Exam 3: Adjusting Accounts and Preparing Financial Statements

Exam 1: Introducing Accounting in Business257 Questions

Exam 2: Analyzing and Recording Transactions216 Questions

Exam 3: Adjusting Accounts and Preparing Financial Statements236 Questions

Exam 4: Accounting for Merchandising Operations200 Questions

Exam 5: Inventories and Cost of Sales197 Questions

Exam 6: Cash and Internal Controls198 Questions

Exam 7: Accounts and Notes Receivable170 Questions

Exam 8: Long-Term Assets205 Questions

Exam 9: Current Liabilities191 Questions

Exam 10: Long-Term Liabilities189 Questions

Exam 11: Corporate Reporting and Analysis200 Questions

Exam 12: Reporting Cash Flows175 Questions

Exam 13: Analysis of Financial Statements185 Questions

Exam 14: Managerial Accounting Concepts and Principles198 Questions

Exam 15: Job Order Costing and Analysis155 Questions

Exam 16: Process Costing191 Questions

Exam 17: Activity-Based Costing and Analysis183 Questions

Exam 18: Cost-Volume-Profit Analysis181 Questions

Exam 19: Variable Costing and Performance Reporting178 Questions

Exam 20: Master Budgets and Performance Planning164 Questions

Exam 21: Flexible Budgets and Standard Costs179 Questions

Exam 22: Decentralization and Performance Measurement154 Questions

Exam 23: Relevant Costing for Managerial Decisions140 Questions

Exam 24: Capital Budgeting and Investment Analysis144 Questions

Exam 25: Accounting With Special Journals160 Questions

Exam 26: Time Value of Money58 Questions

Exam 27: Investments and International Operations181 Questions

Exam 28: Accounting for Partnerships126 Questions

Select questions type

Earned but uncollected revenues that are recorded during the adjusting process with a credit to a revenue account and a debit to an expense account are referred to as accrued expenses.

(True/False)

4.9/5  (37)

(37)

Below is Adventure Travel's adjusted trial balance as of the end of its annual accounting period:

ADVENTURE TRAVEL Adjusted Trial Balance December 31 Cash \ 25,000 Accounts receivable 15,000 Office supplies 4,300 Office equipment 29,600 Accumulated depreciation - Office equipment \ 5,000 Long-term notes payable 25,000 Common stock 10,000 Retained earnings 20,260 Dividends 1,000 Fees earned 75,000 Salaries expense 32,800 Rent expense 16,800 Depreciation expense - Office equipment 3,960 Advertising expense 4,000 Office supplies expense 2,800 Totals \ 135,260 \ 135,260

a.Prepare the necessary closing entries.

b.Prepare a post-closing trial balance.

(Essay)

4.8/5  (31)

(31)

What are the types of adjusting entries used for prepaid expenses,depreciation,and unearned revenues?

(Essay)

4.7/5  (37)

(37)

Describe the two alternate methods used to account for prepaid expenses.

(Essay)

4.9/5  (32)

(32)

The first five steps in the accounting cycle include analyzing transactions,journalizing,posting,preparing an unadjusted trial balance,and recording adjusting entries.

(True/False)

4.9/5  (31)

(31)

An expense account is normally closed by debiting Income Summary and crediting the expense account.

(True/False)

4.8/5  (44)

(44)

Based on the adjusted trial balance,prepare a statement of retained earnings for Martin Sky Taxi Services.

MARTIN SKY TAXI SERVICES Adjusted Trial Balance For the year ended December 31 Cash \ 28,000 Accounts receivable 14,200 Office supplies 1,700 Airplanes 100,000 Accumulated depreciation - Airplanes 45,000 Accounts payable 11,500 Common stock 25,000 Retained earnings 46,900 Dividends 40,000 Fees earned 150,000 Rent expense 13,000 Office supplies expense 2,000 Utilities expense 2,500 Depreciation Expense - Airplanes 15,000 Salary expense 50,000 Fuel expense 12,000 Totals \ 278,400 \ 278,400

(Essay)

4.8/5  (32)

(32)

Due to an oversight,a company made no adjusting entry for accrued and unpaid employee wages of $24,000 on December 31.This oversight would:

(Multiple Choice)

4.8/5  (44)

(44)

Compute profit margin ratio given the following information.

Cost of goods sold: $28,000

Net income: $21,400

Gross profit: $400,000

(Multiple Choice)

4.8/5  (34)

(34)

On January 1,Able Company purchased equipment costing $135,000 with an estimated salvage value of $10,500,and an estimated useful life of five years.Using the straight-line method,what is the amount that should be recorded as depreciation on December 31?

