Exam 9: Long-Term Assets: Fixed and Intangible

Exam 1: Introduction to Accounting and Business176 Questions

Exam 2: Analyzing Transactions210 Questions

Exam 3: The Adjusting Process183 Questions

Exam 4: Completing the Accounting Cycle168 Questions

Exam 5: Accounting for Merchandising Businesses205 Questions

Exam 6: Inventories161 Questions

Exam 7: Internal Control and Cash155 Questions

Exam 8: Receivables163 Questions

Exam 9: Long-Term Assets: Fixed and Intangible177 Questions

Exam 10: Liabilities: Current,installment Notes,and Contingencies188 Questions

Exam 11: Liabilities: Bonds Payable154 Questions

Exam 12: Corporations: Organization, stock Transactions, and Dividends193 Questions

Exam 13: Statement of Cash Flows175 Questions

Exam 14: Financial Statement Analysis189 Questions

Exam 15: Introduction to Managerial Accounting195 Questions

Exam 16: Job Order Costing185 Questions

Exam 17: Process Cost Systems180 Questions

Exam 18: Activity-Based Costing110 Questions

Exam 19: Cost-Volume-Profit Analysis421 Questions

Exam 20: Variable Costing for Management Analysis151 Questions

Exam 21: Budgeting181 Questions

Exam 22: Evaluating Variances From Standard Costs130 Questions

Exam 23: Evaluating Decentralized Operations175 Questions

Exam 24: Differential Analysis and Product Pricing173 Questions

Exam 25: Capital Investment Analysis186 Questions

Exam 26: Lean Manufacturing and Activity Analysis121 Questions

Select questions type

Once the useful life of a depreciable asset has been estimated and the amount to be depreciated each year has been determined,the amounts cannot be changed.

(True/False)

4.8/5  (33)

(33)

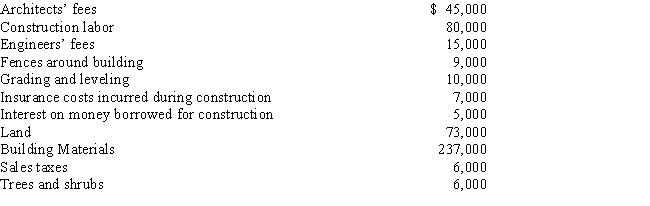

Eagle Country Club has acquired a lot to construct a clubhouse.Eagle had the following costs related to the construction:

Determine the cost of the club house to be reported on the balance sheet.

Determine the cost of the club house to be reported on the balance sheet.

(Essay)

4.8/5  (46)

(46)

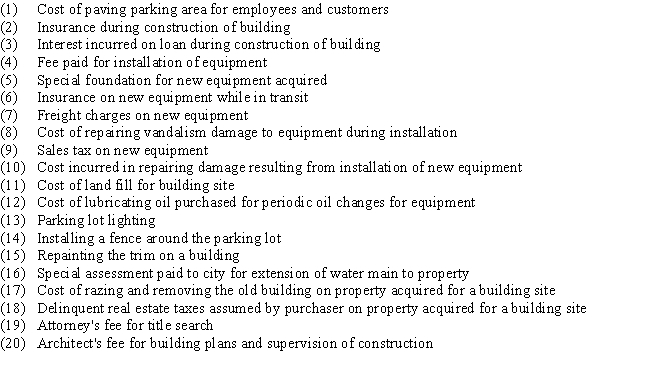

Identify each of the following expenditures as chargeable to (a)Land,(b)Land Improvements,(c)Buildings,(d)Machinery and Equipment,or (e)other account.

(Essay)

4.8/5  (35)

(35)

Both the initial cost of the asset and the accumulated depreciation will be taken off the books with the disposal of the asset.

(True/False)

4.9/5  (26)

(26)

If a fixed asset,such as a computer,were purchased on January 1 for $3,750 with an estimated life of 3 years and a salvage or residual value of $150,the journal entry for monthly expense under straight-line depreciation is

(Multiple Choice)

4.8/5  (36)

(36)

On December 31,Strike Company has decided to discard one of its batting cages.The equipment had an initial cost of $310,000 and has accumulated depreciation of $260,000.Depreciation has been recorded up to the end of the year.Which of the following will be included in the entry to record the disposal?

(Multiple Choice)

4.8/5  (38)

(38)

The difference between the balance in a fixed asset account and its related accumulated depreciation account is the asset's book value.

(True/False)

4.8/5  (37)

(37)

Williams Company acquired machinery on July 1,Year 1,at a cost of $130,000.The estimated useful life of the machinery was 10 years and the estimated residual value was $10,000.Williams uses the double-declining-balance method of depreciation.On October 1,Year 4,Williams sold the equipment for $75,000.

(a)Record the journal entry for the depreciation on this machinery for Year 4.

(b)Record the journal entry for the sale of the machinery.

(Essay)

4.8/5  (36)

(36)

Capital expenditures are costs that improve a fixed asset or extend its useful life.

(True/False)

4.8/5  (34)

(34)

The cost of computer equipment does not include the consultant's fee to supervise installation of the equipment.

(True/False)

4.8/5  (44)

(44)

Functional depreciation occurs when a fixed asset is no longer able to provide services at the level for which it was intended.

(True/False)

4.8/5  (31)

(31)

When land is purchased to construct a new building,the cost of removing any structures on the land should be charged to the building account.

(True/False)

4.7/5  (44)

(44)

The acquisition costs of property,plant,and equipment should include all normal,reasonable and necessary costs to get the asset in place and ready for use.

(True/False)

4.7/5  (29)

(29)

Machinery was purchased on January 1 for $51,000.The machinery has an estimated life of 7 years and an estimated salvage value of $9,000.Double-declining-balance depreciation for the second year would be (round calculations to the nearest dollar):

(Multiple Choice)

4.7/5  (38)

(38)

Which intangible assets are amortized over their useful life?

(Multiple Choice)

4.7/5  (42)

(42)

The cost of a patent with a remaining legal life of 10 years and an estimated useful life of 7 years is amortized over 10 years.

(True/False)

4.8/5  (39)

(39)

Residual value is not incorporated in the initial calculations for double-declining-balance depreciation.

(True/False)

4.7/5  (29)

(29)

On June 1,Michael Company purchased equipment at a cost of $120,000 that has a depreciable cost of $90,000 and an estimated useful life of 3 years or 30,000 hours.

Using straight-line depreciation,calculate depreciation expense for the second year.

(Multiple Choice)

4.8/5  (41)

(41)

The process of transferring the cost of an asset to an expense account is called all of the following except

(Multiple Choice)

4.8/5  (43)

(43)

Showing 41 - 60 of 177

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)