Exam 9: Long-Term Assets: Fixed and Intangible

Exam 1: Introduction to Accounting and Business176 Questions

Exam 2: Analyzing Transactions210 Questions

Exam 3: The Adjusting Process183 Questions

Exam 4: Completing the Accounting Cycle168 Questions

Exam 5: Accounting for Merchandising Businesses205 Questions

Exam 6: Inventories161 Questions

Exam 7: Internal Control and Cash155 Questions

Exam 8: Receivables163 Questions

Exam 9: Long-Term Assets: Fixed and Intangible177 Questions

Exam 10: Liabilities: Current,installment Notes,and Contingencies188 Questions

Exam 11: Liabilities: Bonds Payable154 Questions

Exam 12: Corporations: Organization, stock Transactions, and Dividends193 Questions

Exam 13: Statement of Cash Flows175 Questions

Exam 14: Financial Statement Analysis189 Questions

Exam 15: Introduction to Managerial Accounting195 Questions

Exam 16: Job Order Costing185 Questions

Exam 17: Process Cost Systems180 Questions

Exam 18: Activity-Based Costing110 Questions

Exam 19: Cost-Volume-Profit Analysis421 Questions

Exam 20: Variable Costing for Management Analysis151 Questions

Exam 21: Budgeting181 Questions

Exam 22: Evaluating Variances From Standard Costs130 Questions

Exam 23: Evaluating Decentralized Operations175 Questions

Exam 24: Differential Analysis and Product Pricing173 Questions

Exam 25: Capital Investment Analysis186 Questions

Exam 26: Lean Manufacturing and Activity Analysis121 Questions

Select questions type

When a plant asset is traded for another similar asset,losses on the asset traded are not recognized.

(True/False)

4.8/5  (33)

(33)

A machine costing $57,000 with a 6-year life and $54,000 depreciable cost was purchased January 1.Compute the yearly depreciation expense using straight-line depreciation.

(Short Answer)

4.7/5  (32)

(32)

A leased asset will appear on the balance sheet as a long-term asset.

(True/False)

4.8/5  (36)

(36)

For income tax purposes,most companies use an accelerated deprecation method called double declining balance.

(True/False)

4.7/5  (42)

(42)

Comment on the validity of the following statements."As an asset loses its ability to provide services,cash needs to be set aside to replace it.Depreciation accomplishes this goal."

(Essay)

4.9/5  (37)

(37)

A machine with a cost of $75,000 has an estimated residual value of $5,000 and an estimated life of 4 years or 18,000 hours.What is the amount of depreciation for the second full year,using the double-declining-balance method?

(Multiple Choice)

5.0/5  (44)

(44)

During construction of a building,the cost of interest on a construction loan should be charged to an expense account.

(True/False)

4.9/5  (34)

(34)

Golden Sales has bought $135,000 in fixed assets on January 1st associated with sales equipment.The residual value of these assets is estimated at $10,000 at the end of their 4-year service life.Golden Sales managers want to evaluate the options of depreciation.

(a)Compute the annual straight-line depreciation and provide the sample depreciation journal entry to be posted

at the end of each of the years.

(b)Write the journal entries for each year of the service life for these assets using the double-declining balance

method.

(Essay)

4.9/5  (40)

(40)

Equipment was purchased on January 5,year 1,at a cost of $90,000.The equipment had an estimated useful life of 8 years and an estimated residual value of $8,000.

After using the equipment for 3 years,the useful life was revised to a total of 10 years and the residual value was reduced to $2,004.

Determine the straight-line depreciation expense for the Year 4 and following years.

(Essay)

4.9/5  (35)

(35)

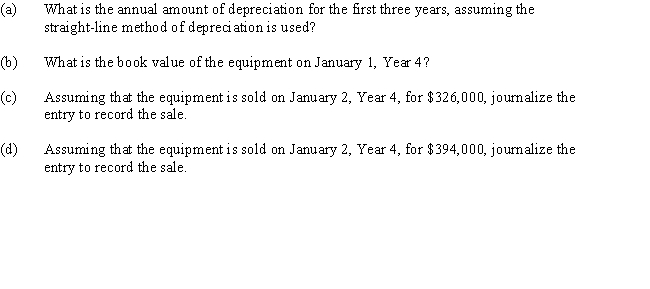

Equipment acquired on January 2,Year 1,at a cost of $525,000 has an estimated useful life of eight years and an estimated residual value of $45,000.

Required:

(Essay)

4.8/5  (36)

(36)

On April 15,Compton Co.paid $2,800 to upgrade a delivery truck and $125 for an oil change.Journalize the entries for the upgrade to delivery truck and oil change expenditures.

(Essay)

4.8/5  (37)

(37)

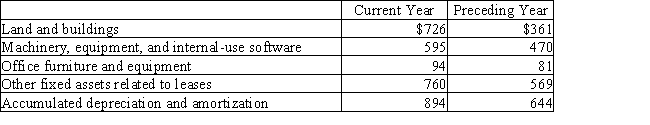

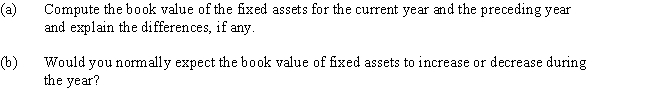

The following information was taken from a recent annual report of Harrison Company (in millions):

Required:

Required:

(Essay)

4.8/5  (32)

(32)

The book value of a fixed asset reported on the balance sheet represents its market value on that date.

(True/False)

4.9/5  (35)

(35)

On July 1,Hartford Construction purchases a bulldozer for $228,000.The equipment has a 9-year life with a residual value of $16,000.Hartford uses the units-of-output method of depreciation,and the bulldozer is expected to yield 26,500 operating hours.

(a)Calculate the depreciation expense per hour of operation.

(b)The bulldozer is operated 1,250 hours in the first year,2,755 hours in the second year,and 1,225 hours in the

third year of operations.Journalize the depreciation expense for each year.

(Essay)

4.9/5  (29)

(29)

The accumulated depletion of a natural resource is reported on the

(Multiple Choice)

4.9/5  (35)

(35)

The units-of-output depreciation method provides a good match of expenses against revenue.

(True/False)

4.8/5  (29)

(29)

When a company sells machinery at a price equal to its book value,this transaction would be recorded with an entry that would include the following:

(Multiple Choice)

4.7/5  (37)

(37)

All property,plant,and equipment assets are depreciated over time.

(True/False)

4.9/5  (46)

(46)

Showing 21 - 40 of 177

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)