the number of hours an employee works and to determine the total labor cost for each pay period.

_______ (3)The amount by which the overhead applied to jobs in a period with the predetermined overhead allocation rate exceeds the overhead incurred in a period.

_______ (4)An accounting system for manufacturing activities based on the periodic inventory system.

_______ (5)The rate established prior to the beginning of a period that relates estimated overhead to an allocation factor such as estimated direct labor and is used to assign overhead cost to a job.

_______ (6)A cost accounting system designed to determine the cost of producing each job or job lot.

_______ (7)A source document that production managers use to request materials for manufacturing and that is used to assign materials costs to specific jobs or to overhead.

_______ (8)A perpetual record that is updated each time units of raw material are both purchased and issued for use in production.

_______ (9)A source document that is used to report how much time an employee spent working on a job or on overhead activities and then to determine the amount of direct labor to charge to the job or the amount of indirect labor to charge to overhead.

_______(10)The amount by which overhead incurred in a period exceeds the overhead applied to jobs with the predetermined overhead allocation rate.

_______(11)A separate record maintained for each job in a job order costing system; it shows direct materials,direct labor,and overhead for each job.

(Essay)

4.9/5  (43)

(43)

The Johnson Manufacturing Company has the following job cost sheets on file.They represent jobs that have been worked on during March of the current year.This table summarizes information provided on each sheet:

Total Cost Number Incurred Status of Job 444 \ 15,050 Finished and delivered 445 \ 22,400 Finished and delivered 446 \ 7,500 Finished and unsold 447 \ 4,300 Finished and delivered 448 \ 33,000 Finished and unsold 449 \ 62,000 Finished and unsolc 450 \ 14,600 Unfinished 451 \ 22,200 Finished and delivered 452 \ 3,600 Unfinished 453 \ 1,000 Unfinished

A. What is the cost of goods sold for the month of March?

B. What is the cost of the goods in process inventory on March 31?

C. What is the cost of the finished goods inventory on March 31?

(Essay)

4.9/5  (34)

(34)

Deltan Corp.allocates overhead to production on the basis of direct labor costs.If Deltan's total estimated overhead is $450,000 and estimated direct labor cost is $180,000,determine the amount of overhead to be allocated to finished goods inventory.There is $20,000 of total direct labor cost in the jobs in the finished goods inventory.

(Multiple Choice)

4.8/5  (45)

(45)

Penn Company uses a job order cost accounting system.In the last month,the system accumulated labor time tickets totaling $24,600 for direct labor and $4,300 for indirect labor.These costs were accumulated in Factory Payroll as they were paid.Which entry should Penn make to assign the Factory Payroll?

(A)

Payroll Expense 28,900 Cash 28,900

(B)

Payroll Expense 24,600 Factory Overhead 4,300 Factorv Pavroll 28,900

(C)

Goods in Process Inventory 24,600 Factory Overhead 4,300 Factory Payroll 28,900

(D)

Goods in Process Inventory 24,600 Factory Overhead 4,300 Accmied Wages Pavable 28,900

(E)

Goods in Process Inventory 28,900 Factory Payroll 28,900

(Multiple Choice)

4.9/5  (37)

(37)

Describe how materials flow through a job order cost accounting system and identify the key documents in the system.

(Essay)

4.8/5  (45)

(45)

RC Corp.uses a job order cost accounting system.During the month of April,the following events occurred:

A. Purchased raw materials on credit, $32,000.

B. Raw materials requisitioned: $25,800 as direct materials and $10,500 indirect materials.

C. Paid factory payroll for the month totaling $37,700 which includes $8,200 indirect labor.

D. Assigned the factory payroll to jobs and overhead.

Make the necessary journal entries to record the above transactions and events.

(Essay)

5.0/5  (41)

(41)

Prepare journal entries to record the following transactions and events for April using a job order cost accounting system.

(a)Purchased raw materials on credit,$69,000.

(b)Raw materials requisitioned: $26,000 direct and $5,400 indirect.

(c)Factory payroll totaled $46,000 (paid in cash),including $9,500 indirect labor.

(d)Paid other actual overhead costs totaling $14,500 cash.

(e)Applied overhead totaling $28,200.

(f) Finished and transferred jobs totaling $77,500.

(g) Jobs costing $58,800 were sold on credit for $103,000.

(Essay)

4.8/5  (36)

(36)

Samer Corp.uses a job order cost accounting system.The following is selected information pertaining to costs applied to jobs during the year:

Jobs still in process at the end of the year:

$167,000,which includes $65,000 direct labor costs.

Jobs finished and sold during the year:

$395,000,which includes $172,000 direct labor costs.

Jobs finished but unsold at end of the year:

$103,000,which includes $38,000 direct labor costs.

Samer Corp.'s predetermined overhead allocation rate is 60% of direct labor cost.At the end of the year,the company's records show that $189,000 of factory overhead has been incurred.

A. Determine the amount of overapplied or underapplied overhead.

B. Prepare the necessary journal entry to close the Factory Overhead account assuming that any remaining balance is not material.

(Essay)

4.7/5  (41)

(41)

Showing 61 - 80 of 155

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)