Exam 9: Inventory Costing and Capacity Analysis

Exam 1: The Manager and Management Accounting195 Questions

Exam 2: An Introduction to Cost Terms and Purposes224 Questions

Exam 3: Cost-Volume-Profit Analysis209 Questions

Exam 4: Job Costing203 Questions

Exam 5: Activity-Based Costing and Activity-Based Management176 Questions

Exam 6: Master Budget and Responsibility Accounting226 Questions

Exam 7: Flexible Budgets,direct-Cost Variances,and Management Control181 Questions

Exam 8: Flexible Budgets, overhead Cost Variances, and Management Control171 Questions

Exam 9: Inventory Costing and Capacity Analysis207 Questions

Exam 10: Determining How Costs Behave192 Questions

Exam 11: Decision Making and Relevant Information218 Questions

Exam 12: Strategy,balanced Scorecard,and Strategic Profitability Analysis172 Questions

Exam 13: Pricing Decisions and Cost Management209 Questions

Exam 14: Cost Allocation, customer-Profitability Analysis, and Sales-Variance Analysis167 Questions

Exam 15: Allocation of Support-Department Costs, common Costs, and Revenues150 Questions

Exam 16: Cost Allocation: Joint Products and Byproducts150 Questions

Exam 17: Process Costing149 Questions

Exam 18: Spoilage, rework, and Scrap153 Questions

Exam 19: Balanced Scorecard: Quality and Time150 Questions

Exam 20: Inventory Management, just-In-Time, and Simplified Costing Methods150 Questions

Exam 21: Capital Budgeting and Cost Analysis151 Questions

Exam 22: Management Control Systems, transfer Pricing, and Multinational Considerations150 Questions

Exam 23: Performance Measurement, compensation, and Multinational Considerations150 Questions

Select questions type

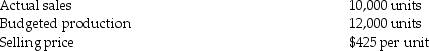

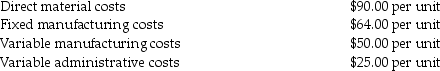

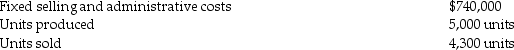

Universal Specialty Group produces a sports theme chair.The following information has been provided by management:

Required:

a.What is the cost per statue if absorption costing is used?

b.What is the cost per statue if "super-variable costing" is used?

c.What is the total throughput contribution?

Required:

a.What is the cost per statue if absorption costing is used?

b.What is the cost per statue if "super-variable costing" is used?

c.What is the total throughput contribution?

(Essay)

4.7/5  (37)

(37)

AAA Manufacturing Inc,makes a product with the following costs per unit:

Direct materials $180

Direct labor $20

Manufacturing overhead (variable)$30

Manufacturing overhead (fixed)$130

Marketing costs $75

What would be the inventoriable cost per unit under variable costing and what would it be under absorption costing?

(Multiple Choice)

4.9/5  (37)

(37)

Which of the following would be subtracted from sales while calculating contribution margin in a variable costing format of an operating income statement?

(Multiple Choice)

4.7/5  (32)

(32)

Variable costing regards fixed manufacturing overhead as a(n)________.

(Multiple Choice)

4.9/5  (36)

(36)

Many companies have switched from absorption costing to variable costing for internal reporting ________.

(Multiple Choice)

4.8/5  (51)

(51)

It is most difficult to estimate ________ because of the need to predict demand for the next few years.

(Multiple Choice)

4.8/5  (34)

(34)

Absorption costing enables managers to increase operating income by increasing the unit level of sales,as well as by producing more units.

(True/False)

4.9/5  (37)

(37)

Normal capacity utilization is the level of capacity that satisfies average customer demand over a period and takes into account seasonal,cyclical,and trend factors.

(True/False)

4.9/5  (39)

(39)

Which of the following assumes that capacity will be decreased because of slowdowns due to plant maintenance or other interruptions of the production lines?

(Multiple Choice)

4.8/5  (31)

(31)

Using master budget capacity as the denominator level sets the cost of capacity at the cost of supplying the capacity,regardless of the demand for the capacity.

