Exam 6: Inventories

Exam 1: Introduction to Accounting and Business176 Questions

Exam 2: Analyzing Transactions210 Questions

Exam 3: The Adjusting Process183 Questions

Exam 4: Completing the Accounting Cycle168 Questions

Exam 5: Accounting for Merchandising Businesses205 Questions

Exam 6: Inventories161 Questions

Exam 7: Internal Control and Cash155 Questions

Exam 8: Receivables163 Questions

Exam 9: Long-Term Assets: Fixed and Intangible177 Questions

Exam 10: Liabilities: Current,installment Notes,and Contingencies188 Questions

Exam 11: Liabilities: Bonds Payable154 Questions

Exam 12: Corporations: Organization, stock Transactions, and Dividends193 Questions

Exam 13: Statement of Cash Flows175 Questions

Exam 14: Financial Statement Analysis189 Questions

Exam 15: Introduction to Managerial Accounting195 Questions

Exam 16: Job Order Costing185 Questions

Exam 17: Process Cost Systems180 Questions

Exam 18: Activity-Based Costing110 Questions

Exam 19: Cost-Volume-Profit Analysis421 Questions

Exam 20: Variable Costing for Management Analysis151 Questions

Exam 21: Budgeting181 Questions

Exam 22: Evaluating Variances From Standard Costs130 Questions

Exam 23: Evaluating Decentralized Operations175 Questions

Exam 24: Differential Analysis and Product Pricing173 Questions

Exam 25: Capital Investment Analysis186 Questions

Exam 26: Lean Manufacturing and Activity Analysis121 Questions

Select questions type

Use of the retail inventory method requires taking a physical count of inventory.

(True/False)

4.9/5  (40)

(40)

If the estimated rate of gross profit is 30%,what is the estimated cost of the inventory on September 30,based on the following data?

(Multiple Choice)

4.9/5  (38)

(38)

Which of the following is used to analyze the efficiency and effectiveness of inventory management?

(Multiple Choice)

4.8/5  (45)

(45)

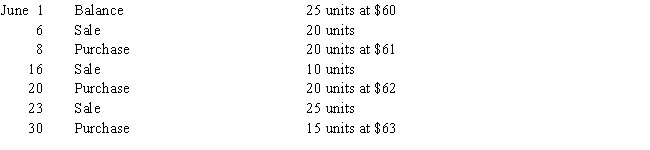

The following data regarding purchases and sales of a commodity were taken from the related perpetual inventory account:

(Essay)

4.8/5  (30)

(30)

What is the amount of cost of goods sold for the year according to the FIFO method?

(Multiple Choice)

4.9/5  (37)

(37)

The inventory method that assigns the most recent costs to cost of goods sold is

(Multiple Choice)

4.8/5  (35)

(35)

The firm uses the periodic system,and there are 20 units of the commodity on hand at the end of the year.What is the amount of inventory at the end of the year according to the FIFO method?

(Multiple Choice)

4.7/5  (36)

(36)

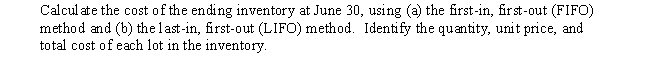

The units of Product Green-2 available for sale during the year were as follows:

There are 17 units of the product in the physical inventory at September 30.The periodic inventory system is used.Determine the cost of goods sold by (a)FIFO,(b)LIFO,and (c)average cost methods.

There are 17 units of the product in the physical inventory at September 30.The periodic inventory system is used.Determine the cost of goods sold by (a)FIFO,(b)LIFO,and (c)average cost methods.

(Essay)

4.8/5  (31)

(31)

Under the periodic inventory system,the inventory account continuously discloses the amount of inventory on hand.

(True/False)

4.9/5  (37)

(37)

The method of estimating inventory that uses records of the selling prices of the merchandise is called

(Multiple Choice)

4.8/5  (29)

(29)

Stevens Company started the year with an inventory cost of $145,000.During the month of January,Stevens purchased inventory that cost $53,000.January sales totaled $140,000.Estimated gross profit is 35%.The estimated ending inventory as of January 31 is

(Multiple Choice)

4.9/5  (31)

(31)

Garrison Company uses the retail method of inventory costing.It started the year with an inventory that had a retail cost of $45,000.During the year,Garrison purchased an inventory with a retail sales value of $300,000.After performing a physical inventory,Garrison calculated the inventory at retail to be $80,000.The markup is 100% of cost.Determine the ending inventory at its estimated cost.

(Multiple Choice)

4.7/5  (41)

(41)

Inventory at the end of the year is overstated.Which of the following statements correctly states the effect of the error?

(Multiple Choice)

4.7/5  (37)

(37)

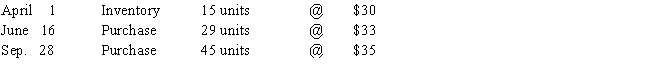

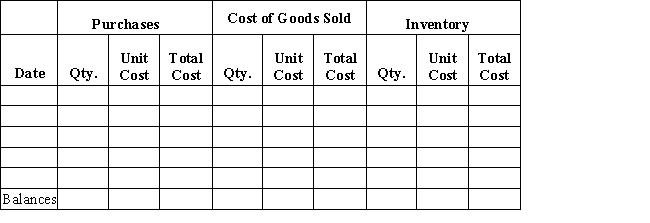

Beginning inventory,purchases,and sales data for widgets are as follows:

Complete the inventory cost card assuming the business maintains a perpetual inventory system and calculates the cost of goods sold and ending inventory using LIFO.

Complete the inventory cost card assuming the business maintains a perpetual inventory system and calculates the cost of goods sold and ending inventory using LIFO.

(Essay)

4.9/5  (36)

(36)

If Addison uses LIFO,the cost of the ending inventory on September 30 is

(Multiple Choice)

4.8/5  (32)

(32)

Assuming that the company uses the perpetual inventory system,determine the ending inventory value for the month of May using the FIFO inventory cost method.

(Multiple Choice)

4.8/5  (38)

(38)

The inventory costing method that reports the earliest costs in ending inventory is

(Multiple Choice)

4.8/5  (42)

(42)

The lower of cost or market is a method of inventory valuation.

(True/False)

4.8/5  (30)

(30)

Showing 81 - 100 of 161

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)