Exam 6: Inventories

Exam 1: Introduction to Accounting and Business176 Questions

Exam 2: Analyzing Transactions210 Questions

Exam 3: The Adjusting Process183 Questions

Exam 4: Completing the Accounting Cycle168 Questions

Exam 5: Accounting for Merchandising Businesses205 Questions

Exam 6: Inventories161 Questions

Exam 7: Internal Control and Cash155 Questions

Exam 8: Receivables163 Questions

Exam 9: Long-Term Assets: Fixed and Intangible177 Questions

Exam 10: Liabilities: Current,installment Notes,and Contingencies188 Questions

Exam 11: Liabilities: Bonds Payable154 Questions

Exam 12: Corporations: Organization, stock Transactions, and Dividends193 Questions

Exam 13: Statement of Cash Flows175 Questions

Exam 14: Financial Statement Analysis189 Questions

Exam 15: Introduction to Managerial Accounting195 Questions

Exam 16: Job Order Costing185 Questions

Exam 17: Process Cost Systems180 Questions

Exam 18: Activity-Based Costing110 Questions

Exam 19: Cost-Volume-Profit Analysis421 Questions

Exam 20: Variable Costing for Management Analysis151 Questions

Exam 21: Budgeting181 Questions

Exam 22: Evaluating Variances From Standard Costs130 Questions

Exam 23: Evaluating Decentralized Operations175 Questions

Exam 24: Differential Analysis and Product Pricing173 Questions

Exam 25: Capital Investment Analysis186 Questions

Exam 26: Lean Manufacturing and Activity Analysis121 Questions

Select questions type

During periods of decreasing costs,the use of the LIFO method of costing inventory will result in a lower amount of net income than would result from the use of the FIFO method.

(True/False)

4.8/5  (34)

(34)

Based upon the following data,estimate the cost of ending inventory using the gross profit method.

(Essay)

4.9/5  (43)

(43)

Based on the following data,calculate the estimated cost of the inventory on March 31 using the retail method.

(Essay)

4.8/5  (45)

(45)

The use of the lower-of-cost-or-market method of inventory valuation increases net income for the period in which the inventory replacement price declined.

(True/False)

4.8/5  (41)

(41)

Inventory errors,if not discovered,will self-correct within two years.

(True/False)

4.7/5  (40)

(40)

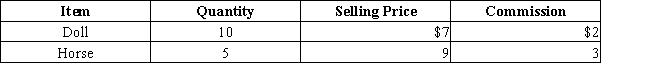

Determine the total value of the merchandise using net realizable value.

(Essay)

4.8/5  (41)

(41)

During times of rising prices,which of the following is not an accurate statement?

(Multiple Choice)

4.8/5  (41)

(41)

Ending inventory is made up of the oldest purchases when a company uses

(Multiple Choice)

4.9/5  (36)

(36)

It's not unusual for large companies to use different inventory costing methods for different segments of its inventory.

(True/False)

4.9/5  (41)

(41)

When merchandise sold is assumed to be in the order in which the purchases were made,the company is using

(Multiple Choice)

4.9/5  (34)

(34)

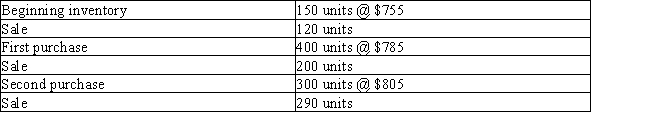

Beginning inventory,purchases,and sales for an inventory item are as follows:

The firm uses the perpetual inventory system and there are 240 units of the item on hand at the end of the year.What is the total cost of ending inventory according to LIFO?

The firm uses the perpetual inventory system and there are 240 units of the item on hand at the end of the year.What is the total cost of ending inventory according to LIFO?

(Essay)

4.9/5  (36)

(36)

The inventory costing method that reports the most current prices in ending inventory is

(Multiple Choice)

4.9/5  (39)

(39)

What is the amount of the inventory at the end of the year rounded to nearest dollar using the average cost method?

(Multiple Choice)

4.9/5  (41)

(41)

When using a perpetual inventory system,the journal entry to record the cost of goods sold is:

(Multiple Choice)

4.7/5  (38)

(38)

During periods of rapidly rising costs,the use of the LIFO method results in illusory or inventory profits.

(True/False)

4.8/5  (43)

(43)

A purchase order establishes an initial record of the receipt of the inventory.

(True/False)

4.8/5  (42)

(42)

Which of the following methods is appropriate for a business whose inventory consists of a relatively small number of unique,high-cost items?

(Multiple Choice)

4.9/5  (36)

(36)

A business using the retail method of inventory costing determines that inventory at retail is $2,300,000.If the ratio of cost to retail price is 55%,what is the amount of inventory to be reported on the financial statements?

(Short Answer)

4.9/5  (40)

(40)

Inventory turnover measures the length of time it takes to acquire,sell,and replace the inventory.

(True/False)

4.8/5  (36)

(36)

Showing 41 - 60 of 161

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)