Exam 11: Performance Evaluation and the Balanced Scorecard

Exam 1: Introduction to Managerial Accounting201 Questions

Exam 2: Building Blocks of Managerial Accounting265 Questions

Exam 3: Cost Behaviour374 Questions

Exam 4: Cost-Volume-Profit Analysis272 Questions

Exam 5: Job Costing353 Questions

Exam 6: Process Costing288 Questions

Exam 7: Activity Based Costing184 Questions

Exam 8: Short-Term Business Decisions271 Questions

Exam 9: The Master Budget and Responsibility Accounting228 Questions

Exam 10: Flexible Budgets and Standard Costs260 Questions

Exam 11: Performance Evaluation and the Balanced Scorecard195 Questions

Exam 12: Capital Investment Decisions and the Time Value of Money205 Questions

Select questions type

The manager of the Midwest sales region at Pace Food would be in charge of a(n)

(Multiple Choice)

4.7/5  (36)

(36)

Use the information below to answer the following question(s):

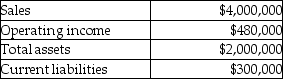

Assume the Cell Phone Division of the First Electronics Corporation had the following results last year (in thousands). Management's target rate of return is 10% and the weighted average cost of capital is 7%. Its effective tax rate is 30%.

-What is the First Electronics Corporation cell phone division's Residual Income (RI)?

-What is the First Electronics Corporation cell phone division's Residual Income (RI)?

(Multiple Choice)

4.7/5  (36)

(36)

Cash flows from operations and gross margin growth would be examples of the

(Multiple Choice)

4.9/5  (45)

(45)

Rickett Company has operating income of $180,000. Its return on investment (ROI) is 30%, while its target rate of return is 12%. The total assets of Rickett Company would be closest to

(Multiple Choice)

4.9/5  (42)

(42)

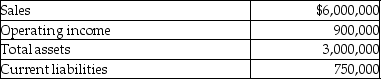

Data on three unrelated companies are given in the following table.

Fill in the missing information.

Fill in the missing information.

(Essay)

4.8/5  (48)

(48)

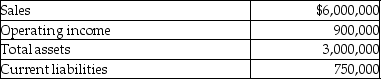

Use the information below to answer the following question(s):

The Tandem division of the Great Adventures Cycles Company had the following results last year (in thousands).

Management's target rate of return is 10% and the weighted average cost of capital is 8%. Tandem's effective tax rate is 35%.

-What is the Tandem division's asset turnover?

Management's target rate of return is 10% and the weighted average cost of capital is 8%. Tandem's effective tax rate is 35%.

-What is the Tandem division's asset turnover?

(Multiple Choice)

4.8/5  (30)

(30)

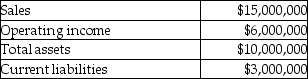

The Hotel Division of Treasure Island Corporation had the following results last year.

Management's target rate of return is 14% and the weighted average cost of capital is 10%. Its effective tax rate is 35%.

Required:

1. Calculate the return on investment (ROI).

2. Calculate the residual income.

3. Calculate the Economic Value Added (EVA).

Management's target rate of return is 14% and the weighted average cost of capital is 10%. Its effective tax rate is 35%.

Required:

1. Calculate the return on investment (ROI).

2. Calculate the residual income.

3. Calculate the Economic Value Added (EVA).

(Essay)

4.9/5  (40)

(40)

The local McDonald's restaurant is likely to be considered to be an investment centre.

(True/False)

4.8/5  (35)

(35)

Revenue centre performance reports often highlight both the flexible budget variance and the sales volume variance.

(True/False)

5.0/5  (31)

(31)

Measures of the balanced scorecard's internal business process perspective include all of the following EXCEPT

(Multiple Choice)

4.9/5  (35)

(35)

A company's flexible budget for 93,000 units of production showed sales of $300,000; variable costs of $150,000; and fixed costs of $90,000. What net operating income would you expect the company to earn if it produces and sells 98,000 units? (Assume 98,000 units is in the relevant range.)

(Essay)

4.9/5  (38)

(38)

Use the information below to answer the following question(s):

Assume the Cell Phone Division of the First Electronics Corporation had the following results last year (in thousands). Management's target rate of return is 10% and the weighted average cost of capital is 7%. Its effective tax rate is 30%.

-What is the First Electronics Corporation cell phone division's Return on Investment (ROI)?

-What is the First Electronics Corporation cell phone division's Return on Investment (ROI)?

(Multiple Choice)

4.9/5  (41)

(41)

Including nonproductive assets in the ROI calculation unfairly increases the reported rate of return.

(True/False)

4.9/5  (36)

(36)

Decentralization allows top management to hire workers with expert knowledge for each business unit.

(True/False)

4.9/5  (33)

(33)

Companies evaluate investment centres the way they evaluate profit centres.

(True/False)

4.8/5  (38)

(38)

Economic Value Added (EVA) is a special type of Return on Investment (ROI) calculation.

(True/False)

4.9/5  (45)

(45)

Which of the following aspects of a performance evaluation system best describes when a company's actual results are compared to the results of competitors?

(Multiple Choice)

4.9/5  (38)

(38)

Which of the following aspects of a performance evaluation system best describes when the company's actual results are compared to industry standards?

(Multiple Choice)

4.8/5  (40)

(40)

Which of the following aspects of a performance evaluation system best describes when targets are compared to actual results?

(Multiple Choice)

4.9/5  (38)

(38)

Showing 161 - 180 of 195

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)