(Multiple Choice)

4.8/5  (31)

(31)

On December 31,the balance in the Prepaid Advertising account was $176,000,which is the remaining balance of a 12-month advertising campaign purchased on August 31 in the current year.Assuming the cost is spread equally over each month,how much did this advertising campaign cost in total?

(Multiple Choice)

4.7/5  (35)

(35)

Accrual accounting and the adjusting process rely on two principles: the ___________________ principle and the ________________________ principle.

(Short Answer)

4.9/5  (39)

(39)

Match the following definitions and terms

Correct Answer:

Premises:

Responses:

(Matching)

4.9/5  (37)

(37)

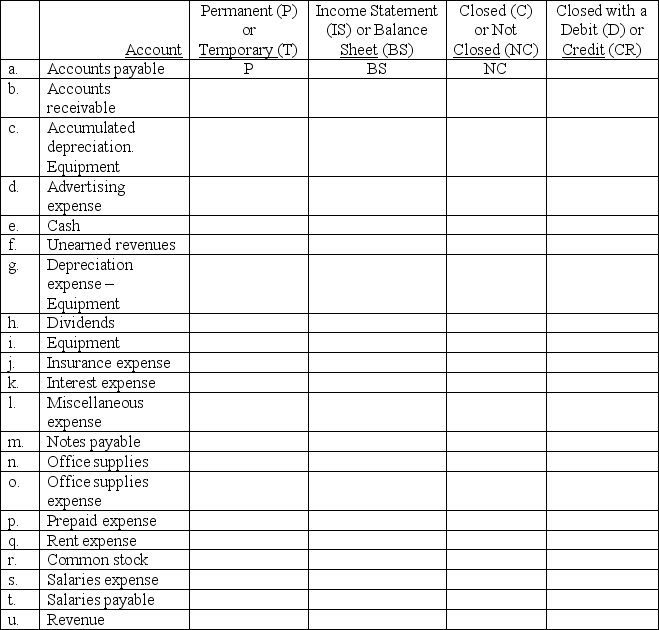

Listed below are a number of accounts.Use the table below to classify each account.Indicate whether it is a temporary or permanent account,whether it is included in the income statement or balance sheet,and if it is closed at the end of the accounting period and,if so,how it is closed.The first one is done as an example.

(Essay)

4.7/5  (45)

(45)

Failure to record depreciation expense will overstate the asset and understate the expense.

(True/False)

4.8/5  (40)

(40)

Statements that show the effects of proposed transactions as if the transactions had already occurred are called:

(Multiple Choice)

4.9/5  (35)

(35)

How is the profit margin calculated? Discuss its use in analyzing a company's performance.

(Essay)

4.8/5  (32)

(32)

All necessary numbers to prepare the income statement can be taken from the income statement columns of the work sheet,including the net income or net loss.

(True/False)

4.7/5  (41)

(41)

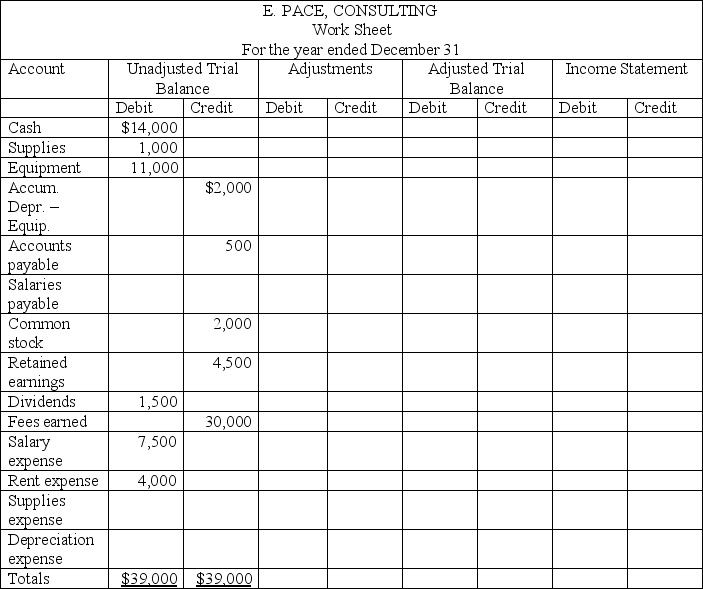

The adjusted trial balance of E.Pace,Consultant,is entered on the partial work sheet below.Complete the worksheet using the following information:

a.Salaries earned by employees that are Unpaid and unrecorded,$500.

b.An inventory of supplies showed $800 of Unused supplies still on hand.

c.Depreciation on equipment,$1,300.

(Essay)

4.8/5  (46)

(46)

Adjusting entries are made after the preparation of financial statements.

(True/False)

4.9/5  (39)

(39)

Showing 21 - 40 of 236

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)