Exam 9: Inventory Costing and Capacity Analysis

Exam 1: The Manager and Management Accounting195 Questions

Exam 2: An Introduction to Cost Terms and Purposes224 Questions

Exam 3: Cost-Volume-Profit Analysis209 Questions

Exam 4: Job Costing203 Questions

Exam 5: Activity-Based Costing and Activity-Based Management176 Questions

Exam 6: Master Budget and Responsibility Accounting226 Questions

Exam 7: Flexible Budgets,direct-Cost Variances,and Management Control181 Questions

Exam 8: Flexible Budgets, overhead Cost Variances, and Management Control171 Questions

Exam 9: Inventory Costing and Capacity Analysis207 Questions

Exam 10: Determining How Costs Behave192 Questions

Exam 11: Decision Making and Relevant Information218 Questions

Exam 12: Strategy,balanced Scorecard,and Strategic Profitability Analysis172 Questions

Exam 13: Pricing Decisions and Cost Management209 Questions

Exam 14: Cost Allocation, customer-Profitability Analysis, and Sales-Variance Analysis167 Questions

Exam 15: Allocation of Support-Department Costs, common Costs, and Revenues150 Questions

Exam 16: Cost Allocation: Joint Products and Byproducts150 Questions

Exam 17: Process Costing149 Questions

Exam 18: Spoilage, rework, and Scrap153 Questions

Exam 19: Balanced Scorecard: Quality and Time150 Questions

Exam 20: Inventory Management, just-In-Time, and Simplified Costing Methods150 Questions

Exam 21: Capital Budgeting and Cost Analysis151 Questions

Exam 22: Management Control Systems, transfer Pricing, and Multinational Considerations150 Questions

Exam 23: Performance Measurement, compensation, and Multinational Considerations150 Questions

Select questions type

Given a constant contribution margin per unit and constant fixed costs,the period-to-period change in operating income under variable costing is driven solely by ________.

(Multiple Choice)

4.8/5  (40)

(40)

When production is less than sales,operating income will be the same regardless of whether variable cost or absorption costing is used.

(True/False)

4.8/5  (33)

(33)

Throughput is a variation of which of the following systems?

(Multiple Choice)

4.9/5  (35)

(35)

Jupiter Corporation incurred fixed manufacturing costs of $19,000 during 2017.Other information for 2017 includes:

The budgeted denominator level is 2,300 units.

Units produced total 2,600 units.

Units sold total 1,700 units.

Variable cost per unit is

Beginning inventory is zero.

The fixed manufacturing cost rate is based on the budgeted denominator level.

Under absorption costing,the production-volume variance is ________.(Round any intermediary calculations to the nearest cent and your final answer to the nearest dollar. )

(Multiple Choice)

4.9/5  (33)

(33)

Venus Corporation incurred fixed manufacturing costs of $6,300 during 2017.Other information for 2017 includes:

The budgeted denominator level is 1,600 units.

Units produced total 760 units.

Units sold total 640 units.

Beginning inventory was zero.

The company uses variable costing and the fixed manufacturing cost rate is based on the budgeted denominator level.Manufacturing variances are closed to cost of goods sold.

Fixed manufacturing costs included in ending inventory total ________.

(Multiple Choice)

5.0/5  (28)

(28)

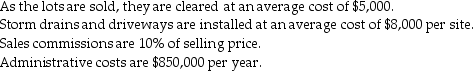

Johnson Realty bought a 2,000-acre island for $10,000,000 and divided it into 200 equal size lots.

The average selling price was $160,000 per lot during 2017 when 50 lots were sold.

During 2018,the company bought another 2,000-acre island and developed it exactly the same way.Lot sales in 2018 totaled 300 with an average selling price of $160,000.All costs were the same as in 2017.

Required:

Prepare income statements for both years using both absorption and variable costing methods.

The average selling price was $160,000 per lot during 2017 when 50 lots were sold.

During 2018,the company bought another 2,000-acre island and developed it exactly the same way.Lot sales in 2018 totaled 300 with an average selling price of $160,000.All costs were the same as in 2017.

Required:

Prepare income statements for both years using both absorption and variable costing methods.

(Essay)

4.8/5  (34)

(34)

________ is based on the level of capacity utilization that satisfies average customer demand over periods generally longer than one year.