(True/False)

4.8/5  (38)

(38)

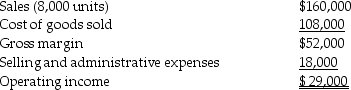

Aspen Popular Company prepared the following absorption-costing income statement for the year ended May 31,2017.

Additional information follows:

Selling and administrative expenses include $1.50 of variable cost per unit sold.There was no beginning inventory,and 8,750 units were produced.Variable manufacturing costs were $11 per unit.Actual fixed costs were equal to budgeted fixed costs

Required:

Prepare a variable-costing income statement for the same period.

Additional information follows:

Selling and administrative expenses include $1.50 of variable cost per unit sold.There was no beginning inventory,and 8,750 units were produced.Variable manufacturing costs were $11 per unit.Actual fixed costs were equal to budgeted fixed costs

Required:

Prepare a variable-costing income statement for the same period.

(Essay)

4.8/5  (39)

(39)

Beginning inventory + cost of goods manufactured = Cost of goods sold + Ending inventory.

(True/False)

4.9/5  (35)

(35)

Under variable costing,lease charges paid on the factory building is an inventoriable cost.

(True/False)

5.0/5  (29)

(29)

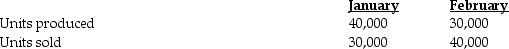

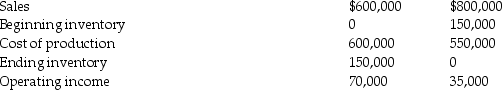

The manager of the manufacturing division of Iowa Windows does not understand why income went down when sales went up.Some of the information he has selected for evaluation include:

The division operated at normal capacity during January.

Variable manufacturing cost per unit was $5,and the fixed costs were $400,000.

Selling and administrative expenses were all fixed.

Required:

Explain the profit differences.How would variable costing income statements help the manager understand the division's operating income?

The division operated at normal capacity during January.

Variable manufacturing cost per unit was $5,and the fixed costs were $400,000.

Selling and administrative expenses were all fixed.

Required:

Explain the profit differences.How would variable costing income statements help the manager understand the division's operating income?

(Essay)

4.9/5  (38)

(38)

The breakeven points are the same under both variable costing and absorption costing.

(True/False)

4.8/5  (36)

(36)

Raul Technologies is concerned that increased sales did not result in increased profits for 2018.Both variable unit and total fixed manufacturing costs for 2017 and 2018 remained constant at $35 and $3,500,000,respectively.

In 2017,the company produced 100,000 units and sold 80,000 units at a price of $87.50 per unit.There was no beginning inventory in 2017.In 2018,the company made 70,000 units and sold 90,000 units at a price of $87.50.Selling and administrative expenses were all fixed at $350,000 each year.

Required:

a.Prepare income statements for each year using absorption costing.

b.Prepare income statements for each year using variable costing.

c.Explain why the income was different each year using the two methods.Show computations.

(Essay)

4.9/5  (37)

(37)

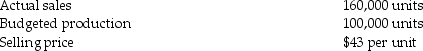

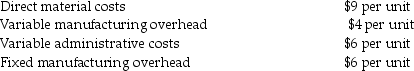

Answer the following question using the information below:

Jason Novelty Company produces a specialty item.Management has provided the following information:

What is the cost per unit if throughput costing is used?

What is the cost per unit if throughput costing is used?

(Multiple Choice)

4.8/5  (36)

(36)

Practical capacity rather than master-budget volume is a better way to price product and avoid downward demand spiral.

(True/False)

4.9/5  (29)

(29)

The following information pertains to Stone Wall Corporation:

Beginning fixed manufacturing overhead in inventory \7 0,000 Ending fixed manufacturing overhead in inventory 49,000 Beginning variable manufacturing overhead in inventory \ 34,000 Ending variable manufacturing overhead in inventory 18,000

What is the difference between operating incomes under absorption costing and variable costing?

What is the difference between operating incomes under absorption costing and variable costing?

(Multiple Choice)

4.9/5  (35)

(35)

Showing 181 - 200 of 207

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)