Exam 9: Inventory Costing and Capacity Analysis

Exam 1: The Manager and Management Accounting195 Questions

Exam 2: An Introduction to Cost Terms and Purposes224 Questions

Exam 3: Cost-Volume-Profit Analysis209 Questions

Exam 4: Job Costing203 Questions

Exam 5: Activity-Based Costing and Activity-Based Management176 Questions

Exam 6: Master Budget and Responsibility Accounting226 Questions

Exam 7: Flexible Budgets,direct-Cost Variances,and Management Control181 Questions

Exam 8: Flexible Budgets, overhead Cost Variances, and Management Control171 Questions

Exam 9: Inventory Costing and Capacity Analysis207 Questions

Exam 10: Determining How Costs Behave192 Questions

Exam 11: Decision Making and Relevant Information218 Questions

Exam 12: Strategy,balanced Scorecard,and Strategic Profitability Analysis172 Questions

Exam 13: Pricing Decisions and Cost Management209 Questions

Exam 14: Cost Allocation, customer-Profitability Analysis, and Sales-Variance Analysis167 Questions

Exam 15: Allocation of Support-Department Costs, common Costs, and Revenues150 Questions

Exam 16: Cost Allocation: Joint Products and Byproducts150 Questions

Exam 17: Process Costing149 Questions

Exam 18: Spoilage, rework, and Scrap153 Questions

Exam 19: Balanced Scorecard: Quality and Time150 Questions

Exam 20: Inventory Management, just-In-Time, and Simplified Costing Methods150 Questions

Exam 21: Capital Budgeting and Cost Analysis151 Questions

Exam 22: Management Control Systems, transfer Pricing, and Multinational Considerations150 Questions

Exam 23: Performance Measurement, compensation, and Multinational Considerations150 Questions

Select questions type

Throughput costing results in a higher amount of manufacturing costs being placed in inventory than either variable or absorption costing.

(True/False)

4.8/5  (36)

(36)

________ method includes fixed manufacturing overhead costs as inventoriable costs.

(Multiple Choice)

4.9/5  (34)

(34)

Kennywood Inc. ,a manufacturing firm,is able to produce 1,000 pairs of pants per hour,at maximum efficiency.There are three eight-hour shifts each day.Due to unavoidable operating interruptions,production averages 825 units per hour.The plant actually operates only 27 days per month.Based on the current budget,Kennywood estimates that it will be able to sell only 503,000 units due to the entry of a competitor with aggressive marketing capabilities.But the demand is unlikely to be affected in future and will be around 518,000.Assume the month has 30 days.What is the theoretical capacity for the month?

(Multiple Choice)

5.0/5  (33)

(33)

When actual production is below practical capacity,there will be unused-capacity cost only in the manufacturing function while unused capacity is not a factor in nonmanufacturing links of the value chair such as in the marketing function.

(True/False)

4.8/5  (31)

(31)

________ are subtracted from sales to calculate gross margin.

(Multiple Choice)

4.8/5  (31)

(31)

Henry Chapman Manufacturing Inc.incurred the following expenses during 2017:

Fixed manufacturing costs \ 100,000 Fixed nonmanufacturing costs \ 87,000 Unit selling price \ 310 Total unit cost \ 100 Variable manufacturing cost rate \ 50 Units produced 1,320 units

What will be the breakeven point if variable costing is used? (Round your final answer up to the next whole unit. )

(Multiple Choice)

5.0/5  (36)

(36)

Under absorption costing,fixed manufacturing costs ________.

(Multiple Choice)

4.8/5  (37)

(37)

U.S.tax reporting requires end-of-period reconciliation between actual and applied indirect costs using the adjusted allocation-rate method or the proration method.

(True/False)

4.8/5  (36)

(36)

Freetown Corporation incurred fixed manufacturing costs of $30,000 during 2017.Other information for 2017 includes:

The budgeted denominator level is 2,000 units.

Units produced total 1,800 units.

Units sold total 1,300 units.

Beginning inventory was zero.

The company uses absorption costing and the fixed manufacturing cost rate is based on the budgeted denominator level.Manufacturing variances are closed to cost of goods sold.

Fixed manufacturing costs included in ending inventory total ________.(Round any intermediary calculations to the nearest cent and your final answer to the nearest dollar. )

(Multiple Choice)

4.8/5  (41)

(41)

The contribution-margin format of the income statement distinguishes manufacturing costs from nonmanufacturing costs.

(True/False)

4.8/5  (28)

(28)

If 800 units are produced and 1,200 units are sold,the costing method which will result in the greatest operating income is ________.

(Multiple Choice)

4.8/5  (31)

(31)

________ reduces theoretical capacity for unavoidable operating interruptions.

(Multiple Choice)

4.8/5  (29)

(29)

Freetown Corporation incurred fixed manufacturing costs of $34,000 during 2017.Other information for 2017 includes:

The budgeted denominator level is 2,000 units.

Units produced total 1,800 units.

Units sold total 1,300 units.

Beginning inventory was zero.

The company uses absorption costing and the fixed manufacturing cost rate is based on the budgeted denominator level.Manufacturing variances are closed to cost of goods sold.

Operating income using absorption costing will be ________ than operating income if using variable costing.(Round any intermediary calculations to the nearest cent and your final answer to the nearest dollar. )

(Multiple Choice)

4.8/5  (42)

(42)

Which of the following is true of master-budget capacity utilization?

(Multiple Choice)

4.8/5  (37)

(37)

To achieve consistency in reporting,a company must use the same capacity-level concept for internal reporting and control as it uses for external reporting and tax reporting.

(True/False)

4.9/5  (30)

(30)

Using master-budget capacity to allocate budgeted fixed manufacturing costs can result in a

(Multiple Choice)

4.9/5  (33)

(33)

Which of the following is not one of the reasons why absorption costing might also be used for internal reporting?

(Multiple Choice)

4.7/5  (44)

(44)

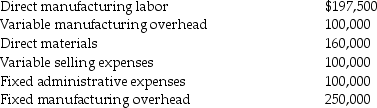

For 2017,Rockford,Inc. ,had sales of 150,000 units and production of 200,000 units.Other information for the year included:

Required:

a.Compute the ending finished goods inventory under both absorption and variable costing.

b.Compute the cost of goods sold under both absorption and variable costing.

Required:

a.Compute the ending finished goods inventory under both absorption and variable costing.

b.Compute the cost of goods sold under both absorption and variable costing.

(Essay)

4.8/5  (30)

(30)

________ is the continuing reduction in the demand for a company's products that occurs when competitor prices are not met.

(Multiple Choice)

4.7/5  (32)

(32)

Banta Corporation is in the business of selling computers.The following expenses were incurred in March 2017:

Fixed manufacturing costs \ 90,000 Fixed nonmanufacturing costs \ 55,000 Unit selling price \ 1,500 Variable manufacturing cost \ 800 Units produced 1,600

What will be the breakeven point if variable costing is used? (Round your final answer up to the next whole unit. )

(Multiple Choice)

4.7/5  (29)

(29)

Showing 141 - 160 of 207

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)