(Multiple Choice)

4.8/5  (46)

(46)

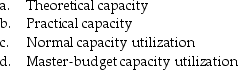

Match each of the following items with one or more of the denominator-level capacity concepts by putting the appropriate letter(s)by each item:

1.Reduces theoretical capacity by considering unavoidable operating interruptions

2.Producing at full efficiency all the time

3.Measures capacity levels in terms of demand

4.Level of capacity utilization that satisfies average customer demand over a period

5.Does not allow for plant maintenance

6.Engineering and human resource factors are important when estimating capacity

7.Level of capacity utilization that managers expect for the current budget period

8.Ideal goal of capacity utilization

9.Takes into account seasonal,cyclical,and trend factors

10.Measures capacity levels in terms of what a plant can supply

1.Reduces theoretical capacity by considering unavoidable operating interruptions

2.Producing at full efficiency all the time

3.Measures capacity levels in terms of demand

4.Level of capacity utilization that satisfies average customer demand over a period

5.Does not allow for plant maintenance

6.Engineering and human resource factors are important when estimating capacity

7.Level of capacity utilization that managers expect for the current budget period

8.Ideal goal of capacity utilization

9.Takes into account seasonal,cyclical,and trend factors

10.Measures capacity levels in terms of what a plant can supply

(Essay)

4.8/5  (41)

(41)

________ is a method of inventory costing in which all variable manufacturing costs and all fixed manufacturing costs are included as inventoriable costs.

(Multiple Choice)

4.8/5  (40)

(40)

To discourage producing for inventory,management can ________.

(Multiple Choice)

5.0/5  (35)

(35)

Ways to "produce for inventory" that result in increasing operating income include ________.

(Multiple Choice)

4.8/5  (36)

(36)

Kennywood Inc. ,a manufacturing firm,is able to produce 1,000 pairs of pants per hour,at maximum efficiency.There are three eight-hour shifts each day.Due to unavoidable operating interruptions,production averages 800 units per hour.The plant actually operates only 28 days per month.Based on the current budget,Kennywood estimates that it will be able to sell only 501,000 units due to the entry of a competitor with aggressive marketing capabilities.But the demand is unlikely to be affected in future and will be around 519,000.Assume the month has 30 days.

What is the practical capacity for the month?

(Multiple Choice)

4.8/5  (34)

(34)

Jupiter Corporation incurred fixed manufacturing costs of $18,000 during 2017.Other information for 2017 includes:

The budgeted denominator level is 2,400 units.

Units produced total 2,700 units.

Units sold total 1,900 units.

Variable cost per unit is

Beginning inventory is zero.

The fixed manufacturing cost rate is based on the budgeted denominator level.

Under absorption costing,total manufacturing costs expensed on the income statement (excluding adjustments for variances)total ________.(Round any intermediary calculations to the nearest cent and your final answer to the nearest dollar. )

(Multiple Choice)

4.9/5  (29)

(29)

Explain the three alternative approaches to dispose of the production-volume variance.

(Essay)

4.8/5  (36)

(36)

Under both variable and absorption costing,research and development costs are period costs.

(True/False)

4.9/5  (29)

(29)

Ms.Sophia Jones,the company president,has heard that there are multiple breakeven points for every product.She does not believe this and has asked you to provide the evidence of such a possibility.Some information about the company for 2017 is as follows:

Total fixed manufacturing overhead \ 184,000 Total other fixed expenses \ 205,000 Total variable manufacturing expenses \ 240,000 Total other variable expenses \ 280,000 Units produced 70,000 units Budgeted production 70,000 units Units sold 50,000 units Selling price \ 40

What are breakeven sales in units using absorption costing if the production units are actually 50,000? (Round any intermediary calculations to the nearest cent and your final answer up to the next whole unit. )

(Multiple Choice)

4.9/5  (27)

(27)

Absorption costing is the required inventory method for external financial reporting in most countries.

(True/False)

4.8/5  (39)

(39)

Jean Peck's Furniture manufactures tables for hospitality sector.It takes only bulk orders and each table is sold for $500 after negotiations.In the month of January,it manufactures 3,000 tables and sells 2,600 tables.Actual fixed costs are the same as the amount of fixed costs budgeted for the month.

The following information is provided for the month of January:

Variable manufarturing costs \ 140 per unit Fixed manufacturing costs \ 90,000 per month Fixed Administrative expenses \ 30,000 per month

At the end of the month Jean Peck's Furniture has an ending inventory of finished goods of 400 units.The company also incurs a sales commission of $13 per unit.

What is the operating income when using absorption costing? (Round any intermediary calculations to the nearest cent and your final answer to the nearest dollar. )

(Multiple Choice)

4.9/5  (36)

(36)

________ is a method of inventory costing in which only variable manufacturing costs are included as inventoriable costs.

(Multiple Choice)

4.8/5  (33)

(33)

Showing 41 - 60 of 207

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)